The JFIU 4th Proliferation Financing typology and case study

06/08/2025

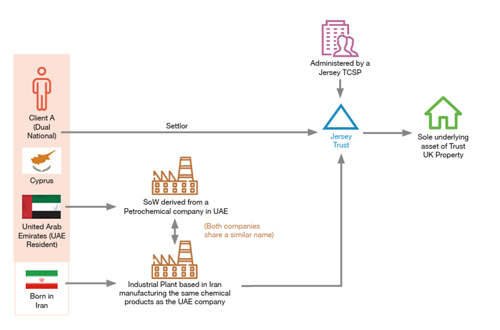

The latest JFIU typology examines a fictional case of:

- Know Your Client (KYC) for an individual/owner of a petrochemical business (amongst others);

- With links to an Iranian company; and

- Which is the subject of US Sanctions as an entity of potential concern for Weapons of Mass Destruction (WMD)-related procurement.

The link to Jersey, in this case, is that:

- These businesses and further assets are in a Jersey Trust which is administered through Jersey Trust and Company Service Provider.

Extracted Facts from the Document

- Below is a consolidated copy of the key facts from the provided document (Typology 16: Proliferation Financing / Dual-Use Goods - TCSP, from the Financial Intelligence Unit - Jersey).

- https://go.fiu.je/Typo16

Client Profile and Business Details

- Client A has been a United Arab Emirates (UAE) resident for the last 20 years but was born and raised in Iran.

- Client A owns a business in the UAE involved in Petrochemical trading and manufacturing textiles and carpets.

- These businesses are not typically subject to any Enhanced Due Diligence (EDD) measures.

- During the sale of the sole underlying asset (a property in the UK), EDD checks were performed, revealing a familial link.

- Client A's petrochemical, textiles, and carpet manufacturing businesses in the UAE were identified as being linked to an Iranian company.

- The linked Iranian company is subject to US sanctions as an entity of potential concern for Weapons of Mass Destruction (WMD)-related procurement.

Indicators of Risk

- Financial statements provided by the Settlor (Client A) revealed significant funds received from the sale of chemicals that could be attributable to dual-use goods.

- The Settlor held dual nationality, which included a European passport (likely obtained on a citizenship and residency basis) and a US passport; this is not uncommon for someone known at the time of onboarding the relationship.

- The UAE has a business-friendly environment, which can allow for the rapid incorporation of companies; these can then be used to disguise ultimate threat actors by creating front companies for illicit purposes.

- The UAE company's primary geographic market was China; it was previously engaged in Singapore at the same time that US authorities began a concerted effort to address Middle East companies being used to circumvent the sanctions process and ultimately facilitate the sale of Iranian chemicals to China.

- Client A held dual nationality and may have had access to funds from Iran, which could have been used to transfer funds across borders and evade detection.

Additional Analysis and Risks from FIU observations and Recommendations

- The FIU internally executed the scenario to its strategic analysis team to consider the creation of a typology for the FIU, focusing on the purpose and role in reining in sectors and products.

- Sanctions screening is not enough to identify Proliferation Financing (PF) risk.

- Proliferation uses tactics that may evade traditional detection methods, such as employing legitimate actors, including friends and family members, to undertake the activity.

- Effective PF risk management requires thorough customer due diligence universally, including Know Your Customer (KYC), Anti-Money Laundering (AML), and ultimately EDD; this would have prompted further review of transaction activity, likely flagging unusual activity earlier.

- As a recognised high-risk jurisdiction, the company's links with Iran should have triggered a heightened requirement, which may have resulted in identifying the initial link to the sanctioned Iranian company sooner.

- Trust and Company Service Providers (TCSPs) are at significant risk of being exploited for PF due to their role in setting up and managing legal entities, such as companies and trusts; these services are often used to create complex corporate structures that launder funds and enable bad actors to facilitate illicit financial flows and evade international sanctions.

- The financial sector's proximity between the UAE and Iran has facilitated easier and quicker movement of goods, people, and money, which can be exploited for illicit activities.

- The movement of General Trading Companies in Free Trade Zone areas remains an ongoing and significant risk.

- All major trade and transhipment hubs offer opportunities for proliferation financing to disguise trade activity that may be used for weapons proliferation.

The FIU message is:

- The importance of Enhanced Due Diligence is a key factor in this case. Effective PF risk management requires thorough customer knowledge at the onboarding of the relationship.

- TCSPs are at significant risk of being exploited for PF due to their role in setting up and managing legal entities.

- These services are often used to create complex Corporate Structures, Shell Companies and Trusts that obscure the identities of those involved, enabling bad actors to facilitate illicit Financial Flows and evade.

- International Sanctions.

Read the complete typology below, or download it here: https://go.fiu.je/Typo16

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.