UBO Three-tier test case study – how A BENEFICIARY UNDER A DISCRETIONARY TRUST become a “controller”

10/08/2025

The UK High Court has found in favour of the banks in a dispute with the EuroChem Group, a Russian fertiliser company, concluding that the banks are prohibited from making payment under on-demand bonds due to asset-freezing provisions under EU Regulation 269/2014 (Regulation 269):

- LLC EuroChem North-West-2 & Anor v Société Générale S.A. & Ors [2025] EWHC 1938 (Comm).

- https://caselaw.nationalarchives.gov.uk/ewhc/comm/2025/1938#download-options

THE KEY FEATURES OF THE CASE ARE:-

- A group of European banks have been ordered not to redeem EUR280 million of on-demand bonds owned by the Russian fertiliser group EuroChem, because the EuroChem companies' valid owner is a Russian national whose assets are frozen under EU sanctions.

- The bonds are governed by English law, so the case was heard in the England and Wales High Court, which confirmed that indirect ownership is sufficient to trigger the asset-freezing provisions under Regulation (EU) No. 269/2014.

- It also determined that A BENEFICIARY UNDER A DISCRETIONARY TRUST is considered the owner of the trust's assets for the same regulation’s purposes (LLC EuroChem North-West-2 v Société Générale, 2025 EWHC 1938 Comm).

WHAT WAS SAID ABOUT DISCRETIONARY TRUST

- The court determined that a beneficiary under a DISCRETIONARY TRUST is considered the owner of the trust’s assets for Annexe I to Council Regulation (EU) No. 269/2014 (“Regulation 269”).

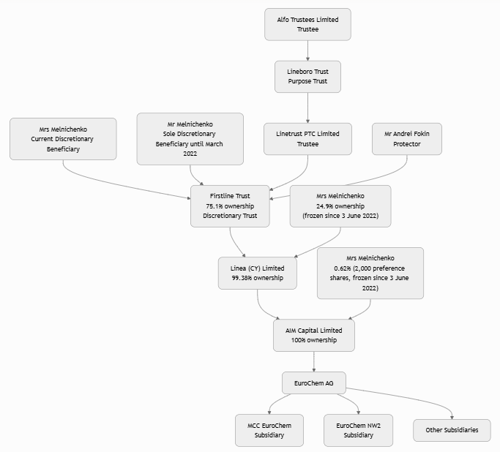

- The court noted that the structure above EuroChem AG involved several TRUSTS, INCLUDING THE FIRSTLINE TRUST (a structure chart is below).

- In the court's view, Mr Melnichenko at all times retained effective control over Firstline Trust (and therefore the claimants) for Regulation 269.

- Firstline Trust was said to be a DISCRETIONARY TRUST with one discretionary beneficiary, Mrs Melnichenko.

- However, until March 2022, the sole discretionary beneficiary was Mr Melnichenko.

- The court held that a beneficiary under a DISCRETIONARY TRUST is the owner of the trust assets (or the person to whom the assets belong or is their holder), for Article 2 of Regulation 269, even if that is not the case as a matter of English or Bermudian law.

- In any event, under the terms of the trust deed, the court said that Firstline Trust was not properly characterised as a DISCRETIONARY TRUST.

- It pointed to the control exercised over the trust by MR ANDREY MELNICHENKO, through MR FOKIN, whom MR MELNICHENKO could rely upon “to do as he wished”.

- Mr Andrei Fokin is a Russian citizen resident in Cyprus.

- His current position is protector of the Firstline Trust, having been appointed to this position on 17 March 2022. Until 22 January 2024, he was a director of AIM Capital. He acknowledged these roles in his witness statement.

- Mr Fokin accepted in cross-examination that he was also the manager of Mr Melnichenko’s family office.

- The court said that it was justified to characterise both MR MELNICHENKO AND MR FOKIN as “UNSCRUPULOUS”.

- MR MELNICHENKO was therefore regarded as THE “OWNER” OF THE FIRSTLINE TRUST ASSETS, including EuroChem AG and its subsidiaries, for Article 2 Regulation 269.

THE STRUCTURE OF EUROCHEM AG IS AS FOLLOWS (extracted from the judgement):

- 100% of the shares in EuroChem AG are owned by AIM Capital Limited (“AIM Capital”), a Cypriot company.

