LAWYERS & BANKS facilitate crime by missing Chinese underground banking red flags

07/08/2025

EXECUTIVE SUMMARY

- HMRC v Cheng Xing and Yan Zhang highlights how professionals can unwittingly facilitate crime.

- This briefing draws on the High Court judgment in HMRC v Cheng Xing and Yan Zhang (approved for handing down by Mr Justice Sweeting), where a Property Freezing Order (PFO) was granted under the Proceeds of Crime Act 2002 (POCA) against UK-based Chinese nationals Cheng Xing and Yan Zhang:

- In the judgment, we learn that HMRC established the three properties and the balance of the HBOS savings account was obtained through unlawful conduct.

- The overwhelming financial evidence showing large sums of money being available to the Cheng Xing and Yan Zhang , which starkly contrasts with their declared income, together with measures THEY USED to evade detection, strongly supports the inference of money laundering and unregistered MSB activities.

- Money laundering offences can be inferred from the way the funds have been dealt with. The scale, nature, and provenance of the monies coming into the Cheng Xing and Yan Zhang accounts, coupled with their minimal declared income, strongly suggest that these funds are the proceeds of unlawful conduct.

- BASED ON THE ABOVE FACTS The Cheng Xing and Yan Zhang assets—three UK properties and a bank account—were frozen due to a "good arguable case" of unlawful conduct.

THE FACTS OF THE CASE

- The evidence adduced demonstrates a substantial discrepancy between the Cheng Xing and Yan Zhang declared income and their actual financial activity and asset acquisition.

- Their combined average annual income after tax was approximately £17,130.46, yet their expenditure on 'high-end' prestige goods alone exceeded £1 million between 2010 and 2018.

- Furthermore, they have apparently 'loaned' £194,149 to their company, UKFRESHASIANFOOD Limited, by October 2023.

- This lifestyle and level of financial support for their business are simply not commensurate with their declared earnings.

- The acquisition of three properties outright, without mortgages, despite their minimal declared PAYE income, further supports the case of criminality.

- The funding for these properties is strongly linked to significant monetary transfers and cash deposits from various third parties, often from China, that are not explained, on the material available, as deriving from any legitimate sources.

- The pattern of numerous, often geographically dispersed, cash deposits (over £544,000 between 2010-2018), and a later shift to significant third-party monetary transfers (over £1.1 million between 2018-2024), points towards a deliberate strategy to move large sums of money in a manner designed to avoid scrutiny.

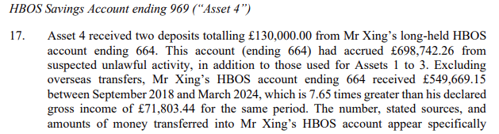

- The characteristics of these movements are indicative of Daigou schemes, Chinese underground banking, and the operation of an unregistered MSB.

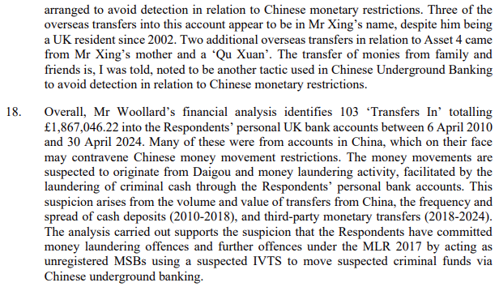

THE CASE INVOLVES

- Suspicions of money laundering through unregistered Money Service Business (MSB) activities.

- Evasion of Chinese monetary restrictions.

- Chinese underground banking – through Daigou (cross-border proxy purchasing) as a form of Informal Value Transfer System (IVTS):

- Daigou (代购) translates to "buying on behalf of: "It typically involves individuals—often overseas Chinese—purchasing goods in foreign countries and sending them back to China for resale. These goods are usually luxury items, cosmetics, or health products that are either cheaper or perceived as more authentic abroad;

- In the context of informal value transfer, Daigou operates outside formal banking channels and can be used to circumvent currency controls imposed by the Chinese government; and

- Daigou as an IVTS.

- Here's how:

- Cash Injection in the Host Country: Criminal proceeds or legitimate funds are deposited into accounts of Daigou operators or their associates in countries like the UK.

- Goods Purchase and Export: These funds are used to buy goods, which are then shipped to China.

- Resale in China: The goods are sold in China, often through informal or online channels.

- Settlement: The proceeds from the resale are used to settle obligations or transfer value back to the original sender, completing the IVTS loop.

