NOT included in JERGOV consultation - JFSC powers to impose sanctions without the involvement of an independent tribunal.

01/01/2026

The Government of Jersey's 2025 [JERGOV] consultation on the Civil Financial Penalties Regime aims to

- ENSURE Jersey adheres to FATF standards by having “effective, dissuasive and proportionate sanctions” AND to enhance enforcement through proportionate penalties.

- REVIEW the maximum amounts of financial penalties that the Jersey Financial Services Commission (JFSC) can impose under the Financial Services Commission (Financial Penalties) (Jersey) Order 2015.

THIS CONSULTATION DEALS WITH FINE VALUE, NOT APPEALS

- The JERGOV consultation marks a crucial phase in refining the civil financial penalties framework for Bands 1 and 2/2A, and the continuation of unlimited penalties for serious (Band 3) violations, while establishing a foundation for more transparent and fairer enforcement through updated JFSC methodology.

- Participants in the consultation are asked to consider three main proposals:

- Does not address independent INDEPENDENT Tribunals

INDEPENDENT Tribunals - 2021 LAST TIME THIS MATTER WAS DISCUSSED

- On July 21, 2021, the Jersey-Gov and JFSC went LIVE (YouTube) to explain the increasing powers of Civil financial penalties legislation and decision-making process consultations. One area discussed was tribunals and the independence of decision-making.

- What was raised by several delegates (via SLIDO) was:

- There was no proposal/suggestion to provide for an independent (and cheaper alternative to going to the Royal Court) administrative and judicial review procedure for regulated persons caught in the cross-hairs of JFSC enforcement.

- George Pearmain, the lead policy adviser on financial crime for the government of Jersey, suggested that Jersey was only following most other jurisdictions.

- https://www.comsuregroup.com/news/the-jersey-finance-industry-is-told-you-don-t-need-an-independent-tribunal/

INDEPENDENT TRIBUNAL and OTHER JURISDICTIONS

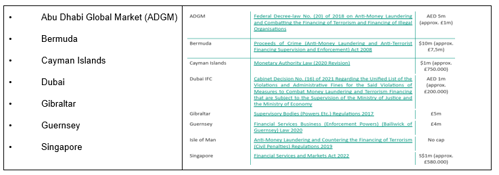

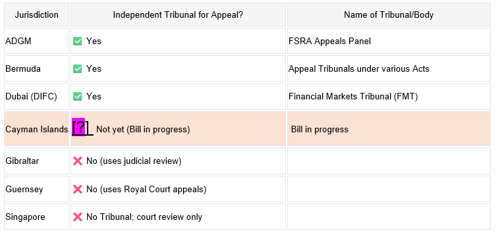

- Jersey government says that as part of the assessment of the fairness, proportionality, and dissuasiveness of Jersey’s regime, the Government of Jersey has considered the following corresponding administrative penalty regimes in other IFCs.

What is interesting in analysing this list above is that three IFCs have independent tribunals, and one is setting one up

See Appendix 1 below for more information

THE SITUATION IN JERSEY

- In Jersey, the Jersey Financial Services Commission (JFSC) has the power to impose civil financial penalties and other regulatory sanctions without the involvement of an independent tribunal. Instead:

- Decisions are made administratively by the Board DMP Committee, following the JFSC’s internal Decision‑Making Process (DMP).

- After a sanction is imposed, the affected party does not have access to a specialised or separate regulatory tribunal.

- For other types of JFSC decisions that don't trigger formal sanction appeal rights,

- The only recourse is a judicial review within three months, and

- Only on grounds of the decision being unlawful, irrational, or procedurally improper.[ogier.com]

- Key Points of Challenge & Concern

- Lack of independent oversight:

- Critics have highlighted that there’s no appeal to an independent tribunal, but rather an internal administrative process followed by court-based review.

- Limited appeal routes:

- Parties can’t appeal through a tribunal; only via the narrow statutory route to the Royal Court, which does not constitute a full merits review by an independent body.

- Judicial review limitations:

- Other decisions must be challenged via judicial review, which offers no complete examination of the merits, just a check for legal or procedural errors.

- Lack of independent oversight:

- Key Criticisms - Here are the main criticisms and proposed reforms related to the lack of an independent appeals process for JFSC financial sanctions:

- No access to an independent appeal tribunal

- Currently, affected parties can appeal JFSC civil penalties or sanctions only to the Royal Court, and only on the basis that the decision was unreasonable. There is no intermediate administrative or regulatory tribunal for merits-based appeal.

- [comsuregroup.com], [ogier.com]

- Heavy-handed enforcement and weak accountability

- Investigative media coverage (e.g., Jersey Evening Post) has criticised the JFSC’s enforcement tactics as “heavy-handed” and lacking transparency and accountability.

- [jerseyeven…ngpost.com],

- OECD and good governance expectation gap

- During legislative consultations, observers, including the OECD, highlighted the absence of administrative appeal mechanisms.

- These promote fairness and timely review of decisions and hold regulators accountable.

- [comsuregroup.com]

- Internal decision-making lacks independence

- Regulatory decisions are made through an internal process (“Board DMP Committee”), rather than by a judicial or quasi-judicial tribunal.

- [ogier.com],

- [ogier.com]

- No access to an independent appeal tribunal

- Proposed Reforms & Improvements

- Introduction of administrative appeal mechanisms

- Stakeholders recommended establishing a lower-tier independent administrative process (rather than relying only on direct court appeals).

- [comsuregroup.com]

- Consultation on the civil penalties’ regime

- The Government paused ongoing civil penalties cases and launched a consultation to reassess thresholds, appeal mechanisms, transparency of methodology, and alignment with good regulatory practice.

