MAS reprimanded nine firms & 18 Individuals for AML breaches following a 2023 Money laundering case

07/07/2025

It has been reported in Singapore, 4 July 2025…

The Monetary Authority of Singapore (MAS) announced today its regulatory actions against nine financial institutions (FIs) and several individuals for breaches related to anti-money laundering. MAS has completed its supervisory examinations against pertinent FIs with nexus to persons of interest (POIs) in the significant money laundering (ML) case of August 2023, and their employees who fell short of MAS’ Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) requirements.

The present suite of actions marks the conclusion of MAS’ enforcement actions against FIs with material nexus to the major ML case.

Regulatory actions against financial institutions:

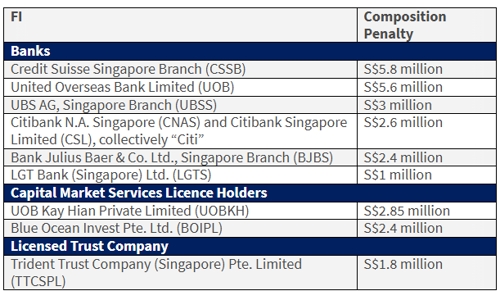

- MAS has imposed composition penalties amounting to S$27.45 million in total on nine FIs for breaches of MAS’ AML/CFT requirements in this case.

- The penalties considered various factors including the extent of the FI’s exposure to the POIs, the number of breaches of MAS’ requirements, and the degree of weakness in the FI’s AML/CFT controls.

The composition penalties are as follows:

The breaches were identified during MAS’ supervisory examinations of the FIs from early 2023 to early 2025. Overall, MAS observed that most of the FIs had established AML/CFT policies and controls.

The breaches arose out of poor or inconsistent implementation of these policies and controls. The FIs have embarked on remediation of the deficiencies, and MAS will closely monitor their progress.

MAS found shortcomings in the areas of:

- Customer risk assessment.

- Five of the FIs (BJBS, BOIPL, Citi, CSSB, UOBKH) failed to implement adequate policies or processes for the rating of ML risks presented by some of their customers.

- This led to the misrating of ML risks, affecting their ability to apply appropriate controls and address the higher ML risks presented by several POIs.

- Establishing and corroborating the source of wealth (SOW) of customers who posed a higher risk of ML.

- All nine FIs did not detect or adequately follow up on significant discrepancies or red flags noted in information and documents that should have cast doubt on some customers’ purported SOW and which indicated increased risk of ML.

- In some cases, there was no corroboration of significant aspects of the SOW.

- Transaction monitoring.

- Eight FIs (BJBS, Citi, CSSB, LGTS, UOB, UOBKH, TTCSPL, UBSS) failed to review relevant transactions flagged as suspicious by their systems adequately.

- The relevant transactions were substantial, inconsistent with the customers’ profiles, or showed unusual patterns.

- Post-Suspicious Transaction Report (STR) follow-up.

- About customers the FIs had filed STRs on, two FIs (UOB and UOBKH) failed to take adequate and timely risk mitigation measures, such as enhanced monitoring and reviewing their risk classification.

The composition penalty imposed on CSSB also considers its breaches of MAS’ AML/CFT requirements in the period November 2017 to October 2023, about accounts maintained by CSSB on behalf of specific US customers.[1]

REGULATORY ACTIONS AGAINST INDIVIDUALS

Additionally, MAS has acted against individuals involved in managing the FIs’ relationships with the POIs.

MAS has issued prohibition orders (POs) ranging from three to six years in duration to the following individuals:

- Mr Tsao Chung-Yi, Chief Executive Officer, and Executive Director (ED) of BOIPL. Mr Tsao was issued a six-year PO, effective from August 1, 2025.

- Ms Wong Xuan Ling, Chief Operating Officer (COO) of BOIPL. Ms Wong was issued a five-year PO with effect from 1 August 2025.

