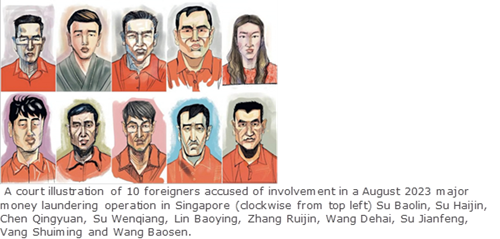

Singapore seizes money launderer's assets in Swiss banks in S$1.8 billion case.

07/09/2023

About S$92 million and S$33 million were seized from bank accounts held by Turkish national Vang Shuiming at Credit Suisse Singapore and Bank Julius Baer respectively, according to a police affidavit presented in the high court on Tuesday.

According to prosecutors, the total value of assets seized by investigating authorities now stands at S$1.8 billion.

Some S$1 billion was seized in simultaneous raids weeks ago.

Investigators are still awaiting information from five unnamed financial institutions, the affidavit said.

Credit Suisse declined to comment. Bank Julius Baer did not respond to requests for comments.

The confiscated assets have included gold bars, designer handbags, jewellery, properties and luxury cars.

The scale of the money laundering operation has shocked the wealthy Asian financial hub, and raised concerns over whether there are loopholes in its financial system.

A state court denied bail for two of the accused foreigners, Wang Baosen and Su Baolin, on Wednesday.

The others had been due to appear in court via a video link, but remained in remand as the lawyers needed more time to speak with them.

OBSERVATION

When the complex Money Laundering case was pieced together and reported in August it became the biggest of its kind in Singapore.

At the time assets seized stood at S$737m and have now shot up to an eye-watering S$1.8bn and counting.

We are now starting to see the initial findings from the Intelligence obtained.

The initial summary of evidence has raised significant questions about crash barriers against illicit money flowing into one of the world’s most important financial hubs.

- Assets have been seized totalling S$125 million from the bank accounts of one of the suspects in the scandal.

- About S$92 million and S$33 million were seized from bank accounts held by Turkish national Vang Shuiming at

- Credit Suisse Singapore and

- Bank Julius Baer

Some of the individuals who were arrested and charged this month held funds totalling millions in

- United Overseas Bank and

- The local units of

- Citigroup and

- RHB Bank.

They also allegedly used fake documents at

- Oversea-Chinese Banking Corp,

- Standard Chartered and

- CIMB Bank

As the facts start to become public, the read across to other financial hubs must not be overlooked. For now, it's the banks in Singapore who are under the spotlight, that could soon turn to many others around the globe. Singapore cannot be an isolated case as funds flowed elsewhere.

WATCH THIS SPACE

Source

The Straits Times Illustrations/Cel Gulapa via REUTERS/File

SINGAPORE, Sept 5 (Reuters) - Police in Singapore investigating a major money laundering operation have seized S$125 million ($91.79 million) from the bank accounts of one of ten foreign suspects accused in the case.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.