Mauritius FSC issues warning over non-approved share transfers and or officer appointments

30/05/2025

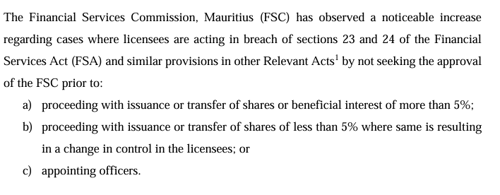

On 20 May 2025, the Financial Services Commission (“FSC”) of Mauritius issued a Circular Letter (CL200525) to the Board of Directors of Management Companies and Licensed Non-Bank Financial Institutions reminding them of their legal obligations under Sections 23 and 24 of the Financial Services Act (“FSA”).

This communique highlights increasing non-compliance and serves as a clear warning to all regulated entities, from management companies to licensed non-bank financial institutions.

2017 COMMUNIQUÉ Amendments to Section 23 of the Financial Services Act 2007

- The above follows the FSC’s January 2017 communiqué, reminding licensees about failing to notify the FSC within 14 days of minor share transactions, a requirement under section 23(1A)(b) of the FSA and reinforced in

Why Prior Approval and Timely Notification Matter

The circular goes on to say

The FSC is asserting its enforcement powers. Non-compliance can result in:

- Administrative penalties

- Public censure

- Suspension or revocation of licenses

- Orders to reverse unapproved changes

Approval First, Action Later — Not the Other Way Around

- Some companies mistakenly believe they can act first and inform later. But for the cases listed above, the law is unambiguous: FSC approval must be obtained before the transaction or appointment occurs.

- This applies regardless of company type — whether it's a small management company or a publicly listed entity on the Stock Exchange of Mauritius. If the company is a licensee under the FSA, it remains fully subject to these provisions.

To stay compliant, companies should:

- Review all shareholder agreements and share transfer processes

- Involve compliance teams early in M&A discussions or board appointments

- Educate directors and shareholders on their regulatory obligations

SOURCE

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.