TESCO BANK FUNDS “INSIDER DEALING” WITH LOANS FOR HOME IMPROVEMENTS!!

27/02/2024

Mohammed Zina [35-year-old] an ex-Goldman Sachs analyst was convicted this month of insider dealing and fraud after a trial lasting nearly three months. He was sentenced to 22-month.

During the trial, the jury heard how Zina had made about £140,000 in profits from trading on stocks including.

- Semiconductor designer Arm and pub company Punch Taverns.

- His biggest win was about £55,000 in profit on trades in US food company Snyder’s-Lance.

Mohammed Zina was originally charged alongside his brother, Suhail Zina, a former Clifford Chance lawyer.

Suhail was acquitted on all nine counts before the trial ended,

- After the FCA withdrew the fraud counts against him and

- The judge ruled that there was no case for him to answer on insider trading.

The Zina case — known as Operation Kempston by the FCA — is the first insider dealing conviction the UK Financial Conduct Authority has secured since 2019.

TESCO’S INVOLVEMENT

Mohammed Zina used his brother [Suhail’s] name, as well as their sister’s, to open trading accounts as a way of disguising his activity from Goldman.

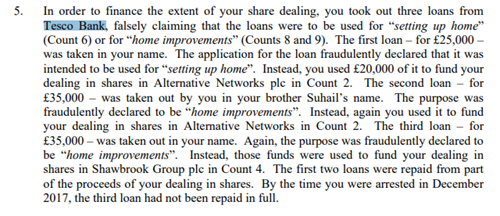

He took out loans with Tesco Bank,

- Applying for them on the basis he wanted to finance home improvements, and

- Used the funds in part to place 46 illegal trades through the accounts in his brother’s and sister’s names.

A witness for Tesco who was called to testify about the loan applications was described by the FCA’s own lead prosecutor Peter Carter KC as “USELESS”.

THE FCA & INSIDER DEALING

- After a fallow period for enforcement in the UK during the Covid-19 pandemic, the FCA is showing signs that it is looking to get back on the front foot.

- The watchdog arrested three London-based individuals on suspicion of insider dealing this month and is in the midst of prosecuting a number of others for the offence.

- The FCA currently has 17 insider dealing investigations open, compared with 22 in 2022 and 14 in 2021, according to data provided by the agency.

- The regulator has had a mixed record on pursuing insider trading.

- In the past decade, it has secured the convictions of employees from blue-chip firms including UBS and BlackRock Investment Management.

- The agency also prosecuted the UK’s biggest-ever insider trading ring — Operation Tabernula — charging nine men, from day traders to a former corporate broker at Deutsche Bank.

- Yet, prosecutions have been lacking in recent years and cases it has pursued have not always gone smoothly.

- Only two of the five men tried in Tabernula were convicted — although another three previously pleaded guilty and one was convicted in absentia —

SOURCE

https://www.judiciary.uk/wp-content/uploads/2024/02/R-v-Zina.pdf

https://www.ft.com/content/c31a63e5-c5aa-4f5a-9a44-23f863c315f3

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.