UPDATED JFSC AML/CFT/CPF HANDBOOK NOW EXPECTED 31 MAY 2026 - Immediate Actions to Take and Prioritise

09/12/2025

On 27 November 2025, the JFSC has:-

- Outlined its responses to Consultation Paper No. 4 2025 in its "Feedback on Enhancements to the AML/CFT/CPF Handbook,"

- Outlined its new rules on criminal background checks

- Issued a follow-on consultation on the topic of “complex structures"

- Deferred PEPs changes pending 2026 Government work/FCA guidance review (communicated first half of 2026).

It is now the intention to have an updated AML/CTF/CPF handbook, Effective on 31 May 2026.

Immediate Actions to Take and Prioritise

- Based on the above, Jersey-supervised persons should focus on actions related to ongoing engagement and preparation for upcoming changes.

- These documents address enhancements to criminal background checks (CRCs) for principals and key persons, and updates to the AML/CFT/CPF Handbook (including complex structures).

Prioritised Immediate Actions

- Highest Priority: Review and Respond to the Open Consultation on Complex Structures (if applicable) https://www.jerseyfsc.org/industry/consultations/follow-on-consultation-amlcftcpf-handbook-enhancements-complex-structures/

- The "follow-on-consultation-aml-cft-cpf-handbook-enhancements-complex-structures.pdf" is an active consultation (No. 8 2025) seeking feedback on revised proposals for handling complex structures in the AML/CFT/CPF Handbook.

- This follows industry input from the prior consultation and splits guidance into standard customer due diligence (CDD) for non-high-risk structures (Section 4) and enhanced CDD for high-risk opaque structures (Section 7).

- Action: Review the draft documents and proposed changes (outlined in Sections 4 and 7 of the consultation). If your organisation deals with complex structures (e.g., in funds, trusts, or multi-layered entities), consider submitting comments directly to the JFSC Policy team (policy@jerseyfsc.org) or via Jersey Finance Limited (JFL) coordinator Tim Hart (timothy.hart@jerseyfinance.je). Responses are non-confidential unless specified, and JFL will collate anonymised industry input.

- Why prioritise? The deadline is approaching (about 2 months away), and input could shape the final guidance. If you miss it, you lose the chance to influence proportionality and practicality. Contact the team for support if needed.

- Timeline: Start reviewing immediately; submit by the deadline below.

- Review Feedback Papers and Assess Internal Impact

- Read the following two documents in full to understand finalised policy positions:

- https://www.jerseyfsc.org/media/0rpnaady/feedback-on-enhancements-to-criminal-background-checks.pdf

- Confirms removal of the three-year rolling Criminal Records or Background Checks refresh; shifts responsibility to Supervised Persons to collect/maintain CRCs (e.g., DBS checks or equivalents) for principal persons (PPs) and key persons (KPs) at application, on changes, and as needed.

- https://www.jerseyfsc.org/media/bzlk5pio/feedback-on-enhancements-to-the-aml-cft-cpf-handbook.pdf

- Proceeds with most enhancements (e.g., EDD for PEPs and complex structures, periodic reviews, beneficial ownership/control, sanctions, and sector-specific guidance for DNFBPs/VASPs), but defers complex structures to the follow-on consultation. Includes support for a standalone Prescribed NPO CFT Handbook.

- Action: Conduct an internal gap analysis to identify how these changes affect your policies, procedures, systems, and training (e.g., updating CDD processes, sanctions screening for indirect links, or CRC collection). Involve compliance teams, MLRO/MLCO, and senior management.

- Why now? Although implementation is scheduled for 2026, early assessment allows time for updates without last-minute rushes. Use the JFSC-provided tools, such as mapping documents and webinars (listed as planned support).

- Prepare for Implementation and Monitor Updates

- Action: Begin planning resource allocation for system/process updates, staff training, and record-keeping enhancements. For CRCs, ensure mechanisms to obtain certified copies within six months of relevant events. For Handbook changes, focus on risk-based approaches (e.g., proportionality in EDD for PEPs/close associates and complex structures).

- Lower priority but start soon: If you're a Prescribed NPO, note the planned standalone CFT Handbook. Contact JFSC teams for clarifications (authorisations@jerseyfsc.org for CRCs; policy@jerseyfsc.org for AML/CFT/CPF).

If you're not directly affected (e.g., not a supervised person), you don't need to do anything else besides staying informed via JFSC channels.

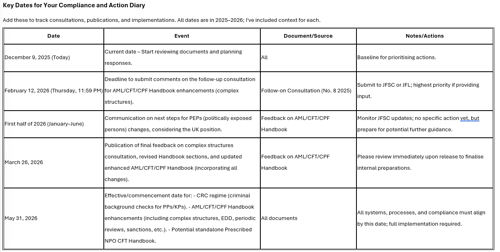

Key Dates for Your Compliance and Action Diary

Add these to track consultations, publications, and implementations. All dates are in 2025–2026; I've included context for each.

These dates are based on JFSC's responses to industry feedback, which emphasised the need for sufficient preparation time—no earlier deadlines (e.g., past consultations closed in January–September 2025). Monitor the JFSC website for any updates or extensions. If you need clarification, use the provided contacts.

Handbook for financial services business, together with a tracked change version. Handbook (tracked changes) Handbook (clean version)

- http://www.jerseyfsc.org/media/gtmjnzvq/tracked-handbook-november-2025.pdf

- http://www.jerseyfsc.org/media/wr5prwn5/clean-handbook-november-2025.pdf

Matrix mapping the COP of the existing Handbook to the new version. Matrix mapping

http://www.jerseyfsc.org/media/dr3dph2e/handbook-mapping-november-2025.xlsx

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.