- Mr Hsia Lun Wei @Henry Hsia, ED, and Relationship Manager (RM) of BOIPL. Mr Hsia was issued a three-year PO with effect from 30 June 2025; and

- Ms Deng Xixi, former RM of BOIPL. Ms Deng was issued a three-year PO, effective from June 30, 2025.

Mr Tsao and Ms Wong

- Had failed as senior managers to ensure that the AML/CFT policies and controls in BOIPL kept pace with significant growth in its business in the three years since the company was set up.

- They failed to develop and implement adequate policies and controls in multiple areas, such as SOW corroboration, customer risk assessment, customer name screening and ongoing reviews of customer due diligence (CDD) information.

- They also failed to ensure that BOIPL’s AML/CFT policies and controls were subjected to audit reviews.

Mr Tsao, Ms Wong, Mr Hsia, and Ms Deng

- Also failed to raise red flags when they were aware of information that should raise suspicion and failed to perform enhanced CDD for multiple POIs.

For the duration of their POs, Mr Tsao, Ms Wong, Mr Hsia, and Ms Deng

- Are prohibited from carrying on any activity or business, or providing any service, the carrying on or provision of which is regulated or authorised by MAS, and from taking part, directly or indirectly, in the management of, or acting as a director, partner or manager of, any FI.[2]

- They are also prohibited from becoming a substantial shareholder of any FI that is a corporation[3]; and if they are already a significant shareholder of a FI that is a corporation, from acquiring any interest in any voting share in the FI other than a voting share in which they already have an interest.

Further, Mr Tsao and Ms Wong

- Are prohibited from performing the function of risk management and control.[4]

REPRIMANDS

MAS HAS ISSUED REPRIMANDS TO THE FOLLOWING INDIVIDUALS FOR MULTIPLE LAPSES:

FOR FAILURE TO ENSURE TTCSPL COMPLIANCE WITH MAS’ REQUIREMENTS:

- Mr Sean Andrew Coughlan, Managing Director, ED, and Resident Manager of TTCSPL.

- Mr Tan Ho Kiat, COO, ED, and Head of Compliance of TTCSPL; and

- Ms Kek Yen Leng, ED, Head of Trust Administration, and Resident Manager of TTCSPL.

- [4+3=7]

As senior managers of TTCSPL, Mr Coughlan and Mr Tan failed to ensure that:

- TTCSPL policies provided sufficient practical guidance on how to establish customers’ SOW. Furthermore,

Mr Coughlan, Mr Tan, and Ms Kek failed as members of the TTCSPL New Business Committee to:

- Detect or adequately assess multiple deficiencies in customers’ SOW corroboration when approving the onboarding of higher-risk customers.

FOR FAILURES TO CONDUCT OR ENSURE PROPER DUE DILIGENCE OR POST-STR FOLLOW-UP IN RESPECT OF SEVERAL POIS:

- Mr Ang Sze Hee, Alvin, former Team Head of Group Retail Privilege Banking, UOB; and

- Mr Tan Sheng Rong, Leonard, former Team Head of Group Retail Privilege Banking, UOB.

- Another nine [9] RMs and RM supervisors were privately reprimanded for more limited lapses.

IN TOTAL 18 REPRIMANDS [4+3+11=18]

To assess an individual’s fitness and propriety for employment, a reprimand does not necessarily mean that the individual is currently unfit or improper.

- MAS had reviewed the conduct of a larger number of employees of the FIs connected to the cases, but did not find evidence of significant lapses by most of them. MAS may act against a few remaining individuals after the conclusion of ongoing court proceedings or investigations.

- FIs should adopt best practices and remain vigilant against ML/TF risks.

- MAS has published supervisory expectations regarding the controls that FIs should implement to address the key findings from our supervisory examinations related to this case.[5]

- The banking industry has also published best practice papers on implementing these controls, particularly in the context of SOW corroboration. FIs should benchmark themselves against MAS’ supervisory expectations and industry best practices, and execute robust, reasonable, and risk-proportionate defences against ML.

- RMs and their supervisors are reminded that they are part of the first line of defence in FIs against ML/TF risks.