- The name of this company matches the initial letters of Mr Melnichenko’s full name.

- 99.38% of the shares in AIM Capital are owned by Linea (CY) Limited, a Cypriot company.

- Mrs Melnichenko holds the remaining shares (2,000 preference shares), and

- have been frozen since the EU sanctioned her on 3 June 2022.

- The Firstline Trust owns 75.1% of Linea (CY) Limited.

- Mrs Melnichenko owns the remainder of the shares in Linea (CY) Limited, and

- have also been frozen from 3 June 2022.

- The Firstline Trust is a DISCRETIONARY TRUST,

- Which currently has one DISCRETIONARY BENEFICIARY –

i. MRS MELNICHENKO.

- Until March 2022 (the precise date is controversial), the SOLE DISCRETIONARY BENEFICIARY was

i. Mr Melnichenko.

- The trustee of the Firstline Trust is

- Linetrust PTC Limited (“Linetrust PTC”), a Cypriot company.

- The protector of the Firstline Trust is

- Mr Andrei Fokin.

- Linetrust PTC is owned by

- Lineboro (“Lineboro Trust”), a purpose trust.

- The trustee of the Lineboro Trust is

- Alfo Trustees Limited, a Cypriot company.+

- It is essential that the structure above EuroChem AG involves several trusts, above all,

- The Firstline Trust; and

- That immediately below EuroChem AG is MCC EuroChem.

- It is also vital TO NOTE

- EuroChem AG’s subsidiaries are not limited to MCC EuroChem and EuroChem NW2.

- EuroChem AG is the direct or indirect owner of all the other EuroChem group companies.

- It has several vital subsidiaries in the EU, notably those relating to the plants in Belgium and Lithuania, as well as a subsidiary incorporated in France (“EuroChem Agro France”) and a subsidiary incorporated in Italy (“EuroChem Agro Italy”).

- Through MCC EuroChem, it owns various business group interests in Russia, where the bulk of the group’s existing manufacturing capacity resides. It also owns the group trading companies, which are incorporated and headquartered in the UAE. There are further subsidiaries in other countries and regions.

From the above, the following visual representation may help readers.

SOURCES

- Herbert Smith Freehills Kramer https://www.hsfkramer.com/notes/bankinglitigation/2025-08/english-high-court-decides-in-favour-of-banks-in-eurochem-bond-claim

- [BAILII]BAILII https://www.bailii.org/ew/cases/EWHC/Comm/2025/1938.html

TO UNDERSTAND MORE, THE FOLLOWING LONGER READ MAY HELP

- Herbert Smith Freehills Kramer https://www.hsfkramer.com/notes/bankinglitigation/2025-08/english-high-court-decides-in-favour-of-banks-in-eurochem-bond-claim

Also shown below

English High Court decides in favour of banks in EuroChem bond claim, confirming payment under on-demand bonds prohibited due to Russian sanctions.

The decision demonstrates the English court's willingness to apply the Ralli Bros principle and public policy in the context of Russian sanctions cases [31 July 2025]

- The High Court has found in favour of the banks in a dispute with the EuroChem Group, a Russian fertiliser company, concluding that the banks are prohibited from making payment under on-demand bonds due to asset-freezing provisions under EU Regulation 269/2014 (Regulation 269): LLC EuroChem North-West-2 & Anor v Société Générale S.A. & Ors [2025] EWHC 1938 (Comm).

- The court found that Mr Melnichenko, who is

- A "designated person" listed in Annexe I to Regulation 269 is the valid owner of the relevant EuroChem group entities.

- On that basis, it found that the bonds in question were frozen under Article 2(1) of Regulation 269, as determined by the French and Italian national competent authorities (NCAs).

- Accordingly, the banks were prohibited from making payments under the bonds.

- In reaching this conclusion, the court held that indirect ownership is sufficient to trigger the asset-freezing provisions under Article 2 of Regulation 269.

- Furthermore, the court determined that a beneficiary under a DISCRETIONARY TRUST is considered the owner of the trust’s assets for Regulation 269.

