"Mat Says: Navigating Senior Manager Risks – Jersey’s Fines vs. UK’s Jail Time"

26/08/2025

This, Mats says, is a Briefing and Warning ABOUT Senior Manager Accountability Risks in Jersey (JFSC Law 1998) vs. UK (ECCTA 2023, Section 196)

This briefing compares the risks faced by senior managers in both jurisdictions, highlights key differences, and provides a warning for compliance, supported by illustrative examples and sources.

Introduction

- Senior manager accountability is a critical focus in both Jersey and the UK, with distinct frameworks governing risks for individuals in senior roles.

- In Jersey, the Financial Services Commission (Jersey) Law 1998 (JFSC Law), through Article 1(1) and Article 21A,

- Imposes civil financial penalties for code of conduct breaches, including anti-money laundering (AML), countering the financing of terrorism (CFT), and countering proliferation financing (CPF), enforced by the Jersey Financial Services Commission (JFSC).

- In the UK, the Economic Crime and Corporate Transparency Act 2023 (ECCTA), effective for offences from 26 December 2023, introduces Section 196, and

- Establishing a senior manager attribution model for corporate criminal liability for economic crimes.

Senior Manager, Accountability in Jersey

Framework

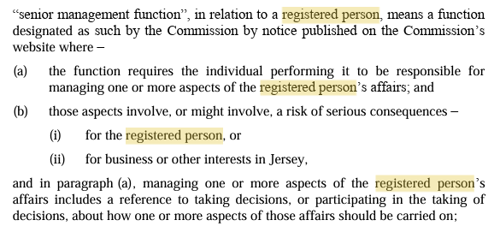

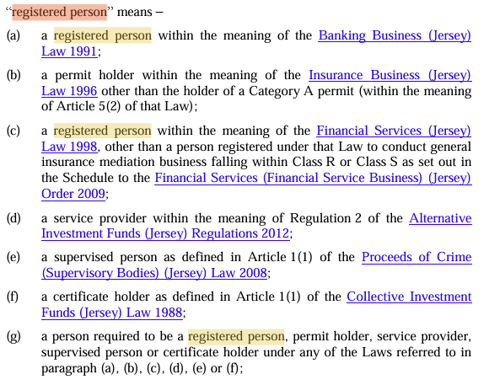

- Article 1(1): Defines a “senior management function” via a JFSC statutory notice (effective 13 March 2023) as roles managing aspects of a registered person’s affairs with potential for serious consequences.

- Article 1(1) of the Financial Services Commission (Jersey) Law 1998 Defines a “Senior Management Function”

- Source: Financial Services Commission (Jersey) Law 1998, Article 1(1)

- Link: https://www.jerseylaw.je/laws/current/Pages/13.225.aspx

- Description: Article 1(1) of the Financial Services Commission (Jersey) Law 1998 defines a “senior management function” as a function designated by the Jersey Financial Services Commission (JFSC) by notice, requiring the individual to manage one or more aspects of a registered person’s affairs that involve, or might involve, a risk of serious consequences for the registered person or Jersey’s interests. This includes decision-making or participation in decisions about how those affairs are carried out.

- JFSC Statutory Notice Designating Senior Management Functions (Effective 13 March 2023)

- Source: Jersey Financial Services Commission, Notice Issued Under Article 1(1) of the FINANCIAL SERVICES COMMISSION (JERSEY) LAW 1998 (FSJL) Designating “Senior Management Functions”

- Link: https://www.jerseyfsc.org/media/6333/notice-issued-under-article-1-1-of-the-financial-services-commission-jersey-law-1998-designating-senior-management-functions.pdf

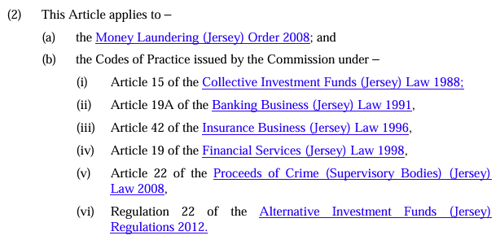

- Description: This statutory notice, issued on 12 January 2023 and effective from 13 March 2023, designates four categories of senior management functions under Article 1(1). These roles involve managing aspects of a registered person’s affairs with potential for serious consequences, particularly related to anti-money laundering (AML), countering the financing of terrorism (CFT), and countering proliferation financing (CPF).

- The Notice supports the JFSC’s civil financial penalties regime under Article 21A of the FINANCIAL SERVICES COMMISSION (JERSEY) LAW 1998 (the Commission Law), targeting significant and material contraventions

- Link:- https://www.jerseylaw.je/laws/current/PDFs/L_11_1998.pdf

- Article 21A: Permits civil financial penalties (up to £400,000 for individuals) for significant and material breaches of the MLO or JFSC Codes if a senior manager consents, connives, neglects, or aids the contravention.

c. Scope: Focuses on codified compliance for registered persons.

d. Extraterritoriality: Applies to senior managers globally, based on function, not residency.

e. Penalties: Fines are non-indemnifiable by the firm, ensuring personal liability.

Risks for Senior Managers

- Civil Financial Penalties: Up to £400,000 for breaches, based on seriousness and circumstances.

