Uzbek Tender Tango: Ping-Pong Power Player's Shadowy Firms Score $200M in Mining Deals Amid Forgery and Fraud Claims

09/02/2026

AN Organised Crime and Corruption Reporting Project (OCCRP) investigation, published in February 2026, has highlighted.

- A major Uzbek state mining company awarded hundreds of millions of dollars in tenders to companies in the U.K., Georgia, and Singapore.

- Reporters found they have connections to an Uzbek ping-pong official, while some have unclear ownership information or received contracts despite company filings indicating they were inactive.

- a network of opaque foreign companies that secured over $200 million in tenders from Uzbekistan's state-owned Almalyk Mining-Metallurgical Complex (AMMC) since 2022.

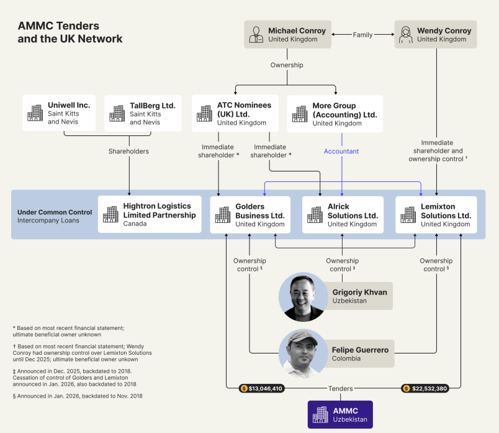

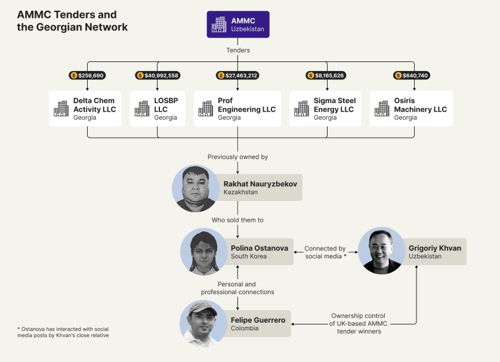

- The complex corporate structure [SEE BELOW] uncovered in this investigation centres on a network of foreign companies spanning the U.K., Georgia, Singapore, and offshore jurisdictions such as Nevis and the Bahamas that have collectively secured more than $200 million in tenders from Uzbekistan's state-owned Almalyk Mining-Metallurgical Complex (AMMC) since 2022.

- At the heart of the arrangement are opaque ownership structures, in which listed owners often appear as proxies with no relevant industry experience, such as

- A British bookkeeper

- A South Korean medical tourism coordinator, and

- A prominent Uzbek ping-pong official with ties to the country's elite.

- This setup raises significant concerns about hidden ultimate beneficial owners (UBOs) who may be exploiting these entities to siphon public funds, facilitated by retroactive and contradictory corporate filings that obscure true control.

Analysis of Issues

The report highlights systemic issues in corporate transparency and procurement integrity, particularly in Uzbekistan's state tenders:

- Obscured Ownership and Proxy Use: Retroactive, chaotic filings and links to unrelated individuals (e.g., Conroy, Ostanova) suggest nominees shielding true UBOs like Khvan, enabling potential cronyism tied to Uzbek elites.

- False Declarations and Inactivity Mismatch: Companies falsely claimed dormant/inactive status while actively trading, violating U.K./Georgian laws and evading taxes/scrutiny.

- Forged Documents and Lack of Due Diligence: Alleged signature forgeries on contracts indicate fraud, with poor verification by AMMC.

- Offshore Opacity and Conflicts: Offshore ties (Nevis, Bahamas) and inter-company competition under common control point to money siphoning risks in a high-corruption environment.

- Broader Risks: Ahead of AMMC's potential IPO, this undermines anti-corruption pledges, erodes trust, and threatens privatisation by allowing politically connected insiders to extract value via shell entities, as noted by experts like Transparency International.

The structuring

Extracted Points on Ownership, UBOs, and Control

- U.K. Companies (Lemixton Solutions Ltd and Golders Business Ltd):

- Lemixton initially listed Wendy Mary Ann Conroy (71-year-old British accountant with no Uzbekistan ties) as the person with significant control (PSC) since 2018.