- This system allows for value transfer without moving money through regulated financial institutions, making it attractive for those seeking to avoid scrutiny or bypass foreign exchange restrictions.

RED FLAGS OF CRIME INCLUDE:

- Large unexplained cash deposits;

- Third-party transfers from family/friends; and

- Discrepancies between declared income (£1,867,046 in transfers vs. low reported earnings).

LESSONS LEARNED

- The case underscores vulnerabilities in property transactions involving non-resident nationals and international funds.

- It highlights the critical role of Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), and Counter-Proliferation Financing (CPF) due diligence, particularly on Source of Funds (SoF—the origin of money for a specific transaction) and Source of Wealth (SoW—the overall origin of a client's assets).

- Failure to scrutinise these can enable criminal exploitation, as seen here with suspected Chinese underground banking.

BANKS AND SOLICITORS

- The court document focuses on HMRC's application and suspicions, not on third parties like solicitors or banks, which are not accused or parties to the case.

- Roles are derived from standard practices in UK property transactions and financial dealings, with specifics from the judgment's financial analysis.

SOLICITORS' ROLES

1. The judgment references anomalies in property purchases (e.g., unexplained funds for Assets 1-3), implying involvement of conveyancing solicitors, but does not name them or criticise their actions.

2. Horizon Law and K and K Solicitors Limited were the conveyancing solicitors.

3. Their roles would have been:

-

- Horizon Law:

- Conveyancing for Property Acquisitions: Likely acted for the respondents in one or more property purchases (e.g., Asset 1, purchased with suspicious overseas transfers). Responsibilities included handling legal documentation, land registry transfers, and client fund management through escrow accounts.

- AML/CTF Due Diligence: As required under MLR 2017, they should have conducted CDD/EDD on SoF/SoW, verifying funds from China (e.g., family transfers evading restrictions). The judgment's anomalies (e.g., cash structuring) suggest potential oversights if not flagged via SARs.

- Role in the Case: Not directly involved in proceedings; the application was ex parte. If representing the respondents post-freeze, they could advise on contesting the PFO at the return date.

- K and K Solicitors Limited:

- Conveyancing and Transaction Support: Probably handled conveyancing for other properties (e.g., Assets 2 or 3), including due diligence on title, searches, and fund flows. Company records show they are a registered UK firm (number 10545780), specialising in property law.

- Risk Assessment and Reporting: Obligated to scrutinise high-risk elements (e.g., third-party funds from 'Qu Xuan' totalling £4m). Failure to escalate could have enabled the suspected laundering, though the document does not allege complicity.

- Role in the Case: Peripheral; no mention of participation. As conveyancers, they may have provided transaction records to HMRC during the investigation.

- Horizon Law:

4. Solicitors in such cases act as gatekeepers, but the judgment emphasises the respondents' conduct. No evidence of wrongdoing by these firms is presented.

BANKS' ROLES

1. The document mentions "Respondents' personal UK bank accounts" and specifically the HBOS savings account.

2. THE BANK'S ROLE WAS:

-

- HBOS (Halifax Bank of Scotland, part of Lloyds Banking Group):

- Account Management and Freezing: Held the savings account frozen under the PFO, suspected to contain laundered funds. Processed transfers (part of 103 incoming totalling £1.87m, 2010-2020).

- Transaction Facilitation and Monitoring: Enabled cash deposits and wires, potentially missing red flags like structuring. Under MLR 2017, you are required to file SARs for suspicious activity.

- Role in the Case: The account is a targeted asset; HBOS complies with the freeze but is not a party. Likely provided statements to HMRC for analysis.

- Other Unnamed UK Banks:

- Personal Account Holders: Managed the respondents' accounts, receiving cash/third-party transfers linked to Daigou and INFORMAL VALUE TRANSFER SCHEME [IVTS].

- Compliance Role: Should have monitored for evasion of Chinese restrictions; the judgment notes tactics to avoid detection.

- Role in the Case: Supplied data for Mr Woollard's analysis but not actively involved.

- This case highlights how professionals can unwittingly facilitate crime.

