JERSEY, the U.S., United Kingdom and Canada sanction the Former Lebanese Central Bank Governor of Lebanon

13/08/2023

The Sanctions and Asset-Freezing (Implementation of External Sanctions) (Jersey) Order 2021 (the Jersey "Order") is made under the Sanctions and Asset-Freezing (Jersey) Law 2019 ("SAFL"), and links to the U.K. Regulations, including the Global Anti-Corruption (Sanctions) (E.U. Exit) Regulations 2021 (the "U.K. Regulations")

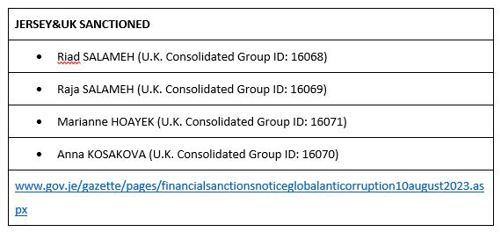

On August 10 2023, the Foreign, Commonwealth and Development Office updated the U.K. Sanctions List to reflect changes to those persons designated under the Global Anti-Corruption (Sanctions) (E.U. Exit) Regulations 2021 (the "U.K. Regulations"). The result is the U.K. Sanctions and Anti-Money Laundering Act 2018 [SAFL], and the Jersey "Order" have adopted the same, and the following designations have been made and are now subject to an asset freeze:

The U.S. Department of the Treasury has also taken sanctions in Coordination with THE United Kingdom and Canada against

- The Former Lebanese Central Bank Governor of Lebanon and

- Co-conspirators in an International Corruption Scheme.

As follows

WHAT DID THEY DO?

According to the U.S. Department of the Treasury

- Within the last several years, international efforts to promote corporate transparency have exposed Salameh's connection to numerous shell companies and bank accounts in Europe and the Caribbean.

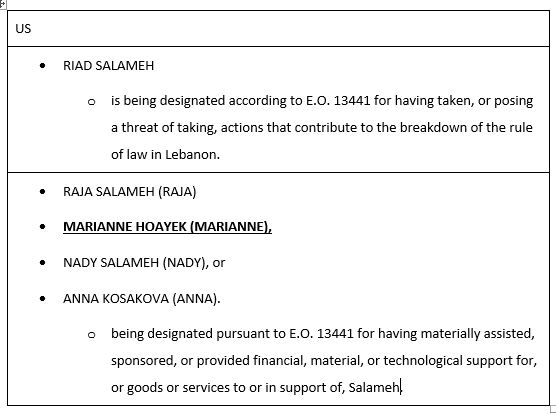

- As governor of the Banque du Liban (BdL), [1] RIAD SALAMEH used his office to engage in various unlawful self-enrichment schemes with the help of close family members and associates.

- In one scheme, Salameh — with the assistance of his brother, [2] RAJA SALAMEH (RAJA) — used a shell company owned by Raja in the British Virgin Islands, Forry Associates, to divert approximately $330 million from transactions involving the BdL.

- As part of this scheme, Salameh approved a contract that allowed his brother's company to take a commission on purchases of financial instruments by Lebanese retail banks from the BdL, even though Raja's company provided no apparent benefit for these transactions and the contract avoided naming Forry Associates or its owner.

- Salameh and Raja then moved these funds to bank accounts in their own names or the names of other shell companies.

- Salameh's primary assistant at the BdL, [3] MARIANNE HOAYEK (MARIANNE), joined Salameh and Raja in this venture by transferring hundreds of millions of dollars — far more than her official BdL salary accounted for — from her own bank account to those of Salameh and Raja.

- The Diverted funds were frequently transferred to many property management companies in France, Germany, Luxembourg, and Belgium that were registered in the names of either:-

- Salameh's son, NADY SALAMEH (NADY), or

- Salameh's former partner, ANNA KOSAKOVA (ANNA).

- NADY was the publicly registered officer of companies registered in Luxembourg that used subsidiaries in Germany and Belgium to purchase high-end commercial real estate worth tens of millions of dollars.

- In France, Anna owned companies that received funds from Forry Associates and used those funds to purchase luxury properties, including apartments for Anna and Salameh in one of Paris' most sought-after neighbourhoods and an office building on the Champs-Elysées where the BdL rented space for its "continuity of operations" centre.

- Salameh also used shell companies in Panama and a trust in Luxembourg to hide his identity.

- He purchased shares in a company where his son, Nady, had worked as an investment advisor, only to sell those shares to a Lebanese bank regulated by the BdL.

- This sale represents both a conflict of interest and a likely violation of a Lebanese law prohibiting employees of the BdL from profiting from other private businesses, enacted to ensure that they devote their attention entirely to safeguarding Lebanon's economic prosperity.

- Salameh is being designated according to E.O. 13441 for having taken or posing a threat of taking actions that contribute to the breakdown of the rule of law in Lebanon.

WASHINGTON —

- August 10, 2023, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) is designating the former governor of Lebanon's central bank, Riad Salameh (Salameh), whose corrupt and unlawful actions have contributed to the breakdown of the rule of law in Lebanon.

- Salameh abused his position of power, likely violating Lebanese law, to enrich himself and his associates by funnelling hundreds of millions of dollars through layered shell companies to invest in European real estate.

- OFAC is also designating four close associates of Salameh, including members of Salameh's family and his primary assistant, who helped to conceal and facilitate this corrupt activity.

- The United States is taking this action alongside United Kingdom and Canada, partners who share the United States' vision of a Lebanon that is governed for the benefit of the Lebanese people and not for the personal wealth and ambition of Lebanon's elite.

- Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian E. Nelson SAID:-

- "By using his position to enrich himself, his family, and his associates in apparent contravention of Lebanese law, Salameh contributed to Lebanon's endemic corruption and perpetuated the perception that elites in Lebanon need not abide by the same rules that apply to all Lebanese people,"

- "We are joining the United Kingdom and Canada in imposing sanctions on the former governor because he used his position to place his personal financial interests and ambitions above those of the people he served, even as the economic crisis in Lebanon worsened."

- Today's coordinated sanctions complement multiple investigations into Salameh and those close to him undertaken by both Lebanese and European law enforcement. OFAC's action is taken pursuant to Executive Order (E.O.) 13441, which authorizes sanctions against certain persons who have taken actions that have the purpose or effect of undermining Lebanon's democratic processes or contributing to the breakdown of the rule of law in Lebanon.

- OFAC's designation of Salameh and individuals involved in his corrupt schemes do not extend to

- the Banque du Liban (BdL) or

- the BdL's U.S. correspondent bank relationships.

- The U.S. government will continue its extensive cooperation with a range of public and private sector entities to support efforts to counter corruption and implement economic reforms in Lebanon.

SANCTIONS IMPLICATIONS

- As a result of today's action, all property and interests in property of these persons that are in the United States or in the possession or control of U.S. persons must be blocked and reported to OFAC.

- In addition, any entities that are owned, directly or indirectly, 50 percent or more by one or more blocked persons are also blocked.

- OFAC regulations generally prohibit all dealings by U.S. persons or within the United States (including transactions transiting the United States) that involve any property or interests in the property of blocked or designated persons.

- This action does not apply to the BdL. Neither the BdL nor its assets should be considered blocked due to today's action.

- The power and integrity of OFAC sanctions derive not only from OFAC's ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law.

- The ultimate goal of sanctions is not to punish but to bring about a positive change in behaviour. For information concerning the process for seeking removal from an OFAC list, including the SDN List, please refer to OFAC's Frequently Asked Question 897.

Source

https://home.treasury.gov/news/press-releases/jy1687

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.