NEWS reports that Iran used HSBC, Santander, and Lloyds to Evade US Sanctions.

06/02/2024

Further to yesterday's Santander, and Lloyds news HSBC has been added to the mix, as follows:-

- Another document in the leak shows a shipping invoice which appears to be linked to the export of plastics from Iran.

- The invoice is between:-

- A Hong Kong company that banks with HSBC and

- A Chinese firm that appears to be a proxy for PCC,

- https://www.thetimes.co.uk/article/iran-santander-lloyds-accounts-front-companies-tlphx72xs

Please read yesterday's posting below or CLICK here https://www.comsuregroup.com/news/ft-reports-that-iran-used-santander-and-lloyds-to-evade-us-sanctions/

FT reports that Iran used Santander and Lloyds to Evade US Sanctions.

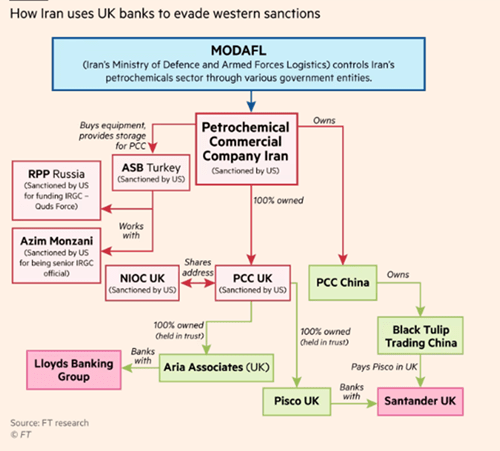

The Financial Times has reported that Iran evaded sanctions and was able to covertly move money around the world using accounts at two of the UK’s biggest banks, Lloyds Banking Group Plc and Santander UK. The FT reported that the lenders provided accounts to front companies secretly owned by a sanctioned Iranian petrochemical company. The newspaper reported on Sunday, citing documents it viewed. Iran’s intelligence services backed the sanctions-evasion plan.

KEY REPORTED FACTS

The FT said:-

- The state-controlled Petrochemical Commercial Company [PCC] and its British subsidiary have been under US sanctions since 2018.

- The firm is accused of raising money for Iran’s Islamic Revolutionary Guard Corps Quds Force as well as cooperating with Russia to fund Iranian-backed proxy militias,

The FT reported, citing documents it analysed, that:-

- The petrochemical company has also used companies in the UK to “receive funds from Iranian front entities in China while concealing their real ownership through ‘trustee agreements and nominee directors. "

The PCC and its British subsidiary, PCC UK, have been under US sanctions since November 2018.

Documents, emails,, and accounting records show that during this time, PCC’s UK division continued to operate out of an office in Grosvenor Gardens in Belgravia, using a complex web of front entities in Britain and other countries.

PCC UK’s Belgravia office is also the registered address for NIOC International Affairs (London) Ltd, a division of Iran’s US-sanctioned national oil company, which Washington has claimed directly finances the IRGC and Iranian military activity for years.

According to the UK corporate registry, Pisco UK is owned by a British national called Abdollah-Siauash Fahimi. However, internal documents, some of which have been leaked online by the Iranian opposition website WikiIran, show that PCC fully controls Pisco, and that Fahimi signed an agreement to own the company in trust on its behalf.

Fahimi has used a PCC email address for correspondence with company officials in Tehran. According to UK corporate filings, He was a PCC UK director from April 2021 until February 2022.

In 2021, Pisco’s Santander account received a transfer from a Chinese company called Black Tulip, which internal PCC records show is another trustee company controlled by a PCC employee.

Last year, the US Treasury accused Iranian petrochemical companies of using multiple front entities to evade sanctions by routing sales through Asia.

Another PCC front company in the UK is Aria Associates, which has an account with Lloyds. It is officially owned by Mohamed Ali Rejal, who, according to internal emails, is the deputy chief executive of PCC UK and has regularly communicated with company officials in Tehran.

Emails show that in July 2021, a PCC accounting official in Tehran emailed Rejal about a planned payment from China, telling him,

- “Please send us the safe account No.

For payment.” Rejal instructed the accounting official to transfer the money into Aria Associates’ Lloyds account, writing:

- “Please make sure that there should not be any indication of PCC or PCC (UK).”

Other documents seen by the FT show that as PCC continued to operate in the UK, it also entered contracts for equipment procurement with a Turkish company called ASB, which was placed under sanctions by the US government for working with senior IRGC officials last year.

Audit reports for PCC UK from 2021 seen by the FT also show the company has maintained large trading balances with PCC in Iran since being placed under sanctions by the US, allowing it to continue operating despite Western banks being blocked from doing business with the company.

Sources

- https://finance.yahoo.com/news/iran-used-santander-lloyds-accounts-222143484.html

- https://www.pymnts.com/bank-regulation/2024/iran-reportedly-used-uk-banking-giants-to-avoid-sanctions/

- Financial Times. https://www.ft.com/content/aac08cf4-a6f2-4e39-995f-23f7fa5ea5ea?sharetype=blocked

- THE TIMES = https://www.thetimes.co.uk/article/iran-santander-lloyds-accounts-front-companies-tlphx72xs

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.