Standard Chartered Bank is being sued for US$2.7 billion concerning fraud and the systematic theft of funds.

02/07/2025

The 1MDB scandal has led to a major lawsuit in Singapore’s High Court. Liquidators are seeking over US$2.7 billion (about US$3.4 billion) from Standard Chartered Bank.

The suit, filed on June 30, seeks to hold StanChart accountable for allegedly enabling fraud against 1MDB and the systematic theft of funds.

Three companies in liquidation linked to 1MDB – ALSEN CHANCE HOLDINGS, BLACKSTONE ASIA REAL ESTATE PARTNERS AND BRIGHTSTONE JEWELLERY – alleged that between 2009 and 2013, StanChart permitted over 100 intra-bank transfers that helped conceal the flow of stolen funds and chose to overlook obvious red flags regarding these transfers.

The suit claims that the bank failed to comply with Singapore’s anti-money laundering (AML) regulations and client due diligence rules.

The case alleges that the bank enabled the laundering of vast sums connected to 1Malaysia Development Berhad, sharply focusing its anti-money laundering (AML) controls and oversight as global regulators continue to crack down on cross-border financial crime.

Here’s a breakdown of the legal arguments:

🔍 Claims by the Liquidators

- Negligence in AML Oversight:

- The bank allegedly permitted over 100 suspicious intra-bank transfers between 2009 and 2013.

- These transfers were linked to shell companies controlled by Jho Low and Eric Tan, both fugitives tied to the 1MDB scandal.

- Failure to Act on Red Flags:

- The bank allegedly ignored obvious indicators of money laundering.

- Funds were used for luxury purchases, personal accounts of Najib Razak’s family, and other illicit purposes.

- Breach of Singapore’s AML Regulations:

- The suit claims Standard Chartered violated client due diligence obligations under Singapore law.

- The bank allegedly failed to verify the legitimacy of the companies and transactions involved.

- Concealment of Illicit Flows:

- The transfers allegedly helped obscure the origin and destination of stolen public funds.

- The liquidators argue that this facilitated the systematic theft of Malaysian public assets.

The 1MDB saga continues reverberating globally, with banks, regulators, and governments still pursuing accountability.

The outcome of this lawsuit could set a significant precedent for how financial institutions are held responsible for past AML failures, especially in cross-border corruption and fraud cases.

Here’s a detailed summary of the Standard Chartered–1MDB lawsuit currently unfolding in Singapore’s High Court, based on the latest reporting.

🧩 Understanding the 1MDB Scandal and the Legal Case Against Standard Chartered

The lawsuit is part of the ongoing global effort to recover billions misappropriated from 1Malaysia Development Berhad (1MDB), Malaysia’s former sovereign wealth fund. In June 2025, liquidators from Kroll filed a suit in Singapore seeking over US$2.7 billion (US$3.4 billion) from Standard Chartered Bank (Singapore).

They allege the bank enabled the laundering of stolen 1MDB funds by failing to detect or act on suspicious transactions between 2009 and 2013.

🔍 The Anatomy of the Alleged Laundering Schemes

The claim centres on:

- Over 100 intrabank transfers allegedly processed by Standard Chartered.

- These transfers were linked to three shell companies with no legitimate business operations.

- The companies were allegedly controlled by fugitives Low Taek Jho (Jho Low) and Eric Tan, key figures in the 1MDB scandal.

- The liquidators argue the bank ignored red flags and violated AML regulations by allowing these transactions.

🛡️ Standard Chartered’s Defence

Standard Chartered has rejected the claims, stating:

- It has not yet received the legal documents.

- It shut down the accounts in early 2013 and reported suspicious activity to authorities.

- The Monetary Authority of Singapore (MAS) had investigated the bank in 2016, finding regulatory breaches but no pervasive control failures or wilful misconduct.

- The bank emphasised its ongoing investment in AML controls and its commitment to fighting financial crime.

🛡️ It asserts:

- The accounts were shut down in early 2013.

- It reported suspicious activity to authorities at the time.

- It cooperated fully with the Monetary Authority of Singapore (MAS).

- MAS’s 2016 inspection found regulatory breaches but no wilful misconduct.

🏛️ Regulatory Response and Singapore’s AML Enforcement

Singapore has firmly opposed AML enforcement, especially in high-profile cases like 1MDB. MAS has:

- Penalised several banks for AML lapses related to 1MDB.

- Strengthened AML regulations and client due diligence requirements.

- Encouraged financial institutions to adopt risk-based approaches and report suspicious transactions proactively.

🌍 Lessons for Global AML Compliance

This case underscores key lessons:

- Historical transactions can still lead to liability years later.

- Shell companies and complex fund flows remain significant AML risks.

- Regulatory cooperation across borders is essential in tackling financial crime.

- Financial institutions must maintain robust internal controls, even when dealing with high-profile or politically exposed clients.

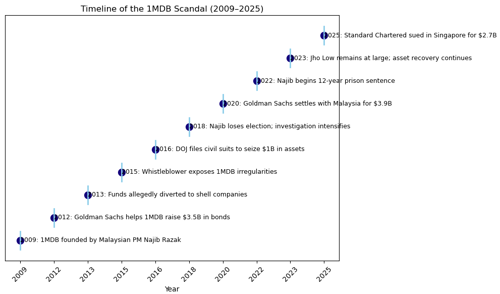

📅 Visual Timeline of the 1MDB Scandal (2009–2025)

This timeline highlights key events from the founding of 1MDB to the 2025 lawsuit against Standard Chartered:

🔚 Conclusion: The Ongoing Impact of the 1MDB Scandal

The 1MDB saga continues reverberating globally, with banks, regulators, and governments still pursuing accountability.

The outcome of this lawsuit could set a significant precedent for how financial institutions are held responsible for past AML failures, especially in cross-border corruption and fraud cases.

References

- Standard Chartered Hit with $2.7 Billion 1MDB Lawsuit https://www.globallawtoday.com/law/case-law/2025/07/standard-chartered-hit-with-2-7-billion-1mdb-lawsuit/

- 1MDB saga: Standard Chartered Bank refutes $3.4 billion claim by ... https://www.straitstimes.com/singapore/courts-crime/standard-chartered-bank-refutes-us2-7-billion-claim-by-liquidators-in-singapore-in-1mdb-saga

- Standard Chartered Bank faces US$2.7 billion lawsuit in Singapore ... - CNA https://www.channelnewsasia.com/business/standard-chartered-bank-1mdb-enabling-fraud-lawsuit-singapore-5213426

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.