- [jerseyfsc.org],

- [jerseyfinance.com]

- Strategic review of the regulatory framework

- The Minister for External Relations acknowledged public concern and initiated a strategic review, including the JFSC’s role, transparency, independence, and the potential introduction of appeal mechanisms.

- [statesassembly.je]

- Enhancing transparency and accountability

- Recommendations include subjecting the JFSC to Freedom of Information laws and requiring it to publish clearer reasons for decisions, echoing earlier rulings that administrative bodies must provide reasoned explanations.

- [statesassembly.je],

- [mourant.com]

- Introduction of administrative appeal mechanisms

JERSEY SHOULD IMPLEMENT AN INDEPENDENT AND MORE AFFORDABLE ADMINISTRATIVE/JUDICIAL REVIEW PROCEDURE.

- Here are the key reasons why Jersey should implement an independent and more affordable administrative/judicial review procedure for regulated entities subject to JFSC enforcement:

- Enhanced Accountability & Fairness

- An independent appeals body ensures systematic and equitable enforcement, helping maintain public and industry confidence.

- [comsuregroup.com]

- As noted by the OECD, regulated persons must have access to standardised appeal processes and timely decisions on their challenges.

- [comsuregroup.com]

- Reduced Cost & Barriers to Justice

- Current judicial review in the Royal Court is often prohibitively expensive, requiring legal representation and court fees.

- [citizensadvice.je],

- [careyolsen.com]

- A streamlined, administrative appeal process would lower these financial and procedural hurdles, ensuring justice isn’t limited to those who can afford it.

- Timeliness & Efficiency

- Administrative tribunals typically deliver rapid resolutions, avoiding delays inherent in full court proceedings.

- This efficiency helps regulated persons avoid prolonged uncertainty, and regulators maintain predictable enforcement timelines.

- Proportionate Sanctions & Merits-Based Review

- A properly empowered tribunal can conduct a merits-based assessment, ensuring fines are proportionate to the misconduct―not simply punitive.

- This encourages both deterrence and compliance, aligning with overarching regulatory objectives highlighted in JFSC’s enforcement policy.

- [ogier.com]

- Alignment with International Best Practice

- Many leading global financial jurisdictions (e.g., UK, DIFC, Bermuda) provide independent review avenues for regulatory enforcement decisions.

- Introducing a similar framework in Jersey enhances the Island's reputation and competitive positioning as a robust, business-friendly IFR centre.

- Streamlined Administrative Law

- Jersey already has the Administrative Decisions (Review) (Jersey) Law 1982, which supports administrative reviews of governmental decisions.

- [jerseylaw.je]

- Extending its scope to include JFSC civil penalties would leverage existing mechanisms, providing a clear and accessible review path.

- Enhanced Accountability & Fairness

Summary

- An independent and low-cost appeal mechanism would:

-

- Ensure fairness and accountability 👍

- Increase accessibility to justice

- Speed up dispute resolution

- Encourage proportionate sanctions

- Align Jersey with global regulatory standards

- Use established administrative law structures

APPENDIX 1

JURISDICTIONS WITH INDEPENDENT APPEALS TRIBUNALS

1. Abu Dhabi Global Market (ADGM)

- The FSRA Appeals Panel is an independent adjudicative body established under the ADGM Financial Services and Markets Regulations 2015.

- It hears appeals (References) in full merits review, affirming, varying, overturning, or remitting FSRA decisions. [adgm.com]

- Its decisions may be further challenged by judicial review in ADGM’s Court of First Instance. [adgm.com]

2. Bermuda

- The Ministry of Finance appoints Appeal Tribunals to hear appeals by financial entities (e.g., banks, funds) against decisions of the Bermuda Monetary Authority (BMA).

- [gov.bm], [Consultati…ns - FINAL]

- Tribunal procedures and jurisdiction are governed by specific Tribunal Regulations (e.g., Banking Appeal Tribunal, Investment Funds Appeal Tribunal Regulations).

- [commonlii.org],

- [Consultati…ns - FINAL]

3. Dubai (DIFC / DFSA)

- The Financial Markets Tribunal (FMT), established under DIFC’s Regulatory Law 2004, hears:

- References (appeals of DFSA decisions) with full merits reviews,

- Regulatory proceedings involving fines, censures, prohibitions, etc.

- [dfsa.ae]

- Appeals from the FMT’s decisions on points of law can be made to the DIFC Court.

- [dfsa.ae]

? Jurisdictions waiting on Independent Tribunal Appeals

Cayman Islands

- While CIMA can impose administrative fines under the Monetary Authority Act, the new Administrative Appeals Tribunal Bill (2025) is still pending legislation and not yet in force. There is currently no independent tribunal for appealing fines.

- [parliament.ky], [caymaninde…endent.com]

❌ Jurisdictions Without Independent Tribunal Appeals

Gibraltar

- The GFSC receives complaints and has internal processes under the Financial Services Act, but there's no statutory independent external tribunal designated for appeals of financial penalties. Appeals must be made through judicial review in local courts.

- [gibraltarlaws.gov.gi], [fsc.gi]

Guernsey

- The GFSC issues fines and enforcement decisions, which may be reviewed by the Royal Court, followed by the Court of Appeal. These are judicial reviews rather than appeals to a separate independent tribunal.

- [gfsc.gg], [bedellcristin.com]

Singapore

- The MAS imposes administrative fines (composition penalties), but no independent tribunal exists to hear appeals. Instead, affected parties may seek judicial review in the courts.

- [theonlinecitizen.com]

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.