- Golders initially declared "no registrable person" (no PSC) while managed by ATC Nominees (UK) Limited, controlled by Michael Conroy (Wendy's son).

- Both companies have been declared dormant (inactive) since 2021, despite winning millions in tenders and shipping goods to AMMC.

- After reporter inquiries in late 2025, retroactive changes: Grigoriy Khvan (Uzbek ping-pong official) added as PSC backdated to 2018, then quickly replaced by Felipe Guerrero (Colombian with no mining background), also backdated to 2018.

- Managed by MoreGroup (Michael Conroy's firm); MoreGroup denied involvement in ownership info and stated an "internal investigation" into errors.

- Under common control with Alrick Solutions Ltd (U.K., Khvan as PSC backdated to 2018) and Hightron Logistics (Canada, owned by Nevis-based Tallberg Ltd and Uniwell Inc., secretive offshore entities).

- Contracts featured alleged forged signatures of Wendy Conroy and Ruairi Laughlin-McCann (former MoreGroup employee), who denied involvement and reported to authorities.

- Georgian Companies (LOSBP LLC, Prof Engineering LLC, and three others):

- Owned by Polina Ostanova (41-year-old South Korean citizen with Uzbek roots, medical tourism background, no mining experience).

- Ostanova purchased five companies in February 2025 from Rakhat Nauryzbekov (Kazakh) for ~$350, despite two already having $65.9M in AMMC tenders.

- All five were declared inactive for at least two years, with no financial statements filed, despite tenders and shipments.

- Ostanova linked to Khvan (via social media likes of his partner's posts) and Guerrero (joint travel, shared representations in South Korean firms like a beauty products company and car dealership).

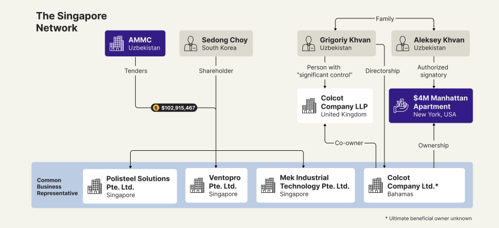

- Singapore Companies (Polisteel Solutions Pte Ltd, Ventopro Pte Ltd, Mek Industrial Technology Pte Ltd):

- Listed owner: Sedong Choy (South Korean national) as sole shareholder.

- Linked to Khvan via Colcot Company Ltd (Bahamas), where Khvan is a director; a Chinese firm's report claimed common control, though denied by representatives.

- Colcot purchased a $4.4M Manhattan apartment signed by Aleksey Khvan (Grigoriy's son).

- Mek Industrial Technology's U.S. lobbying contract listed Uzbekistan as the represented country and a Tashkent address, despite Singapore incorporation.

- Attorney Mark Ludwikowski (representing the firms) denied Khvan's ownership or control but was photographed with Aleksey Khvan and Uzbek officials.

- Overall Connections:

- All companies tied to Khvan or Guerrero, raising proxy ownership concerns.

- Companies competed against each other in tenders despite common ownership/control.

- No clear UBOs in many cases; use of proxies, offshore entities (Nevis, Bahamas), and retroactive filings obscure true beneficiaries.

- Owners generally lack mining experience or Uzbekistan ties (e.g., bookkeepers, medical coordinators, Colombians).

Red flags

- The core concerns revolve around potential cronyism, fraud, and money siphoning in a high-corruption environment, where politically connected insiders, possibly linked to Uzbek elites like those close to President Shavkat Mirziyoyev, may be using shell companies to extract value from public assets.

- Key red flags include companies with no mining experience winning bids, inter-company "competitions" despite common control, alleged forged signatures on contracts, and mismatches between official filings and actual activities.

- This undermines Uzbekistan's anti-corruption pledges and poses risks to AMMC's planned privatisation and IPO, as it could erode investor trust and enable illicit enrichment.

- Overall, these elements depict systemic failures that enable cross-border corruption, calling for stronger registry enforcement and greater transparency to prevent such schemes.

