“The Peddling Peril Index: Global Benchmark for Strategic Trade Controls and WMD Non-proliferation”

18/11/2025

The Peddling Peril Index (PPI) is an international ranking system that evaluates how well countries implement strategic trade controls to prevent the spread of weapons of mass destruction (WMD) and related technologies.

Purpose

- It measures the effectiveness of national systems for controlling exports, imports, transit, and transhipment of sensitive goods and technologies.

- The goal is to reduce proliferation risks by identifying gaps and encouraging improvements in trade control systems worldwide. [resources.inmm.org]

How It Works

- The PPI ranks about 200 countries and territories using over 100 indicators across five key areas:

- International Commitments (e.g., adherence to treaties like UN Security Council Resolution 1540)

- Legislation (comprehensive export control laws)

- Ability to Monitor and Detect Strategic Trade

- Ability to Prevent Proliferation Financing

- Adequacy of Enforcement [cdn.fourwaves.com]

Why It Matters

- It is the only public methodology that regularly evaluates national strategic trade control systems.

- Helps governments benchmark their performance and identify vulnerabilities.

- Supports global non-proliferation efforts by highlighting countries that need stronger controls. [everand.com]

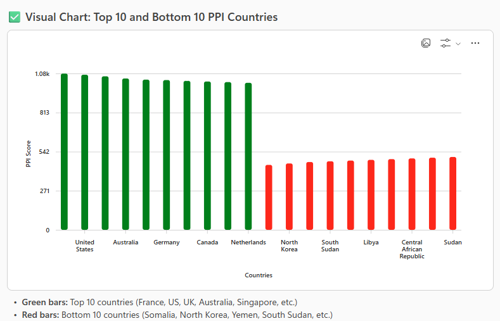

Latest Peddling Peril Index (PPI) Rankings – 2023/2024 Edition

The PPI ranks countries on their ability to implement strategic trade controls across five areas: international commitments, legislation, monitoring, proliferation financing prevention, and enforcement.

Top Performers - These countries have strong legal frameworks, robust enforcement, and advanced systems to detect and prevent the financing of proliferation.

Lower Tier Examples - Lower scores often reflect gaps in legislation, enforcement, and monitoring capabilities.

- How PPI Relates to Sanctions Enforcement and AML/CFT Compliance

- Overlap with AML/CFT:

PPI includes an indicator for “Ability to Prevent Proliferation Financing”, which directly intersects with AML/CFT frameworks. Countries with strong AML/CFT regimes tend to score higher because they can detect and disrupt financial flows linked to WMD proliferation. [cdn.fourwaves.com] - Sanctions Enforcement:

Adequate strategic trade controls complement sanctions regimes by preventing sanctioned entities from accessing dual-use goods or financing illicit procurement. Weak PPI scores often signal vulnerabilities that sanctions evaders exploit. [finintegrity.org] - Risk Management for Businesses:

Companies operating in or trading with low-ranked jurisdictions face higher compliance risks. Regulators increasingly expect firms to integrate export control checks with sanctions screening and AML/CFT programs to avoid penalties and reputational damage. [finintegrity.org]

Compliance Briefing: Integrating PPI Insights into Sanctions and AML/CFT Risk Assessments Recommendations:

- Incorporate PPI rankings into country risk assessments for trade, finance, and supply chain decisions.

- Apply enhanced due diligence (EDD) for transactions involving low-ranked jurisdictions.

- Align export control compliance with sanctions screening and AML/CFT monitoring to detect dual-use goods and suspicious financial flows.

- Train compliance teams on proliferation financing indicators and strategic trade control obligations.

- Document risk-based decisions and maintain audit trails for regulators.

Strategic Benefit:

- Using PPI insights strengthens compliance posture, reduces exposure to regulatory penalties, and supports global non-proliferation efforts.

Source

https://isis-online.org/peddling-peril-index

https://resources.inmm.org/sites/default/files/2021-09/a1578.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.