The JFSC overhauls its higher risk country lists [the D2 lists]

03/02/2022

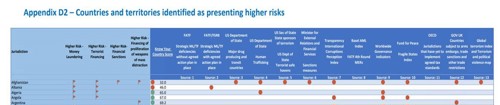

On the 1 February 2022, the JFSC announced that their Appendix D2* LIST [Countries and territories identified as presenting higher risks] has had an overhaul as can be shown in the following diagram and link 01022022-appendix-d2.pdf (jerseyfsc.org)

The changes they have made include:

- Addition of data including replacing obsolete Sources and reflecting the FATF 4th round mutual evaluations results

- Addition of indicators (red flags) to distinguish between countries which are higher risk for ML and those that are higher risk for TF, Sanctions and PF. This is to help support you with your business risk assessments for each of these risks categories

- Highlighting where a country is identified as presenting a higher risk.

The JFSC tell us

- Countries, territories, and areas listed under Sources 1 and 2 are also to be treated as being non-compliant with FATF Recommendations for the purpose of

3.Source 6 will only capture financial sanctions regimes that relate to a country, territory, or area, i.e., it will not capture thematic sanctions regimes.

- For a full list of financial sanctions regimes applicable in Jersey see Sanctions by country and category. https://www.jerseyfsc.org/industry/international-co-operation/sanctions/sanctions-by-country-and-category/

4.The risk indicators (red flags) are populated from the following sources:

- The Higher Risk/Money Laundering-list (Column B) is based on Sources 1, 2, 3, 4, 7, 8, 9, 10 and 11

- The Higher Risk/Financing of Terrorism-list (Column C) is based on Sources 1, 2, 3, 4, 5, 8, 9, 10 and 13

- The Higher Risk/Financial Sanctions-list (Column D) is based on Source 6 only

- The Higher Risk/Financing of Proliferation of Weapons of Mass Destruction-list (Column E) is based on Sources 1 and 12.

The JFSC also add a risk warning

- Countries, territories, and areas covered by each Source may not be consistent when one Source is compared with another Source. Equally, the information may be incomplete or out of date.

- The JFSC do not accept responsibility for the findings and conclusions of these sources.

- Relevant persons are expected to exercise judgement in relation to how they interpret and use the Sources and should reach and document their own consideration and conclusions on risk.

- See Sections 3, 6 and 7 of the AML/CFT Handbook for further guidance. https://www.jerseyfsc.org/industry/financial-crime/aml-cft-handbooks/

*Appendix D2 of the Handbook for the prevention and detection of money laundering and the countering of terrorism financing provides details of countries, territories and areas that have been identified by reliable and independent third-party sources as presenting a higher risk of:

- Money laundering;

- Financing of terrorism and;

- Financing of proliferation of weapons of mass destruction.

SOURCES

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.