The JFSC publish its Thematic examination programme 2023

25/01/2023

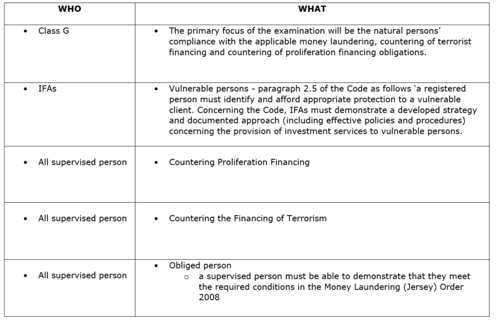

The JFSC has published its visit plans for 2023. In summary, they are looking at the following:-

The JFSC say:

- A particular topic or topics are selected for consideration and review across many different entities and/or individuals from the same sector or across sectors.

- This enables the standard of compliance and associated risks on the topic to be assessed more broadly.

- Examinations may be conducted through various means, including a questionnaire, in-depth examinations/desk-based activity or a combination of both.

- If your business is selected for inclusion in a thematic examination, the JFSC will contact you in due course to provide further details about the examination process.

2023 themes in more detail

Natural persons undertaking Class G trust company business

- Natural persons acting or fulfilling the function of or arranging for another person to act or fulfil the position of a director or alternate director of a company require a Class G trust company business licence. These individuals are often sought to provide expertise in one or more specific areas, for example, real estate funds or hedge funds, or act as trusted family advisors concerning privately owned companies.

- The primary focus of the examination will be the natural persons’ compliance with the applicable money laundering, countering of terrorist financing and countering of proliferation financing obligations.

- For example,

- Supervised persons must demonstrate that they have a comprehensive business risk assessment, effective systems and controls concerning taking on new customers and be able to evidence they have undertaken relevant training.

- The JFSC will also review compliance with certain key parts of the Code of Practice for Trust Company Business as it applies to natural persons.

Independent Financial Advisers – investment services to vulnerable persons

- Principle 2 of the Investment Business Code of Practice states that “a registered person must have the highest regard for the interests of its clients’.

- In particular, the requirements in respect of vulnerability are set out in paragraph 2.5 of the Code as follows ‘a registered person must identify and afford appropriate protection to a vulnerable client.

- Independent Financial Advisers must demonstrate a developed strategy and documented approach (including effective policies and procedures) concerning the provision of investment services to vulnerable persons.

- The JFSC has previously published guidance notesoutlining its expectations regarding the treatment and level of care provided to vulnerable or potentially vulnerable persons.

Reliance on obliged persons

- Supervised persons may meet their obligations to apply certain Customer Due Diligence (CDD) or Enhanced CDD measures by relying on measures that an OBLIGED PERSON has already used to find out and obtain evidence of the identity of a mutual customer.

- Reliance must always be subject to

- The conditions set out in the Money Laundering (Jersey) Order 2008 and

- To the extent that a supervised person places reliance on an obliged person,

- A supervised person must be able to demonstrate that they meet the required conditions in the Money Laundering (Jersey) Order 2008

Countering the Financing of Terrorism / Countering Proliferation Financing

In general terms,

- Terrorist financing

- Is the provision or collection of funds from legitimate or illegitimate sources

- With the intention of, or in the knowledge that these funds are intended to be used to carry out any act of terrorism,

- Whether or not those funds are used for that purpose.

Proliferation financing

- Can be described as providing financial services and products for the transfer and export of nuclear, chemical or biological weapons, their means of delivery and related materials.

- It involves financing trade in proliferation-sensitive goods

- But could also include other financial support for legal or natural persons or arrangements engaged in proliferation.

The examination will determine how well JFSC-supervised persons have implemented effective measures to counter terrorist financing and proliferation financing.

SOURCE

https://www.jerseyfsc.org/news-and-events/thematic-examination-programme-2023/

End

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.