Mauritius to Turkey to [?]: The US Long Arm Reaches Foreign Nationals Impacting Its Interests

08/10/2025

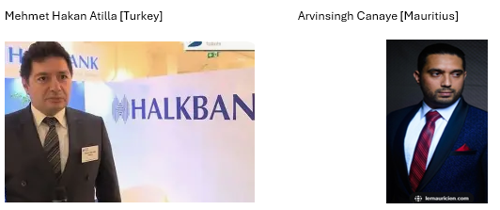

The cases of Mehmet Hakan Atilla [Turkey] and Arvinsingh Canaye [Mauritius] both exemplify the United States' application of extraterritorial jurisdiction in financial crimes, where non-US citizens are prosecuted for actions primarily occurring abroad if they impact US interests, such as the financial system or national security.

Below are key similarities based on the details of each case:

- Non-US Nationality and Extraterritorial Actions:

- Both individuals are non-US nationals. Atilla is Turkish, and Canaye is from Mauritius.

- Their alleged criminal activities essentially took place outside the US, but the US asserted jurisdiction due to the schemes' connections to US laws, markets, or systems.

- For Atilla, this involved a conspiracy to evade US sanctions on Iran through international banking transactions.

- For Canaye, it centred on an international securities fraud and money laundering scheme involving manipulated US stocks.

- Involvement in Financial Crimes with US Nexus:

- Each case revolves around financial misconduct that violated US statutes.

- Atilla was convicted of bank fraud and conspiracy to violate US sanctions against Iran, which affected US economic policies.

- Canaye pleaded guilty to money laundering conspiracy in a scheme that defrauded US securities markets and involved laundering proceeds through international entities.

- In both instances, the US justified prosecution because the activities used or impacted the US dollar, banking system, or securities exchanges, triggering extraterritorial application of laws like the International Emergency Economic Powers Act (for sanctions) and federal securities and money laundering statutes.

- Prosecution and Conviction in US Courts:

- Despite the international nature, both were arrested, indicted, and processed through US federal courts.

- Atilla was convicted in 2018 by a New York federal court and sentenced to 32 months in prison.

- Canaye was arrested in 2018, pleaded guilty, and received time served after custody.

- This reflects the US's "long-arm" jurisdiction, where minimum contacts with the US (e.g., correspondent banking or stock trading) suffice for legal reach.

- Timing and Broader Implications:

- Both cases unfolded around 2018, highlighting a period of heightened US enforcement against international financial schemes.

- They demonstrate how US authorities use tools like indictments and extradition to target foreign actors in schemes with even indirect US ties, often involving cooperation with international regulators.

- Use of US Financial Infrastructure:

- A core similarity is the reliance on US-based systems.

- Atilla's scheme involved US banks for dollar-denominated transactions to bypass sanctions.

- Canaye's fraud used US stock markets and attempted to launder funds through purchases like artwork, implicating US anti-money laundering laws.

- This nexus allows the US to claim jurisdiction under principles like the "effects doctrine," where foreign conduct has substantial effects within the US.

What Should a Non-US Financial Services Professional Do to Protect Themselves from the Long Arm of US Law.

Non-US financial professionals can minimise their exposure to the US jurisdiction by focusing on compliance, risk assessment, and implementing structural safeguards.

The goal is to avoid inadvertent violations while conducting legitimate business, as US laws often apply extraterritorially to activities with US connections. Here are practical steps:

- Conduct Thorough Due Diligence and Compliance Checks:

- Always screen clients, transactions, and partners for US sanctions lists (e.g., OFAC) and ensure no involvement in restricted activities.

- Use compliance software to monitor for US nexus, such as dollar-clearing through US banks.

- If dealing with US-related assets, check to see if you need to be registered and /or comply with bodies like the SEC or CFTC, if applicable.

- Minimise US Contacts:

- Structure operations to avoid "minimum contacts" that trigger US jurisdiction, such as:

- Not soliciting US clients,

- Avoiding US servers

- Avoiding banks for transactions, for instance, use non-US currencies and clearing systems where possible.