- Reputational Damage: Public JFSC enforcement actions harm professional standing.

- Limited Protection: No firm indemnification; personal insurance is often impractical.

- Regulatory Scrutiny: Risk-based JFSC enforcement targets significant breaches, requiring robust AML/CFT/CPF oversight.

Example

Hypothetical AML Breach:

- A Category 2 senior manager (Head of Client Relationships) at a Jersey trust company neglects proper AML checks, breaching the MLO.

- The JFSC imposes a £150,000 fine under Article 21A for neglect, alongside firm penalties.

- The manager faces financial and reputational consequences without indemnification.

Senior Manager Accountability in the UK (ECCTA 2023, Section 196)

Framework

- Section 196: Corporations are criminally liable for Schedule 12 economic crimes (e.g., fraud, bribery, money laundering, sanctions breaches) if a senior manager commits the offence within their authority, effective from 26 December 2023.

- Senior Manager Definition: Individuals with significant roles in decision-making or managing substantial organisational activities (e.g., regional directors, department heads), broader than the “directing mind and will.”

- Scope: Covers mens rea-based economic crimes (e.g., fraud by false representation, Bribery Act 2010 offences). No statutory defence (e.g., reasonable procedures) applies.

- Consequences: Corporate liability includes unlimited fines, director disqualifications, and asset recovery. Senior managers face individual criminal prosecution.

- Extraterritoriality: Applies to overseas conduct prosecutable in the UK.

Risks for Senior Managers

- Criminal Liability: Personal prosecution risks imprisonment (e.g., up to 7 years for fraud), fines, or disqualifications.

- Corporate Prosecution Impact: Corporate liability increases scrutiny on the manager, risking job loss or sanctions.

- Reputational Harm: High-profile SFO/CPS prosecutions damage professional standing.

- No Defence: Direct liability for offences within authority heightens personal exposure.

Example

Hypothetical Fraud Case:

- A regional director at a UK bank authorises fraudulent misrepresentations (Schedule 12 offence). Under Section 196, the bank faces criminal liability, and the director risks prosecution, potentially facing imprisonment and fines, with the bank incurring unlimited fines.

Key Differences

- Liability Type: Jersey imposes civil penalties, with fines up to £400,000, while the UK’s criminal liability risks imprisonment and broader corporate consequences, making UK risks more severe.

- Offence Scope: Jersey’s focus is narrow (codes and AML/CFT/CPF), while the UK covers a wide range of economic crimes, increasing potential exposure.

- Consequences: Jersey’s penalties are financial and regulatory; the UK includes imprisonment and ancillary orders (e.g., disqualifications), amplifying personal risk.

- Accountability: Jersey requires proof of neglect or connivance, offering some leeway; the UK’s direct liability for offences within authority is stricter.

- Enforcement: Jersey’s JFSC is regulatory-focused; the UK’s SFO/CPS pursue criminal prosecutions, heightening stakes.

Similarities

- Personal Accountability: Both target senior managers beyond traditional top-tier roles.

- Reputational Risk: Enforcement actions in both jurisdictions damage professional standing.

- Extraterritorial Reach: Both apply to non-residents, increasing global exposure.

- Compliance Burden: Robust governance is critical in both regimes.

Warning for Senior Managers

Jersey: Senior managers face significant civil penalties and reputational risks for code and AML/CFT/CPF breaches. The non-indemnifiable £400,000 fine cap and JFSC’s risk-based enforcement demand proactive compliance with the MLO and Codes. Managers must use tools like the RACI Matrix to clarify roles and ensure robust AML systems.

UK: The ECCTA’s Section 196 imposes far greater risks, with criminal liability risking imprisonment, fines, and disqualifications for Schedule 12 offences. The lack of a statutory defence and broad offence scope heightens personal exposure. Managers must oversee all economic crime risks, as corporate prosecutions amplify scrutiny.

Urgent Actions:

- Jersey: Review roles against JFSC categories, update governance, and train staff to avoid neglect-based penalties.

- UK: Audit decision-making authority, implement anti-fraud/bribery controls, and seek legal advice to mitigate criminal risks under ECCTA.

Failure to act risks severe consequences, especially in the UK, where criminal sanctions elevate personal and corporate exposure.

Sources

- UK Government, Joint SFO-CPS Corporate Prosecution Guidance, 18 August 2025: https://www.gov.uk/government/publications/joint-sfo-cps-corporate-prosecution-guidance/joint-sfo-cps-corporate-prosecution-guidance

- Jersey Financial Services Commission, Notice Designating Senior Management Functions, 12 January 2023: https://www.jerseyfsc.org/news-and-events/notice-designating-senior-management-functions-published/

- Appleby, “Determination of the ‘Senior Management Function’ in Jersey,” 26 January 2023: https://www.applebyglobal.com/publications/determination-of-the-senior-management-function-in-jersey/

Comsure Group, “Alignment of JFSC Notice on Senior Management Functions,” 5 August 2025: https://www.comsuregroup.com/news/alignment-of-jfsc-notice-on-senior-management-functions-with-codes-of-practice-and-amlcftcpf-handbook/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.