Jersey seeks Swiss help in its $13 billion sales proceeds, money laundering, and sanctions breaches investigation

02/07/2025

2/7/25 It has been reported in numerous reputable public sources that there are allegations of historical massive financial transfers from Russia, which were allegedly funnelled through companies and trusts in Jersey. The allegations include Roman Abramovich, Jersey-based trusts, and potential breaches of sanctions and money laundering laws.

8/9/25 As an update, It has been reported (7th September) by the Guardian Newspaper that :- Swiss judges say Money Laundering and Sanction Breaches will be the subject of the criminal proceedings in Jersey. The article goes on to say that Court documents show that Roman Abramovich is the subject of a criminal investigation by the Jersey authorities over allegations of money laundering with bribery as a predicate offence. https://www.comsuregroup.com/news/judges-say-jersey-can-substantiate-the-allegation-of-money-laundering-connected-to-a-13-billion-company-sale/

For example,

Using the open-source information, the following has been found and may be of interest

The Jersey Attorney General has requested that Switzerland provide criminal assistance in a criminal investigation against Roman Abramovich et al. for money laundering and breach of economic sanctions laws.

- https://www.lexology.com/pro/content/jersey-investigating-abramovich-linked-companies-over-1990s-corruption-claims

- https://globalinvestigationsreview.com/just-sanctions/article/jersey-investigating-abramovich-linked-companies-over-1990s-corruption-claims

- https://www.rferl.org/a/1061759.html

- http://news.bbc.co.uk/1/hi/business/4290282.stm

- https://www.theguardian.com/world/2012/aug/31/berezovsky-abramovich-case-q-and-a

- https://en.wikipedia.org/wiki/Roman_Abramovich

- THE SWISS CASE/JUDGMENTS

JERSEY ALLEGATIONS DATE BACK TO THE 1990S, INCLUDING

- Bribery (Krysha payments) to gain control over a Russian company, which was sold for $13 billion, with proceeds routed through Jersey-based trusts and companies.

- Jersey authorities suspect that assets under G's control were used in transactions in violation of sanctions and in the laundering of illicit funds.

- Funds were placed into trusts where G. was a beneficiary until 2022.

- After G. was sanctioned by Jersey in 2022, further transactions involving G.-linked entities potentially breached sanctions laws.

REQUEST TO ANONYMIZE THE “CIRCUMSTANCES” SURROUNDING THE CASE

- 3 offshore companies linked to 2 Cypriot trusts settled by Mr. Abramovich opposed the request.

- They also asked the Swiss court to anonymise the “circumstances” surrounding the case further in its judgment.

THE COURT OF APPEAL REJECTED THE APPLICATIONS FOR FURTHER ANONYMISATION, STATING:

- “In practice, the Court anonymises the names of natural persons and legal entities and, in principle, also of smaller towns and villages before publishing a decision.

- In this respect, the appellant's request and its legitimate interest in protecting its personality are already considered.”

- However, “as far as the requested anonymisation of the 'circumstances' is concerned, the criminal proceedings for money laundering in Jersey, on which the request for mutual legal assistance is based, are already known to the public.

- The sanctions lists in Jersey and Switzerland are also public.

- Against this background, there is no reason to make the present decision more anonymous.”

MONEY LAUNDERING THROUGH JERSEY

It is alleged that the Jersey-based companies (J. Ltd, K. Ltd) received massive financial transfers from Russia and have helped manage the assets through Trusts and structures set up in Jersey, which are key to the suspected concealment and movement of funds.

The Jersey request's origin is 29 June 2022.

- The case revolves around events that began in the 1990s, but the sanctions-related violations occurred after March 2022, when G. was added to Jersey's sanctions list.

- Switzerland’s recognition of G. under sanctions occurred on 16 March 2022.

