The case HMRC v Xing [2025] EWHC 2057 (Admin) involves a significant enforcement action targeting alleged underground banking and illicit financial flows linked to Chinese nationals in the UK.

06/08/2025

FREEZING ORDERS: Chinese couple's assets frozen without notice in underground banking investigation.

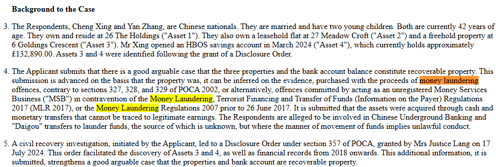

HM Revenue and Customs has been granted a property freezing order against Chinese nationals Cheng Xing and Yan Zhang in respect of three properties and a bank account valued at over GBP1.4 million in total.

HMRC alleges the pair are involved in Chinese underground banking and 'Daigou' transfers to launder funds of unknown origin, and sought the order without notice because of the risk of dissipation (HMRC v Xing, 2025 EWHC 2057 Admin).

Here's a breakdown of the key elements:

🧾 Case Summary

- Parties: HM Revenue and Customs (HMRC) vs Cheng Xing and Yan Zhang.

- Court: High Court (Administrative Division).

- Citation: [2025] EWHC 2057 (Admin).

- Order Granted: Property Freezing Order (PFO) without notice.

💰 Assets Frozen

- Three properties and one bank account.

- Total value: Over £1.4 million.

⚖️ Allegations

- HMRC alleges involvement in:

- Chinese underground banking networks;

- Daigou transfers (informal cross-border shopping and remittance); and

- Money laundering of funds with an unknown origin.

🚨 Legal Grounds for Freezing

- The order was granted without notice due to:

- Risk of dissipation of assets; and

- Concerns that the individuals might move or conceal funds if alerted.

🔍 Daigou & Underground Banking Context

- Daigou: A practice where individuals purchase goods abroad to resell in China, often used to bypass import duties or currency controls.

- Underground banking: Informal systems for transferring money across borders, often outside regulated financial channels.

📌 Implications

- This case reflects HMRC’s increasing use of civil recovery tools like PFOs to disrupt suspected illicit finance.

- It also highlights the UK’s focus on cross-border financial crime, especially involving non-resident nationals and complex asset structures.

SOURCE

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.