- In addition, the court considered the application of EU Regulation 833/2014 (Regulation 833), which restricts claims brought by or on behalf of Russian entities where the claim is connected to contracts and their performance has been affected by the measures imposed under that regulation.

- The decision will be of particular interest to financial institutions as it demonstrates the English court's willingness to apply the common law principle in Ralli Bros v Compania Naviera Sotay Aznar [1920] 2 KB 287 (which prevents enforcement of a contract if its performance is illegal in the place of performance), and to refuse enforcement of contracts on public policy grounds in the context of sanctions against Russia.

- The judgment provides a detailed analysis of the concept of “place of performance” under the Ralli Brothers rule, specifically about on-demand bonds which do not specify a place of performance explicitly, following the approach adopted in Britten Norman Ltd v State Ownership Fund of Romania [2000] Lloyd’s Rep and Marconi Communications International Limited v PT Pan Indonesia Bank Limited TBK [2005] EWCA Civ 422.

- The judgment reinforces the position that decisions made by NCAs are binding on operators within their jurisdictions, and that compliance with sanctions takes precedence over contractual obligations, even where autonomous financial instruments such as demand bonds are concerned.

- The decision also provides a detailed analysis of the EU sanctions regulations and the concepts of "ownership and control", particularly in the context of complex corporate structures involving trusts and transfers of ownership.

Herbert Smith Freehills Kramer LLP represented Société Générale S.A. in these proceedings.

Background

- The defendant banks (the Banks) issued six on-demand bonds (the Bonds), governed by English law. The Bonds were issued in favour of the first claimant (EuroChem NW2) in connection with the construction of an ammonia plant in Kingisepp, Russia. Technimont S.P.A. (Tecnimont), an Italian engineering company, was contracted to design and construct the plant.

- On 24 February 2022, Russia invaded Ukraine. Subsequently, the EU imposed sanctions on the founder of the EuroChem Group, Mr Andrey Melnichenko and his wife, Mrs Aleksandra Melnichenko.

- In May 2022, Tecnimont suspended its services to EuroChem NW2. EuroChem NW2 alleged default by Tecnimont and terminated the contracts. The dispute between Tecnimont and EuroChem NW2 was referred to as an arbitration (not considered further in the present judgment).

- In August 2022, EuroChem NW2 made demands under the Bonds. The Banks declined to pay, on the basis that to do so would be illegal because of EU sanctions. On 23 December 2024, EuroChem NW2 entered into a Deed of Assignment and Assumption (the Assignment) by which it assigned the proceeds of the Bonds to its indirect parent EuroChem Group AG (EuroChem AG, the second claimant).

- The claimants issued proceedings against the Banks, asserting that valid demands were made under the Bonds, which the Banks were obliged to pay.

- The Banks raised several defences: they referred to determinations by NCAs in France, Italy, and the Netherlands that the Bonds were frozen under EU sanctions, making payment illegal. Even if those authorities’ views were not decisive, the Banks contended that the Bonds were owned or controlled by Mr Melnichenko, a designated person under the sanctions regime. That payment would be prohibited under Article 2 of Regulation 269. They also argued that payment would make funds available to sanctioned Russian banks, contrary to Article 2(2) of Regulation 269. Insofar as necessary, the Banks also relied on illegality under Article 11 of Regulation 833.

- The Banks contended that since payment was illegal in the place of performance, the Bonds were unenforceable under English law due to the rule in Ralli Brothers (the rule on foreign illegality, as explained in more detail below) or as a matter of public policy.

Decision

The High Court found in favour of the Banks, confirming that they were prohibited from making payment under the Bonds due to asset-freezing provisions under EU Sanctions.

Interpretation of the EU sanctions regime

The judgment sets out a comprehensive legal analysis of the relevant EU sanctions regime and its application to the facts of the case.

Regulation 269

- The court analysed the key provisions of Regulation 269, particularly Article 2, which requires the freezing of all funds and economic resources “belonging to, owned, held or controlled by” designated persons, and prohibits making such resources available to them, directly or indirectly, noting that bonds are explicitly included as “funds” under the regulation.

