Mauritius terrorist offences and financing - legislative frameworks, risk assessments, and a notable recent case.

21/09/2025

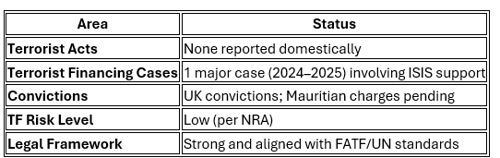

There is limited but concrete evidence of terrorist offences and terrorist financing in Mauritius, primarily involving legislative frameworks, risk assessments, and a notable recent case.

Here's a structured overview:

1. Legislative Framework

Mauritius has a robust legal infrastructure to combat terrorism and its financing:

- Prevention of Terrorism Act 2002 (POTA):

- Defines acts of terrorism and related offences.

- Criminalises support, training, harbouring, and financing of terrorism.

- Establishes a Counterterrorism Unit and Counterterrorism Committee.

- Section 15 criminalises dealing in terrorist property, including concealment, transfer, or control of such assets.

- Convention for the Suppression of the Financing of Terrorism Act 2003:

- Aligns Mauritius with international standards.

- Criminalises the provision or collection of funds for terrorist acts, even if the act is not ultimately committed.

- Financial Intelligence and Anti-Money Laundering Act (FIAMLA):

2. Evidence of Terrorist Financing

Confirmed Case (2024–2025):

Three Mauritian nationals were provisionally charged with financing terrorism and added to the national sanctions list under the UN Sanctions Act 2019:

- Individuals involved: Mohammad Zafirr Rechad Golamaully, Lubnaa Rechad Golamaully, and Samuel Tashvin Jodhun.

- Allegations:

- Financial support to ISIS via intermediaries in Turkey.

- Family members in Mauritius and the UK were implicated in sending funds.

- UK-based relatives were convicted in 2016 for similar offences under the UK Terrorism Act

3. National Risk Assessments (NRA)

Terrorist Financing Risk Level: Low

- According to the 2025 NRA:

- No terrorist acts have been committed in Mauritius.

- No known terrorist groups operate in the country.

- No convictions for terrorist financing (as of the report date).

- However, cross-border inflows and radicalisation risks were noted.

- Two modes of TF activity were identified:

- Inflows from suspected foreign financiers to Mauritians with ISIS sympathies.

- Use of informal money transfer systems.

NPO Sector Risk:

4. Institutional Response

- FIU plays a central role in detecting and reporting TF activities.

- Asset Recovery Act 2011 allows for confiscation of terrorist property, even without a conviction.

Summary

References

- Volume 6 new.pdf - Mauritius https://attorneygeneral.govmu.org/Documents/Laws%20of%20Mauritius/A-Z%20Acts/P/Pr/PreventionofTerrorismAct-I9.pdf

- UNIT 4: Financing of Terrorism and Asset

- Recovery https://oermu.uom.ac.mu/server/api/core/bitstreams/f8821105-3f58-4b98-bcf4-3387db05b60d/content

- 3 Mauritians ADDED to the island's sanction list AND charged with ...https://www.comsuregroup.com/news/3-mauritians-added-to-the-islands-sanction-list-and-charged-with-financing-terrorism/

- Presentation - mra.mu https://www.mra.mu/download/NRAFindings-PPT.pdf

- National Risk Assessment – Financial Intelligence Unit (FIU) https://www.fiumauritius.org/fiu/?page_id=2306

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.