The Mauritius Penalty Framework & Severity Levels regulations are effective on 18 November 2025.

02/01/2026

The Financial Intelligence and Anti-Money Laundering (Administrative Penalties) Regulations 2025, introduced under sections 19H(1)(d)(iii) and 35 of Mauritius's Financial Intelligence and Anti-Money Laundering Act (FIAMLA), mark a pivotal advancement in the nation's anti-money laundering and counter-terrorism financing (AML/CFT) regime.

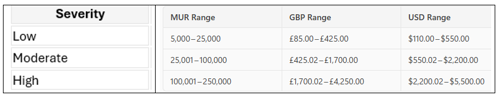

Effective from November 18, 2025, these regulations empower regulatory bodies to impose administrative penalties on professionals and entities for breaches of specified obligations, with fines ranging from Rs 5,000 to Rs 250,000 based on the breach's gravity (low, moderate, or high), considering factors like nature, duration, compliance history, and economic impact to promote proportional and effective enforcement.

Executive Summary

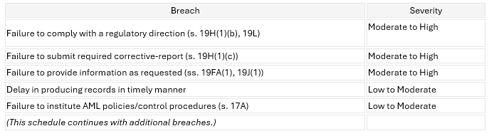

- Severity mapping: Full list of 39 breaches categorised as Low, Moderate, Moderate-to-High, or High.[see below]

- Penalty bands: Range from Rs 5k to Rs 250k depending on severity.[see below]

- Regulatory discretion: Penalty point set using detailed contextual assessment.[see below]

Penalty Framework & Severity Levels

Three severity tiers:

- Low, Moderate, and High severity breaches.

- [finelineco…liance.com], [comsuregroup.com]

- Monetary fines range from Rs 5,000 to Rs 250,000, depending on breach severity.

- [comsuregroup.com], [loop.mu]

Categorised Breaches by Severity

The First Schedule of the Regulations lists common breaches with assigned gravity:

Complete List of Breaches by Severity (First Schedule)

Below is a comprehensive breakdown of the FIAMLA (Administrative Penalties) Regulations 2025 for Mauritius, effective 18 November 2025. It includes all listed breaches by severity and the associated penalty ranges.

Low Severity

- Failure to provide information and produce records within the specified time and place under sections 19FA(1)/19J(1) of FIAMLA 2002

- [fiumauritius.org], [supremecou….govmu.org]

Moderate Severity

- Failure to conduct employee screening under reg 22(1)(b) of AML Regulations 2018

- Failure to train directors/officers/employees under reg 22(1)(c) of AML Regulations 2018

- Failure to identify and verify beneficial owners under AML Regulations 2018

- [fiumauritius.org], [supremecou….govmu.org]

Moderate to High Severity

- Failure to comply with a regulatory direction (s 19H(1)(b), s 19L)

- Failure to submit corrective measures report (s 19H(1)(c))

- Failure to provide information on request (ss 19FA(1), 19J(1))

- Failure to establish/maintain AML policies, controls, procedures (s 17A)

- Failure to identify, assess & understand ML/TF risks (s 17(1))

- Failure to assess ML/TF risks for new products/business/technology (s 17(3), reg 19 AML 2018)

- Failure to implement group-wide AML/CFT programme (reg 23 AML 2018)

- Failure in third-party due diligence reliance (reg 21 AML 2018, s 17D)

- Failure in measures for high-risk countries (s 17H, reg 24 AML 2018)

- Failure to implement UN sanctions controls (s 41 Sanctions Act)

- Failure to implement PEP measures (reg 15 AML 2018)

- Failure in disclosure procedures (reg 27 AML 2018)

- Failure in registers for internal/external disclosures (reg 30 AML 2018)

- Failure to provide full access during on-site inspections (s 19K(3))

- Failure to ensure compliance as a compliance officer (reg 22(1)(a) AML 2018)

- Failure to provide access for on-site inspections (s 19K(1))

- Failure to provide information for National Risk Assessment (s 19E(2)(b))

- [fiumauritius.org], [supremecou….govmu.org]

High Severity

- Failure to appoint MLRO/Deputy MLRO (reg 26 AML 2018)

- Failure to maintain reporting/disclosure procedures (reg 26(3) AML 2018)

- Failure to designate a senior compliance officer (reg 22(1)(a) AML 2018)

- Failure to implement independent audit function (reg 22(1)(d) AML 2018)

- Failure in customer due diligence (s 17C, 17E; regs 3–5, 8, 10 AML 2018)

- Failure in enhanced due diligence (s 17C(3)–(4); regs 12, 24(3) AML 2018)

- Failure to maintain required books and records (s 17F AML 2002)

- Failure in ongoing transaction/customer monitoring (regs 3(1)(e), 15(1)(d) AML 2018)

- Failure to report suspicious transactions (reg 8(5) AML 2018)

- Failure to establish anonymous or fictitious accounts (s 17B AML 2002)

- Engaging with shell banks (reg 17 AML 2018)

- Failure to register with FIU (s 14C FIAMLA; Registration Reg. 2019)

- Dealing with or providing assets to designated parties (Sanctions Act, ss 23–24)

- Failure to report under the Sanctions Act (s 25)

- Disclosing Suspicious Transaction Report (STR) in breach (s 16 FIAMLA)

- [fiumauritius.org], [supremecou….govmu.org]

Penalty Ranges by Severity (Second Schedule)

Regulatory bodies must apply penalties within these ranges, based on breach severity:

Calculation of Exact Penalty

Under Regulation 4, regulators must consider the following factors before deciding the specific amount (within the applicable range):

[fiumauritius.org], [supremecou….govmu.org], [maurice-info.mu]

- Nature, gravity, and duration of the breach

- Promptness and effectiveness of remedial action

- Historical compliance and recurrence

- Disciplinary measures against the involved staff

- Previous remediation was mandated and implemented

- Economic impact of the penalty on the entity

- Any other relevant aggravating or mitigating factors

Enforcement Considerations

Regulatory bodies (e.g., FIU, GRA, MIPA, Registrar of Companies) must evaluate a range of factors before imposing penalties:

- Nature, gravity, and duration of the breach

- Remedial actions taken

- Compliance history and recurrence

- Contribution by staff

- Economic impact

- Any other relevant factors

- [fiumauritius.org], [gra.govmu.org], [comsuregroup.com]

Reporting Timelines (Amended under AML/CFT Act 2024)

A 2024 update to FIAMLA revised reporting timelines:

- Information requested by the FIU must now be submitted within 15 working days, replacing the previous “as soon as practicable” standard.

- [axis.mu]

What This Means for You

- Clearer responsibility: Specific breaches triggering sanctions are now clearly enumerated and categorised by gravity.

- Stricter deadlines: File requested information within 15 working days to avoid High-severity fines.

- Heavier penalties: Fines can reach up to Rs 250,000 depending on breach severity.

- Contextual penalty calculation: Regulatory bodies must consider multiple factors—including prior compliance performance—before finalising any fine.

Source

- https://www.fiumauritius.org/fiu/wp-content/uploads/2025/12/112_the-Financial-Intelligence-and-Anti-Money-Laundering-Administrative-Penalties-Reg25.pdf

- https://www.comsuregroup.com/news/mauritius-cabinet-approves-new-amlcft-penalty-regulations-for-2025/

- https://finelinecompliance.com/blogs-1/f/mauritius-amlcft-administrative-penalties-2025-update

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.