- The court also considered supplementary EU materials, including guidance documents and Commission opinions, which clarify the interpretation of “ownership” and “control” and the operation of “firewalls” intended to insulate EU subsidiaries from the influence of designated persons. The court referred to relevant decisions of the European Court of Justice and national courts, as well as pending referrals from Italian courts to the European Court of Justice on the treatment of discretionary trusts under the regulation. The judgment focused on the purposive interpretation required for EU sanctions instruments, emphasising that the concepts of “ownership” and “control” are to be given an autonomous and broad meaning.

- Applying these principles, the court found that the Bonds were “funds” within the meaning of Regulation 269 and owned or controlled by EuroChem NW2, which was itself owned or controlled by Mr Melnichenko. The court said both supported this conclusion: (1) the determinations of the relevant NCAs (notably in France and Italy); and (2) the court’s factual findings. Each of these issues is considered further below (following the discussion of Regulation 833).

- As a result, the Bonds were subject to asset-freezing under Article 2(1) of the regulation, and any payment under the Bonds was prohibited.

Regulation 833

- The court explained that Regulation 833 imposes restrictions on the sale, supply, transfer, or export of certain goods and technology to Russia, as well as prohibitions on providing financing or financial assistance related to those items. Of particular relevance was Article 11, which prohibits the satisfaction of claims (including under guarantees or bonds) made in connection with a contract, the performance of which has been affected by the measures imposed under Regulation 833, if the claim is made by or on behalf of a Russian entity.

- The parties agreed, for this case, to assume that the underlying construction contracts were affected by Regulation 833.

- The court then considered whether the claims under the Bonds were “in connection with” the affected contracts. While the claimants argued that on-demand bonds are autonomous and not connected to the underlying contracts, the court found that there was a sufficient factual connection between the Bonds and the contracts to bring the claims within the scope of Article 11. The court further found that, because the original demands under the Bonds were made by EuroChem NW2 (a Russian entity), and the Assignment of proceeds to EuroChem AG did not change the underlying nature of the claim, Article 11 of Regulation 833 operated to prohibit satisfaction of the claims under the Bonds.

Determination by the relevant NCAs

- The judgment examined the role of the NCAs and their determinations in various jurisdictions regarding the application of EU sanctions to the EuroChem group and the Bonds at issue.

- The court noted that under Regulation 269, enforcement and interpretation are delegated to the competent authorities of each EU member state.

- These NCAs are responsible for making factual determinations about ownership, control, and the freezing of assets, as well as for granting or refusing derogations and licences. The judgment reviewed the positions taken by the NCAs in several key jurisdictions, including France, Italy, Switzerland, the Netherlands and Cyprus.

- The judgment concluded that the determinations of the NCAs were precise and are binding on operators in their respective jurisdictions.

- Accordingly, since the NCAs in France and Italy had determined that EuroChem NW2 is owned or controlled by Mr or Mrs Melnichenko and that its assets, including the Bonds, are frozen, payment under the Bonds was prohibited under French and Italian domestic law.

- Accordingly, the court didn't need to decide the question of ownership or control, but it did so in case its decision about the role of NCAs was incorrect.

Ownership and control of EuroChem NW2 and EuroChem AG

The court held that Mr Melnichenko is the owner of EuroChem NW2 and of EuroChem AG, and their assets, including the Bonds, for Article 2 of Regulation 269.

EuroChem group trust structure

- The court noted that the structure above EuroChem AG involved several trusts, including the Firstline Trust. In the court's view, Mr Melnichenko at all times retained effective control over Firstline Trust (and therefore the claimants) for Regulation 269.

- Firstline Trust was said to be a DISCRETIONARY TRUST with one discretionary beneficiary, Mrs Melnichenko.

- However, until March 2022, the sole discretionary beneficiary was Mr Melnichenko.

- The court held that a beneficiary under a DISCRETIONARY TRUST is the owner of the trust assets (or the person to whom the assets belong or is their holder), for Article 2 of Regulation 269, even if that is not the case as a matter of English or Bermudian law.

- In any event, under the terms of the trust deed, the court said that Firstline Trust was not properly characterised as a DISCRETIONARY TRUST.

- It pointed to the control exercised over the trust by Mr Melnichenko, through Mr Fokin, whom Mr Melnichenko could rely upon “to do as he wished”.

- The court said that it was justified to characterise both Mr Melnichenko and Mr Fokin as “unscrupulous”.

