JFSC Beneficial ownership 3 tier UBO guidance diagram updated along with x2 other changes

23/08/2021

The update includes two critical updates to the guidance.

- In Section 1,

- The JFSC now explain the definition of “beneficial owner” in the law and

- How The JFSC record the information in myRegistry.

- Section 5 for companies owned by a trust.

As of August 2021 [20th], the JFSC has updated our beneficial ownership guidance. The guidance was last updated in January 2021 when the Financial Services (Disclosure and Provision of Information) (Jersey) Law 2020 (Disclosure Law) came into force.

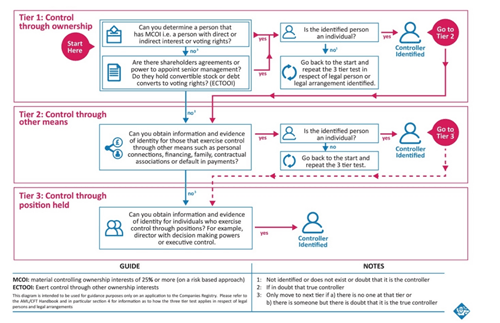

The update includes the following updated 3 tier UBO guidance diagram:

Jersey regulated firms no longer need to record the SETTLOR AS A CONTROLLER unless:

- The settlor has retained powers of control, such as:

- The right to appoint or remove a trustee,

- Amend the trust deed, or

- Revoke the trust.

- And although Settlors are not controllers, the JFSC still wish to collect their details as part of the more comprehensive information the JFSC use to assess the activities and structure.

- They also say the guidance also applies to an entity held in a charitable trust; and say:

- Where there is a legal arrangement that is a charitable trust or any capital market transaction, you must also identify as a controller each security-holder that can exercise effective control over the underlying security–issuing vehicle.

- And the JFSC will also require details of the arranger or instigator of any capital market transactions involving charitable trusts as part of the more comprehensive information the JFSC use to assess the activities and structure.

- And the data is input into:

- The activity field (upon incorporation) or

- The further information field (upon transition or update of associated parties).

Aug 2021 update:

- https://www.jerseyfsc.org/industry/guidance-and-policy/beneficial-ownership-and-controller-guidance/

- https://www.jerseyfsc.org/media/4833/gn-beneficial-ownership-and-control-guidance.pdf

Read more:

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.