Was a Jersey (CI) company linked to the largest-ever WMD-TERRORISM-related forfeiture in the US?

25/04/2025

Was a Jersey company linked to the largest-ever terrorism-related forfeiture in the US. YES.

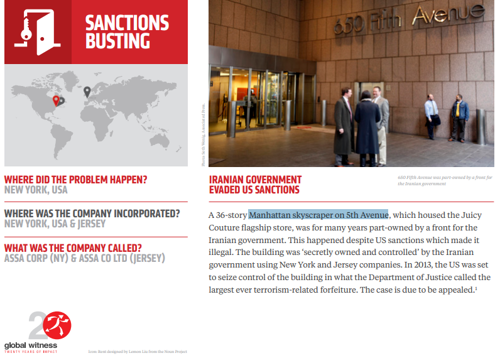

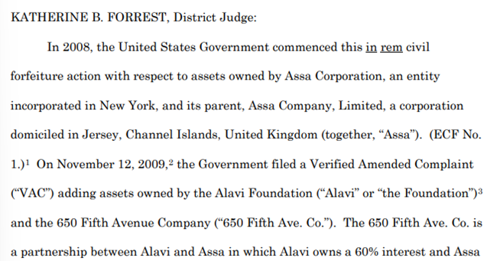

For many years, a 36-story Manhattan skyscraper located at 650 Fifth Avenue, which housed the Juicy Couture flagship store, was part-owned by a front for the Iranian government. This happened despite US sanctions, which made it illegal.

The Manhattan skyscraper was ‘secretly owned and controlled’ by the Iranian government using New York and JERSEY (CHANNEL ISLANDS) companies.

- The Alavi Foundation and

- Assa Corporation.

Assa Company Limited,

Assa was controlled by and acted for or on behalf of Iran's Bank Melli.

WMD SANCTIONS 2008-2010

Assa was sanctioned by the EU and the US

US

- Added to the Specially Designated Nationals (SDN) list maintained by the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) on December 17, 2008, pursuant to Executive Order 13382, which targets proliferators of weapons of mass destruction (WMD) and their delivery systems.

- Removed from the SDN list in January 2016 as part of the Joint Comprehensive Plan of Action.

EU 2010

- Listed by the European Union on July 26, 2010 as an entity linked to Iran's proliferation-sensitive nuclear activities or Iran's development of nuclear weapon delivery systems;

- Removed from the E.U. list in January 2016 as part of the Joint Comprehensive Plan of Action.

2013

In 2013, the U.S. government wanted to seize and sell the Iranian-owned Manhattan skyscraper located at 650 Fifth Avenue. The Department of Justice described this as the largest-ever terrorism-related forfeiture.

The proceeds from the sale were intended to compensate victims of Iranian-sponsored terrorism.

The building's owners were accused of violating federal money laundering laws and sanctions against Iran, with rental income reportedly being transferred back to Tehran.

The Alavi Foundation planned to appeal the ruling, disagreeing with the court's analysis.

AN APPEAL

The appeal overturned the initial ruling that ordered the seizure of the Iran-linked skyscraper at 650 Fifth Avenue. The federal appeals court found several flaws in the original decision, including procedural errors and issues with the evidence presented. This was seen as a setback for the U.S. Department of Justice, which had hoped to use the proceeds from the building's sale to compensate victims of Iranian-sponsored terrorism.

The overturning of the initial ruling to seize the Iran-linked skyscraper at 650 Fifth Avenue has several implications:

- Legal Precedent: The decision highlights the importance of procedural fairness and thorough evidence review in legal cases. The appeals court found significant errors in the original ruling, which sets a precedent for future cases involving complex international and financial matters.

- Impact on Victims: The ruling is a setback for victims of Iranian-sponsored terrorism who were expecting compensation from the sale of the building. The funds intended for these victims will not be available unless the government can successfully pursue other legal avenues.

- US-Iran Relations: The case underscores ongoing tensions between the US and Iran, particularly regarding sanctions and financial activities. The decision may influence how similar cases are handled and affect diplomatic relations.

- Property Ownership: The Alavi Foundation retains control over the building, which means it generates income that could be linked to Iran. This raises concerns about enforcing sanctions and monitoring foreign-owned properties in the US.

SOURCES

- Federal Court Overturns Ruling to Seize Iran-Linked Skyscraper in New ...https://www.ctbuh.org/news/federal-court-overturns-ruling-to-seize-iran-linked-skyscraper-in-new-york-city/

- US court throws out ruling allowing seizure of Iran-linked Manhattan tower.https://www.timesofisrael.com/us-court-throws-out-ruling-allowing-seizure-of-iran-linked-manhattan-tower/

- Federal Court Overturns Ruling To Seize Iran-Linked Skyscraper In Manhattanhttps://en.radiofarda.com/a/federal-court-of-appeal-overturns-ruling-to-seize-iran-linked-skyscraper-in-manhattan/30102929.html

- U.S. verdict: seizure of Iran-linked Manhattan skyscraper overturned ...https://www.jpost.com/Middle-East/US-verdict-seizuring-of-Iran-linked-Manhattan-skyscraper-overturned-598209

- US to seize ‘Iran-owned’ New York skyscraper - Al Jazeera https://www.aljazeera.com/economy/2013/9/19/us-to-seize-iran-owned-new-york-skyscraper

- U.S. to seize Manhattan skyscraper secretly owned by Iran https://money.cnn.com/2013/09/17/news/economy/iran-building/index.html

- https://www.justice.gov/sites/default/files/usao-sdny/legacy/2015/03/25/650%20Fifth%20Avenue%20-%20Opinion%20and%20Order.pdf

- https://www.justice.gov/usao-sdny/pr/acting-manhattan-us-attorney-announces-historic-jury-verdict-finding-forfeiture-midtown

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.