- Mr Melnichenko was therefore regarded as the “owner” of the Firstline Trust assets, including EuroChem AG and its subsidiaries, for Article 2 Regulation 269.

Changes to the EuroChem group structure and "firewall" measures

- The court also addressed changes to the group’s structure following Mr Melnichenko's designation, including the transfer of assets, changes in management, and the establishment of compliance “firewalls” around EuroChem AG and its EU subsidiaries, aimed at demonstrating independence from Mr Melnichenko.

- In the court's view, following the implementation of EuroChem AG’s firewall measures, neither Mr Melnichenko nor Mrs Melnichenko had control over EuroChem AG and its subsidiaries in the EU. However, those measures did not extend to Russian entities such as EuroChem NW2, which remained under the actual control of Mr Melnichenko.

- The court had “no doubt” that Mr Melnichenko continued to exercise power, at least in Russia.

Assignment

- The court found that the Assignment of the proceeds of the Bonds to EuroChem AG was ineffective, as there could be no proceeds for the Assignment to operate on while the Bonds remained frozen.

- The court nevertheless went on to consider whether it was wrong and the Assignment was practical, whether the Banks paying the proceeds of the Bonds to EuroChem AG would be a breach of Article 2(2) of Regulation 269.

- The court accepted that EuroChem AG’s firewall was approved by the Swiss NCA and that authorities in France, Cyprus, and the Netherlands acknowledged this approval. The court noted that the Italian NCA had not clearly stated whether it accepted EuroChem AG’s firewall measures.

- The court inferred that this was likely to be because the Italian NCA (rightly) considered that Switzerland should make the determination.

- The court accepted the claimants’ evidence regarding the firewall, and as a result, concluded that a payment to EuroChem AG would not be a breach of Article 2(2). The presumption under Article 2(2) that funds provided to an entity will be transferred to those who own or control it was displaced in the case of EuroChem AG. However, since the Bonds themselves were frozen, this issue was largely academic.

- The court noted that the pending licence applications to the French and Italian NCAs were unlikely to affect its conclusions. These applications sought authorisation for the Banks to pay EuroChem AG in light of the Assignment.

- The court acknowledged that the NCAs may find such transfers acceptable in principle, given the firewall. However, the NCAs were not responsible for determining the legal effect of the Assignment under English law, particularly since the Bonds themselves remain frozen and were not assigned. If any NCA later determined that the Bonds were not frozen, the legal position might change.

Place of performance under the Bonds: the rule in Ralli Brothers

- The claimants said that the place of performance was Russia, so that EU sanctions did not apply. The Banks argued that the place of performance was in France and Italy, so that payment would be illegal because (as matters presently stand) the NCA in each country had determined that the Bonds are frozen under Article 2(1) of Regulation 269 (as explained above).

- The court considered the legal principle from Ralli Brothers v Compania Naviera Sota y Aznar: This confirmed that a contract, even if valid under its governing law, is generally unenforceable to the extent that its performance would be unlawful in the country where it must be performed. The court had to decide whether the Banks would be carrying out the payment in a country where it would be illegal to do so, rather than just taking preparatory steps to pay. The court also looked at whether the Banks had made reasonable efforts to obtain a licence to pay.

- The court acknowledged that the legal position on this issue is not entirely settled.

- However, it preferred the approach taken in Britten Norman and Marconi Communications (ie that the place the demand is to be made is the place of payment, unless the contract says otherwise), as it better reflects the nature of on-demand instruments, where payment is expected to follow immediately upon demand.

- Therefore, under English law, payment under the Bonds would have to occur in France and Italy. Since both jurisdictions prohibit such payments under EU sanctions, performance by the Banks would be unlawful, triggering the Ralli Brothers rule and rendering the Bonds unenforceable.

- The court further addressed whether the Banks took reasonable steps to obtain licences or authorisations to make payment, concluding that reasonable steps were taken, although the licences were refused.

- The court also confirmed that had it been against the Banks on the application of the rule in Ralli Bros, it still would have dismissed the claims as a matter of public policy, having regard to the grave importance of the sanctions in EU law and the fact that UK policy is precisely aligned with that of the EU.

Accordingly, the court dismissed the claimants’ claims.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.