- Widespread corporate opacity and potential fraud, exemplified by companies declaring themselves "dormant" or "inactive" in official records despite actively winning tenders and shipping goods, which violates laws in jurisdictions like the U.K. and Georgia.

- Alleged forged signatures on multimillion-dollar contracts, inter-company "competitions" under apparent common control, and

- The use of tax havens to shield ownership underscores risks of cronyism in Uzbekistan's procurement process.

Specific Concerns Regarding the UK Registry System

A major focus of the investigation is the exploitation of vulnerabilities in the UK Companies House registry, which maintains corporate records and is intended to promote transparency.

The report highlights how two UK-incorporated firms, Lemixton Solutions Ltd and Golders Business Ltd, won tens of millions in AMMC tenders while submitting inaccurate or misleading information:

- Inaccurate and Retroactive Filings:

- Both companies declared themselves "dormant" (inactive with no significant transactions) in annual accounts since 2021, despite actively securing contracts worth over $35 million combined and shipping goods to Uzbekistan, as evidenced by import-export data.

- Under UK law, this is illegal if the filings are "misleading, false, or deceptive" without excuse.

- After OCCRP inquiries in late 2025, the firms made chaotic retroactive changes: Grigoriy Khvan (an Uzbek ping-pong official) was briefly added as the Person with Significant Control (PSC), backdated to 2018, before being replaced by Colombian national Felipe Guerrero, also backdated.

- This suggests an attempt to retroactively legitimise hidden ownership, exploiting the registry's lax enforcement.

- Reactive Oversight and Opacity:

- Experts like Ben Cowdock from Transparency International UK note that the system relies on "reactive checks," allowing incorrect data to persist for years.

- This enables fraudulent companies to operate unchecked, as evidenced by firms with no websites, minimal employees, and owners (such as a 71-year-old British bookkeeper with no Uzbekistan ties) who appear as proxies.

- British MP Phil Brickell criticised the registry for failing to identify effective control, calling it ineffective in addressing suspected activity.

- Despite recent UK reforms to curb the use of anonymous companies, the investigation underscores persistent gaps that facilitate global corruption networks.

- Broader Implications:

- Such abuses highlight how the UK registry can be weaponised to launder reputations or funds, especially in deals with corrupt regimes.

- The report contrasts this with Uzbekistan's procurement database, which provided more useful insights, emphasising the UK's shortcomings in real-time verification.

Concerns Regarding the Use of Trusts

The investigation also delves into how trusts are used to obscure ultimate beneficial owners (UBOs), allowing true controllers to benefit without direct visibility:

- Mechanisms of Obfuscation:

- UK law requires naming a PSC, typically someone with over 25% voting rights or significant influence.

- However, if a trust is involved, only the trustee (who holds control) must be disclosed, while the UBO (who reaps economic benefits) can remain anonymous.

- In this case, the initial PSC listings (e.g., Wendy Conroy or no PSC at all) and subsequent backdated changes suggest that trustees or nominees are shielding individuals such as Khvan, who has elite Uzbek ties.

- The firms' management by MoreGroup (a corporate services provider known for opaque structures) further implies trust-like arrangements to mask ownership.

- Links to Offshore Networks:

- The UK companies are under "common control" with entities in Canada and offshore havens like Nevis (a Caribbean tax haven), where ownership traces to secretive firms like Tallberg Ltd and Uniwell Inc.

- This layering, combining UK registry filings with trusts and offshore shell companies, creates a veil that complicates tracing UBOs and potentially enables tax evasion, sanctions evasion, or the laundering of corrupt proceeds.

- Risks and Criticisms:

- This setup raises alarms about "shadow ownership" by politically exposed persons, as Cowdock warns, where unqualified entities win state contracts to extract funds.

- The lack of mandatory UBO disclosure in trust scenarios allows exploitation, undermining global anti-money laundering efforts.

- In Uzbekistan, it amplifies cronyism, as similar OCCRP probes have linked Mirziyoyev's relatives to offshore networks associated with preferential deals.

SOURCE

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.