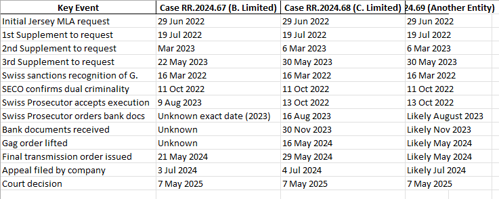

- Most critical legal actions and evidence requests from Jersey took place in 2022–2023, with final orders issued in mid-2024 and all three court decisions finalised on 7 May 2025.

📢 THE CASE/JUDGMENTS

- You will find the direct links to the cases in the Comments below.

- https://bstger.weblaw.ch/pdf/20250507_RR_2024_66.pdf

- https://bstger.weblaw.ch/pdf/20250507_RR_2024_67.pdf

- https://bstger.weblaw.ch/pdf/20250507_RR_2024_68.pdf

CRITICAL DATES

FURTHER READING

🔹 1. WHAT IS THE CASE ABOUT?

All three rulings relate to mutual legal assistance requests from Jersey to Switzerland, stemming from a criminal investigation in Jersey into:

- Suspected money laundering

- Violations of sanctions law (mainly linked to Ukraine/Russia)

- Suspected corruption in Russia during the 1990s

The core allegations are that individuals (notably one referred to as G.) used Jersey-based companies (e.g. J. Ltd and K. Ltd) to launder proceeds from an allegedly corrupt sale of a Russian company for USD 13 billion, and that these funds continued to be managed or transferred after G. was placed on a sanctions list in March 2022.

The Jersey authorities asked Switzerland to release banking records related to various companies (B. Limited, C. Limited) believed to be involved in the alleged laundering and sanctions breaches.

🔹 2. WHAT DECISIONS HAVE BEEN MADE?

In all three cases:

- The Swiss Federal Prosecutor (Bundesanwaltschaft) approved the transfer of banking documents to Jersey.

- The companies B. Limited and C. Limited appealed these decisions, arguing:

- The requests were politically motivated ("fishing expeditions")

- There was insufficient proof of dual criminality

- They were denied full access to unredacted files

- The Swiss Federal Criminal Court (Appeals Chamber) rejected the appeals and upheld the decisions to transfer the data.

KEY POINTS FROM THE COURT’S REASONING:

- The Jersey request was legitimate and based on sufficient suspicion.

- The conduct alleged (e.g. money laundering, sanctions violations) would also be punishable under Swiss law (“double criminality”).

- Partial redactions were allowed to protect third-party privacy and did not violate due process.

🔹 3. HOW IS JERSEY IMPLICATED?

Jersey plays a central role:

- The requesting state in all three mutual legal assistance procedures.

- Jersey authorities are conducting the core investigation into money laundering and sanctions breaches.

- The Jersey-based companies (J. Ltd, K. Ltd) are alleged to have received massive financial transfers from Russia and to have helped manage the assets through trusts.

- Trusts and structures set up in Jersey are key to the suspected concealment and movement of funds.

🔹 4. WHAT’S NEXT?

- The decisions of the Swiss court allow Jersey to obtain the Swiss bank records it requested.

- The companies involved may appeal further to the Swiss Federal Supreme Court, but only under limited conditions (e.g. if assets are being seized or constitutional questions arise).

- Jersey authorities will likely use the obtained records to prosecute further or build charges against those involved (including G. and potentially others).

---

THESE X3 THREE CASES ARE SUMMARISED IN ENGLISH BELOW

(AS COMSURE CANNOT GUARANTEE THE ACCURACY OF THE TRANSLATION, PLEASE ENSURE YOU SEEK YOUR TRANSLATION)

NO1

https://bstger.weblaw.ch/pdf/20250507_RR_2024_66.pdf

The document is a Swiss Federal Criminal Court ruling dated May 7, 2025, relating to international legal assistance in criminal matters to Jersey.

