Mauritius FSC ANNUAL REPORT 2020/21 – some notes on MC visits and enforcement

24/01/2022

With over 19,000 entities under its purview, the completion of this action item required the FSC to develop a well-articulated plan that effectively directs supervisory focus to areas of higher money laundering and terrorist financing risks by targeting higher risk entities for onsite inspections. As a result, the FSC conducted 771 (4%) inspections in the reporting period.

The visits resulted in 110 (14%) being looked at by the enforcement committee, which resulted in show cause letters issued, sanctions and monetary penalties imposed.

The types of administrative sanctions taken by the EC July 2020 to June 2021 July 2019 to June 2020

- Revocation of Licences [5]

- Disqualification of Officers [8]

- Private Warning [6]

- Public Censure - -

- Administrative Penalty [11]

Concerning MC AND In line with the FATF Action Plan, 55 inspections had been earmarked for the TCSP sector for 2020/21 AML/CFT Inspection Cycle 1.

Moreover, 7 MCs that had severe deficiencies and breaches in their AML/CFT framework were referred to Enforcement Directorate for relevant enforcement/follow-up actions. One of those MCs was targeted for a follow-up inspection.

The visits plan for MCs

At close of the year under review, despite the COVID-19 pandemic, all the 55 MCs were inspected. To enable the proper and smooth conduct of the AML/CFT onsite inspections, the FSC Mauritius developed and implemented an online Onsite Inspection Model. The onsite inspections focused on the following areas of AML/CFT amongst others, and involved “walk-through” verifications:

- The Enterprise Risk Assessment and Client Risk Assessment;

- Policies and Procedures pertaining to AML/CFT, proper risk rating of clients, ongoing monitoring of clients and their transactions;

- Proper record keeping of Customer Due Diligence (CDD) documentations and client transactions;

- Independent CDD and reliance on third parties for CDD;

- Beneficial Owner;

- Ongoing Monitoring;

- Politically Exposed Persons;

- Targeted Financial Sanctions (TFS) including sanctions screening tools and assets freezing;

- Enhanced Measures;

- Suspicious Transactions Reporting process and internal disclosure mechanism and use of new technologies;

- Money Laundering Reporting Officer (MLRO);

- Compliance Officer and adequacy of resources;

- Board of Directors/Senior Management oversight;

- AML/CFT Training;

- AML/CFT Audit; and

- Client file reviews.

Based on the findings following the inspections, certain gaps were identified.

Accordingly, MCs were tasked to adopt a remedial plan. The FSC Mauritius ensured that these remedial plans submitted by licensees were effectively implemented.

From the remedial plans received during the year under review, it was noted that MCs understood the scope and rationale for the AML/CFT inspections conducted.

The remedial plans were comprehensive and time barred.

Subsequently, after 2 months, MCs provided a Status Report backed by appropriate documentary evidence of actions taken (e.g. Business Risk Assessment (BRA) and AML/CFT Audit reports).

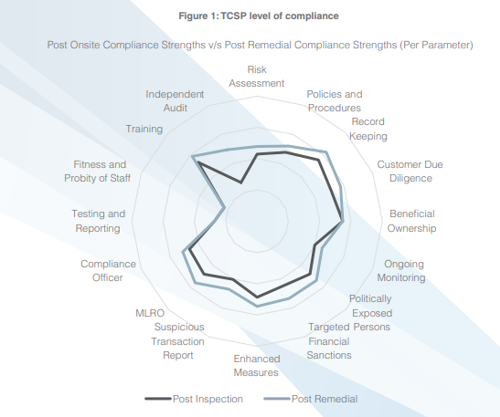

Figure 1: TCSP level of compliance Post Onsite Compliance Strengths v/s Post Remedial Compliance Strengths (Per Parameter)

The above diagram illustrates the level of AML/CFT compliance achieved by TCSP post inspections and follow-ups. It can be noted that significant improvement has been achieved on risk assessment independent audit, amongst others.

In a few instances, the FSC Mauritius also met with the representatives of the MCs where the remedial plans submitted were not aligned with the required standards.

https://www.fscmauritius.org/media/118189/fsc_ar_2021.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.