- They should exercise the necessary vigilance and be alert to material red flags when dealing with existing and prospective customers, including when reviewing information obtained from such customers as part of the CDD process.

- They should identify and escalate concerns internally where warranted, so that appropriate risk mitigation measures can be taken.

- Ms Ho Hern Shin, Deputy Managing Director (Financial Supervision), MAS, said,

- “Like other major international financial centres, Singapore is exposed to money laundering risks.

- The vigilance of our financial institutions and their employees is critical in mitigating such risks.

- MAS will work closely with financial institutions to promote more consistent implementation of AML/CFT measures. Where there are serious failings by FIs and their employees, MAS will not hesitate to take firm action.”

Additional Information:

Composition of AML/CFT offences

- MAS’ AML/CFT requirements for banks, merchant banks, capital market intermediaries, and licensed trust companies are set out in MAS Notice 626 on Prevention of Money Laundering and Countering the Financing of Terrorism – Banks, MAS Notice 1014 on Prevention of Money Laundering and Countering the Financing of Terrorism – Merchant Banks, MAS Notice SFA04-N02 on Prevention of Money Laundering and Countering the Financing of Terrorism – Capital Markets Intermediaries and MAS Notice TCA-N03 on Prevention of Money Laundering and Countering the Financing of Terrorism – Licensed Trust Companies.

- Each breach of Notice 626, Notice 1014, Notice SFA04-N02 and Notice TCA-N03 is an offence punishable under section 27B(2) of the Monetary Authority of Singapore Act (Cap. 186) or the Monetary Authority of Singapore Act 1970 (MAS Act 1970) and/or section 16(4) of the Financial Services and Markets Act 2022 (FSMA) where the maximum prescribed fine is $1,000,000 per offence. The breach is compounded under section 176(1A) of the MAS Act 1970 and/or section 177(1) of the FSMA.

***

- [1] In connection with these accounts, Credit Suisse Services AG had entered into a non-prosecution agreement with the US Department of Justice on 5 May 2025. The breaches found by MAS relate to failure to (i) obtain aliases of persons appointed to act on behalf of customers; (ii) establish and corroborate SOW; and (iii) identify beneficial owners of accounts.

- [2] As defined in section 2 of the FSMA.

- [3] As defined in section 2 of the FSMA.

- [4] As defined in section 6 of the FSMA.

- [5] https://www.mas.gov.sg/regulation/guidance/amlcft-supervisory-expectations-from-recent-inspections

Banks

- Credit Suisse Singapore Branch (CSSB) S$5.8 million

- United Overseas Bank Limited (UOB) S$5.6 million

- UBS AG, Singapore Branch (UBSS) S$3 million

- Citibank N.A. Singapore (CNAS) and Citibank Singapore Limited (CSL), collectively “Citi”, S$2.6 million

- Bank Julius Baer & Co. Ltd., Singapore Branch (BJBS) S$2.4 million

- LGT Bank (Singapore) Ltd. (LGTS) S$1 million

- Capital Market Services Licence Holders

- UOB Kay Hian Private Limited (UOBKH) S$2.85 million

- Blue Ocean Invest Pte. Ltd. (BOIPL) S$2.4 million

- Licensed Trust Company

- Trident Trust Company (Singapore) Pte. Limited (TTCSPL) S$1.8 million

MAS HAS ISSUED REPRIMANDS TO THE FOLLOWING INDIVIDUALS FOR MULTIPLE LAPSES:

- Mr Sean Andrew Coughlan, Managing Director, ED, and Resident Manager of TTCSPL.

- Mr Tan Ho Kiat, COO, ED, and Head of Compliance of TTCSPL; and

- Ms Kek Yen Leng, ED, Head of Trust Administration, and Resident Manager of TTCSPL.

- Mr Ang Sze Hee, Alvin, former Team Head of Group Retail Privilege Banking, UOB; and

- Mr Tan Sheng Rong, Leonard, former Team Head of Group Retail Privilege Banking, UOB.

- Another nine RMs and RM supervisors were privately reprimanded for more limited lapses.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.