- Not travelling to the US if at risk of arrest.

- Seek Expert Legal Advice:

- Consult US-qualified lawyers specialising in international finance and extraterritorial law to review business models.

- This includes opinions on whether activities fall under US statutes like the Bank Secrecy Act or Foreign Corrupt Practices Act.

- Implement Robust Internal Policies:

- Develop anti-money laundering (AML) and know-your-customer (KYC) programs aligned with global standards, which can demonstrate good faith and potentially mitigate penalties.

- Train staff on US extraterritorial risks.

- Consider Asset Protection Structures:

- Use international trusts or entities in jurisdictions with strong privacy laws to separate personal assets from business risks, while ensuring full tax compliance (e.g., FATCA reporting for US ties).

- Avoid structures solely for evasion, as this could invite scrutiny.

- Monitor Travel and Extradition Risks:

- Be aware of extradition treaties and avoid travel to countries likely to extradite to the US. If indicted, challenge jurisdiction through legal channels.

These steps emphasise proactive compliance over avoidance, as US enforcement targets non-compliance in global finance.

Sources

- https://www.justice.gov/usao-sdny/pr/turkish-banker-mehmet-hakan-atilla-sentenced-32-months-conspiring-violate-us-sanctions

- https://en.wikipedia.org/wiki/United_States_v._Atilla

- https://www.aljazeera.com/news/2018/5/16/mehmet-hakan-atilla-gets-32-month-sentence-in-iran-sanctions-case

- https://www.cliffordchance.com/briefings/2020/07/second-circuit-affirms-bank-fraud-convictions-in-sanctions-evasi.html

- https://www.justice.gov/usao-edny/pr/six-individuals-and-four-corporate-defendants-indicted-50-million-international

- http://www.comsuregroup.com/news/mauritius-money-laundering-firm-has-its-license-revoked-but-not-still-no-prosecution/

- https://www.taxnotes.com/lr/resolve/fatca-expert/individuals-corporations-charged-with-fraud-money-laundering/27z55

- https://www.law.com/newyorklawjournal/2018/03/02/traders-tried-to-launder-stock-fraud-funds-with-picasso-purchase-feds-say/

- https://www.bloomberg.com/news/articles/2018-03-02/six-people-charged-by-u-s-over-50-million-securities-fraud

- https://www.law360.com/articles/1145689/peddler-of-shell-cos-gets-time-served-for-beaufort-fraud

- https://www.nestmann.com/offshore-asset-protection-strategies-for-american-investors

- https://www.crowell.com/a/web/hFLWauERRr3obWePkg7cxd/4TtkMi/abc-guide-to-cross-border-litigation_crowell-moring.pdf

- https://www.osborneclarke.com/insights/long-arm-jurisdiction-how-remedies-can-extend-non-upc-states

- https://tlblog.org/how-to-criticize-u-s-extraterritorial-jurisdiction-part-ii/

- https://creativeplanning.com/international/insights/financial-planning/financial-planning-for-foreign-nationals-in-the-us/

- https://www.inhousecommunity.com/article/long-arm-justice-unexpected-risks-international-business/

- https://www.chapman.com/publication-cftc-exemptions-for-non-us-fund-managers-transacting-in-us-derivatives-markets

- https://globalwealthprotection.com/how-to-legally-protect-your-assets-when-living-abroad/

- https://www.wilmerhale.com/-/media/files/shared_content/editorial/publications/documents/20200416-the-personal-jurisdiction-filter-in-the-recognition-and-enforcement-of-foreign-judgments-in-the-united-states.pdf

- http://www.assetprotectionlawyer.com/International-Asset-Protection/Protection-By-Going-International.aspx

- https://www.congress.gov/crs-product/94-166

- https://scholarship.law.cornell.edu/cgi/viewcontent.cgi?article=4640&context=clr&ref=ar.syriaaccountability.org

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.