SUSTAINABILITY-RELATED RISKS: Is your JFSC EWRA (BRA) ready?

06/06/2025

The JFSC has issued a consultation on proposals about SUSTAINABLE FINANCE on 27 May 2025. The JFSC is inviting comments on this consultation paper by 4 July 2025.

The consultation is here:

The consultation is aligned to the JFSC’s lead actions as part of Jersey’s Sustainable Finance Action Plan (the Action Plan) published in November 2024:

- https://www.gov.je/Industry/Finance/Pages/SustainableFinancePlan.aspx

- https://www.gov.je/SiteCollectionDocuments/Industry%20and%20finance/Sustainable%20Finance%20Action%20Plan%20May%202025.pdf

This consultation paper seeks feedback on:

- Proposals to enhance THE CODES OF PRACTICE concerning two of the JFSC’s lead actions as part of Jersey’s Sustainable Finance Action Plan (the Action Plan) published in November 2024:

- Sustainability risk

- Business integrity risk and

- The potential impact of the proposals.

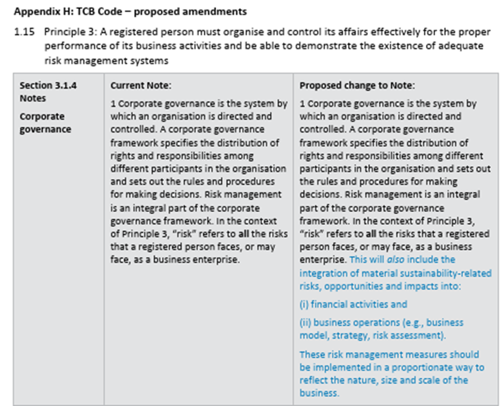

More specifically, it is proposed that the codes will state:-

- Risk management is an integral part of the corporate governance framework.

- In the context of Principle 3 of the JFSC CODES, “risk” refers to all the risks that a registered person faces, or may face, as a BUSINESS ENTERPRISE*

- *ENTERPRISE-WIDE BUSINESS RISK ASSESSMENT [EWRA]

- These risks include integration of material SUSTAINABILITY-RELATED RISKS, opportunities, and impacts into:

- Financial activities and

- Business operations, including but not limited to

- Business Model,

- Strategy,

- Risk assessment

- etc

THE PROPOSED AMENDMENT IS ALSO SHOWN HERE

START ACTING NOW

So, at this time, JFSC-regulated firms should consider how to comply with the above new proposed codes for integrating sustainability-related risks and opportunities and how they impact the enterprise-wide business risk assessment.

FIRMS SHOULD CONSIDER THE FOLLOWING ELEMENTS:

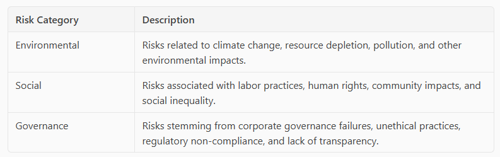

- Identification of Sustainability-Related Risks and Opportunities

- Environmental Risks: Climate change, resource scarcity, pollution, and biodiversity loss.

- Social Risks: Labour practices, community relations, human rights, and health and safety.

- Governance Risks: Ethical conduct, regulatory compliance, and transparency.

- Integration into Financial Activities

- Financial Impact Analysis: Assess how sustainability risks and opportunities affect financial performance, including revenue, costs, and asset values.

- Investment Decisions: Incorporate ESG criteria into investment evaluations and decisions.

- Financial Reporting: Include sustainability-related disclosures in financial statements and reports.

- Integration into Business Operations

- Business Model: Adapt the business model to mitigate sustainability risks and leverage opportunities, such as shifting to renewable energy sources or sustainable supply chains.

- Strategy: Embed sustainability into the corporate strategy, setting clear sustainability goals and objectives.

- Risk Assessment: Conduct regular risk assessments using scenario analysis and stress testing tools, including sustainability-related risks.

- Methodology for Risk Assessment

- Materiality Assessment: Determine which sustainability risks are material to your business and stakeholders.

- Risk Identification and Prioritisation: Identify and prioritise risks based on their potential impact and likelihood.

- Risk Mitigation and Management: Develop strategies to mitigate identified risks, including contingency planning and transfer mechanisms.

- Monitoring and Reporting: Establish processes for ongoing monitoring and reporting of sustainability risks and performance against sustainability goals.

- Governance and Accountability

- Board and Executive Oversight: Ensure the board and executive management understand and oversee sustainability risks.

- Stakeholder Engagement: Engage with stakeholders to understand their concerns and expectations regarding sustainability.

- Transparency and Disclosure: Provide transparent disclosures about sustainability risks, opportunities, and impacts.

By integrating these elements into your enterprise-wide business risk assessment, you can effectively address sustainability-related risks and opportunities, ensuring compliance with the JFSC CODES and enhancing your overall risk management framework

Here's a basic template for conducting a sustainability-related risk assessment. You can customise it to fit your specific needs and context:

Sustainability-Related Risk Assessment Template

- Introduction

Provide an overview of the purpose and scope of the risk assessment.

- Risk Identification

Identify potential sustainability-related risks across environmental, social, and governance (ESG) categories.

- Risk Assessment

Assess the likelihood and potential impact of each identified risk.

- Risk Mitigation Strategies

Outline strategies to mitigate the identified risks.

4.1 Environmental Risks

- Reduce greenhouse gas emissions.

- Improve resource efficiency.

- Transition to renewable energy sources.

4.2 Social Risks

- Strengthen social governance frameworks.

- Ensure fair labour practices.

- Engage with local communities.

4.3 Governance Risks

- Enhance corporate governance policies.

- Promote ethical behaviour.

- Ensure regulatory compliance.

- Monitoring and Reporting

Establish processes for ongoing monitoring and reporting of sustainability risks.

- Monitoring: Regularly review and update risk assessments.

- Reporting: Provide transparent disclosures about sustainability risks and performance.

- Conclusion

Summarise the key findings and the importance of addressing sustainability-related risks.

References

You can find more detailed templates and tools online, such as the free sustainability risk assessment template available on Template.net [1] or the ESG risk assessment template from Logic Manager [2].

[1] Free Sustainability Risk Assessment Template to Edit Online https://www.template.net/edit-online/472796/sustainability-risk-assessment

[2] FREE Excel Sheet Download: ESG Risk Assessment Template - ERM Software https://www.logicmanager.com/resources/esg/esg-risk-assessment-template/

References

[1] How to integrate ESG risks into the enterprise’s overall risk ... www.thomsonreuters.com/en-us/posts/esg/enterprise-risk-management/

[2] ESG explained: Risk assessment - Viewpoint https://viewpoint.pwc.com/dt/us/en/pwc/in_the_loop/assets/esgexplainedriskassess22.pdf

[3] DIAGNOSTIC Assessing the level of integration of ESG-related risks into ... www.wbcsd.org/wp-content/uploads/2023/11/WBCSD-Diagnostic-Assesing-the-level-of-integration-of-ESG-related-risks-into-enterprise-risk-management.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.