Below is a summary and translation of the main points into English:

Federal Criminal Court Decision (7 May 2025)

Case No.: RR.2024.66

# Parties Involved:

- A. Limited (formerly D. Limited), represented by attorneys Raphael Brunner and Kiril R. R. Haslebacher – *Appellant*

- Swiss Federal Prosecutor's Office (Bundesanwaltschaft) – *Respondent*

# Subject Matter:

Legal assistance to Jersey regarding:

- Money laundering investigations

- Violations of economic sanctions

- Request for release of evidence under Article 74 of the Swiss Mutual Legal Assistance Act (IRSG)

Background Summary:

- Jersey’s Attorney General initiated a criminal investigation against individuals E., F., and G. for suspected money laundering and violation of sanctions laws.

- Allegedly:

- G. paid bribes in the 1990s to gain control of a Russian company (I.) and later sold its shares for USD 13 billion, with proceeds routed through Jersey-based shell companies.

- Funds were placed into trusts where G. was a beneficiary until 2022.

- After G. was sanctioned by Jersey in 2022, further transactions involving G.-linked entities potentially breached sanctions laws.

- Director changes and asset transfers followed the sanctions, raising further suspicions.

- Swiss authorities became involved due to a legal assistance request from Jersey in June and July 2022, with supplemental requests in 2023.

- The Swiss economic agency SECO confirmed that some acts, especially post-sanction transactions, potentially met the criteria of dual criminality (i.e., would be criminal under Swiss law, too).

- The Swiss Federal Prosecutor ordered the release of A. Limited's banking records from Bank O. (now Bank P.), which were later lifted, so that the company could be informed.

Legal Claims by A. Limited:

- Limited appealed the release order and requested

- Full access to unredacted case files

- Annulment of the entry and final orders

- Dismissal of the Jersey request for assistance

- Alternative: Return of the case to prosecutors for clarification from Jersey authorities on:

- The relevance of the bank documents

- The delay in prosecuting alleged 1990s bribery (known since 2012)

- Costs to be borne by the Federal Prosecutor

Court's Ruling & Reasoning:

- The appeal was denied. Key reasons:

- No violation of procedural rights: Redactions were limited to third parties; core information was disclosed.

- Adequate description of offences: Jersey's request met legal standards (bribery, trusts, offshore accounts).

- Dual criminality upheld: Allegations align with Swiss money laundering laws (Art. 305bis of the Criminal Code).

- No “fishing expedition”: Jersey provided specific facts linking transactions and persons to the offences.

- No evidence of political motives or persecution, which could have invalidated the request.

- Proportional

NO2

https://bstger.weblaw.ch/pdf/20250507_RR_2024_67.pdf

Swiss Federal Criminal Court (Bundesstrafgericht) ruling dated May 7, 2025, concerning an international legal assistance matter in criminal proceedings with Jersey. Here's a summary of the key points translated into English:

🧾 Case Overview

Court: Swiss Federal Criminal Court, Appeals Chamber

Case Number: RR.2024.67

Presiding Judge: Roy Garré

Parties:

- Appellant: B. Limited, represented by attorneys Raphael Brunner and Kiril R. R. Haslebacher

- Respondent: Swiss Federal Prosecutor’s Office

📌 Background

Jersey authorities requested mutual legal assistance from Switzerland on June 29, 2022, which was later supplemented in July 2022, March 2023 and May 2023.

- The request concerned investigations against individuals E., F., and G. for money laundering and violations of economic sanctions.

Allegations date back to the 1990s, including bribery (Krysha payments) to gain control over a Russian company, which was sold for $13 billion, with proceeds routed through Jersey-based trusts and companies.

Jersey authorities suspect that assets under G.'s control were used in transactions in violation of sanctions and the laundering of illicit funds.

💼 Key Legal Issues

- Legal Assistance Validity:

- The Federal Prosecutor ordered Swiss banks to hand over bank records of B. Limited.

- B. Limited appealed, requesting:

- Full access to unredacted records,

- Cancellation of the cooperation with Jersey,

- Alternatively, to send further inquiries to Jersey before proceeding,

- Compensation of legal costs.