- HBOS (Halifax Bank of Scotland, part of Lloyds Banking Group):

WHAT SHOULD PROFESSIONALS BE AWARE OF TO AVOID FACILITATING CRIME

- The Importance of AML/CTF/CPF Due Diligence on Source of Funds and Source of Wealth

Due diligence on SoF and SoW is a cornerstone of global and UK regulatory frameworks, including the Money Laundering Regulations 2017 (MLR 2017), FATF Recommendations, and POCA 2002. It prevents the integration of illicit proceeds into legitimate systems, protects financial integrity, and mitigates risks from high-risk jurisdictions like China (noted for capital controls and underground banking).

- Distinction and Purpose: SoF focuses on the immediate origin of transaction funds (e.g., bank transfers, cash), while SoW examines the broader accumulation of wealth (e.g., employment, investments). Verifying both ensures funds are not derived from crime, terrorism, or proliferation activities. In this case, overseas transfers from family (e.g., Mr Xing's mother and 'Qu Xuan') and cash deposits evading detection highlighted unverified SoF, while low declared income contrasted with £1m+ in assets pointed to dubious SoW.

- Regulatory Imperative: Under MLR 2017, firms must apply Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) for high-risk scenarios (e.g., international transfers, cash-heavy dealings). FATF Recommendation 10 requires "reasonable measures" to establish SoF/SoW for PEPs or high-risk clients. Neglect can lead to fines, as in SRA cases where solicitors failed SoF checks in property deals.

- Risk Mitigation: In CTF/CPF contexts, unverified SoF/SoW can facilitate terrorist funding or WMD proliferation via dual-use goods. Here, suspected INFORMAL VALUE TRANSFER SCHEME [IVTS] (Informal Value Transfer Systems) like Chinese underground banking could evade sanctions, emphasising CPF relevance. Adequate diligence preserves assets for recovery (as in this PFO) and deters "professional enablers" like solicitors.

- Broader Impacts: Poor diligence erodes trust in the UK financial system, exposes firms to reputational damage, and enables economic crime. HMRC's analysis showed 103 transfers totalling £1.87m (2010-2018), mostly cash, underscoring how unchecked SoF/SoW allowed suspected laundering to persist for 15 years.

- Red Flags Highlighting Risks in Source of Funds and Source of Wealth

Red flags are indicators of potential illicit activity, as outlined in UK guidance from the Law Society, CLC, and SRA.

In this case, flags included cash structuring (deposits under £10k thresholds), third-party/family funding from China, and income-asset mismatches. Below is a table of key red flags, categorised by SoF and SoW, with examples from the judgment.

These flags, if spotted, trigger EDD, including independent verification (e.g., bank statements, tax returns).

- Possible Mistakes Solicitors Made in Not Spotting Anomalies/Red Flags on SoF and SoW

Solicitors handling the Respondents' property purchases (Assets 1-3) likely facilitated transactions without adequate CDD/EDD, as required under MLR 2017 and SRA guidelines.

Common errors in such cases include over-reliance on client-provided docs and failure to escalate high-risk flags, as seen in SRA fines (e.g., Dentons case, where inadequate SoF/SoW checks led to sanctions).

In conveyancing, solicitors are "professional enablers" at high risk, per SRA reports:

- Inadequate Verification: Accepting family transfers or cash proofs without independent corroboration (e.g., no checks on Chinese origins or restrictions). Mistake: Not requesting full transaction trails or third-party confirmations, as in fined cases like Tyndallwoods Solicitors (£27k penalty for AML lapses).

- Failure to Apply EDD: Overlooking high-risk factors (e.g., China links, cash structuring) and not conducting enhanced checks like SoW profiling. Mistake: Treating as low-risk despite international elements; SRA guidance mandates EDD for property deals with foreign funds.

- Ignoring Income-Asset Discrepancies: Not questioning how low-declared income supported high-value purchases. Mistake: Relying on self-declarations without tax records or lifestyle analysis is a common pitfall in manual processes prone to errors.

- Over-Reliance on Manual/Paper-Based Systems: Slow or error-prone checks missing patterns (e.g., repeated third-party transfers). Mistake: Not using digital tools for ongoing monitoring, leading to undetected structuring over the years.

- Not Escalating to MLRO: Failing to report suspicions internally or to NCA via SARs. Mistake: Assuming other parties (e.g., banks) handled checks, despite the SRA prohibiting reliance on external work.

These lapses could expose solicitors to SRA sanctions, fines, or criminal liability under POCA.

Recommendations: Implement robust training, digital AML tools, and firm-wide risk assessments to avoid similar oversights.

SEE https://www.bailii.org/ew/cases/EWHC/Admin/2025/2057.html

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.