- Federal Court Ruling:

- The court dismissed the appeal.

It found the Jersey request sufficiently justified, as there was a clear suspicion of money laundering tied to bribery and complex offshore structures.

- The request did not constitute a politically motivated fishing expedition, and the material requested was deemed relevant.

- No violation of due process or fundamental rights was found.

- Redactions in disclosed documents were acceptable to protect third parties.

⚖️ Final Judgment

- The appeal by B. Limited is dismissed.

- Request for additional anonymisation in publication is rejected.

- Legal costs of CHF 5,000 are imposed on B. Limited.

📮 Right to Appeal

The ruling can be appealed to the Swiss Federal Supreme Court within 10 days, only if:

- The decision involves extradition, seizure, or transfer of assets,

- And it concerns a critical case (e.g., fundamental procedural rights violation).

NO3

https://bstger.weblaw.ch/pdf/20250507_RR_2024_68.pdf

The second document you've uploaded is another Swiss Federal Criminal Court ruling from the Appeals Chamber (Beschwerdekammer des Bundesstrafgerichts), dated May 7, 2025, involving mutual legal assistance in criminal matters with Jersey.

Below is a complete English translation of the key contents and structure of the document:

Swiss Federal Criminal Court (Bundesstrafgericht)

Appeals Chamber

Ruling of May 7, 2025

Case no. RR.2024.68

📍 In the Matter of

Mutual legal assistance in criminal matters with Jersey (JE)

📌 Parties

Appellant:

- C. Limited, represented by lawyers Raphael Brunner and Kiril R. R. Haslebacher, Zurich

Authority Requested:

- Swiss Federal Prosecutor's Office, Bern

📝 Summary of Facts

- Jersey authorities submitted a request for mutual legal assistance to the Swiss Confederation on June 29, 2022, and supplemented it several times until May 2023.

- The request relates to criminal proceedings against E., F., and G. for money laundering and violations of sanctions.

- The case involves alleged bribery (Krysha payments) in the 1990s to obtain control over a Russian company, which was subsequently sold in 2013 for over USD 13 billion.

- Proceeds were allegedly funnelled through Jersey-based structures, and suspicions concern laundering and possible sanction violations post-2014 (related to Crimea/Ukraine sanctions).

- The Swiss Federal Prosecutor issued orders to Swiss banks in May and June 2023 to hand over records concerning C. Limited, an entity involved in the structure.

- C. Limited filed an appeal on October 4, 2024, objecting to the handover.

⚖️ Appellant's Arguments (C. Limited)

- Requested full access to the case documents (without redactions).

- Demanded annulment of the legal assistance order.

- Alternatively, I asked Jersey for more information and clarification.

- Argued the request was politically motivated and lacked sufficient specificity.

- Claimed violation of the principle of double criminality and proportionality.

- Requested compensation for legal costs.

🏛️ Ruling by the Appeals Chamber

- Request Validity:

- Jersey’s request was deemed lawful, detailed, and based on real suspicions.

- Clear linkage to money laundering, with transactions through Switzerland justifying legal assistance.

- Double Criminality:

- The underlying acts (e.g., bribery, money laundering, sanctions violations) are punishable under Swiss law, meeting the requirement.

- No Political Nature:

- The court found no indications of political motivation or rights violations.

- Redactions in Disclosure:

- Redactions of third-party information were considered lawful and proportionate.

- Proportionality & Necessity:

- The data requested from banks was limited in scope and directly relevant.

🧾 Court's Decision

- The appeal is dismissed.

- The request to anonymise parties in publication is rejected.

- Legal costs of CHF 5,000 are imposed on C. Limited.

📮 Appeal Option

An appeal may be lodged with the Swiss Federal Supreme Court within 10 days, only if the decision concerns:

- Seizure or transfer of assets abroad,

- And raises issues of general importance (e.g., major procedural violations).

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.