Jersey is implementing the OECD Crypto-Asset Reporting Framework (CARF) to enhance tax transparency.

09/12/2025

The Government of Jersey is implementing the OECD Crypto-Asset Reporting Framework (CARF) to enhance tax transparency for crypto-asset transactions and prevent their use for tax evasion.

This aligns with global standards and complements the existing Common Reporting Standard (CRS), which has been in place for financial institutions in Jersey since 2016. Jersey signed the Multilateral Competent Authority Agreement for CARF on November 26, 2024, following a commitment in November 2023 alongside 48 other jurisdictions.

Key Implementation Details

- Effective Dates: The rules come into force on January 1, 2026, pending approval of draft regulations by the States Assembly (debated in the week of December 8, 2025). The first reporting period covers transactions from January 1, 2026, with initial reports due to Revenue Jersey by June 30, 2027, and the first international exchanges expected in 2027.

- Scope: CARF requires annual reporting of aggregated transaction data by type and value, including exchanges between crypto-assets, exchanges between crypto-assets and fiat currencies, transfers of crypto-assets (e.g., to unhosted wallets), and reportable retail payment transactions exceeding €50,000 where merchants accept crypto-assets. Relevant crypto-assets include digital representations of value on blockchain or similar technology, such as stablecoins, certain NFTs, and crypto derivatives. Exclusions apply to low-risk assets (e.g., those not usable for payment/investment), Central Bank Digital Currencies (CBDCs), and items already covered by CRS.

- Reporting and Due Diligence: Entities must perform due diligence to identify reportable users (including their tax residence, TINs, and beneficial owners), maintain records for 5 years, and submit XML-formatted reports. Any overlaps with CRS reporting should be notified to Revenue Jersey to avoid duplication. Penalties for non-compliance include up to £300 per failure (plus daily fines), up to £3,000 for inaccurate info, and criminal offences for obstruction or document destruction.

Who Is Caught (Affected) Under CARF

The framework primarily targets Reporting Crypto-Asset Service Providers (RCASPs), but it also impacts their users and related entities.

Here's a breakdown:

- RCASPs: Any individual, entity, or arrangement that facilitates or effectuates crypto-asset exchange transactions for or on behalf of customers. This includes crypto exchanges, brokers, dealers, and other intermediaries operating in or from Jersey. They must comply with due diligence, information collection (e.g., user tax details), and annual reporting to Revenue Jersey.

- Crypto-Asset Users: Individuals or entities (including trusts, partnerships, and their controlling persons) engaging in reportable transactions. They may need to provide additional tax information to RCASPs, such as tax residence and TINs, for verification.

- Financial Institutions and Others: Under related CRS amendments (effective alongside CARF), this extends to virtual asset service providers, investment entities focused on crypto, and indirect crypto investments via derivatives or vehicles. Trusts face joint liability among the trustees, and partnerships face joint liability through their responsible partner.

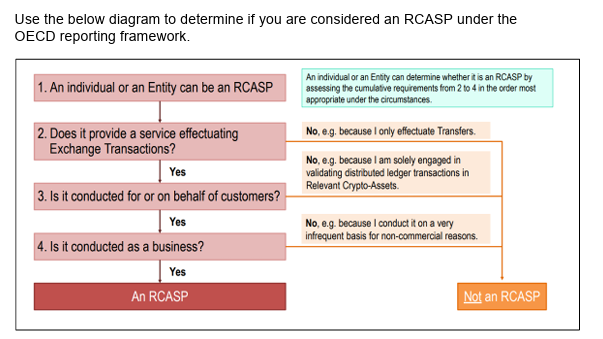

Flow Chart and Easy-to-Use Explanation

The Government of Jersey has issued an industry note (guidance document) that includes an easy-to-use decision tree (essentially a flow chart) to help determine whether an entity qualifies as an RCASP and thus falls under CARF obligations. This is referenced in Section 4 of the note as the "RCASP decision tree." While a detailed visual description isn't available in the text extracts, it serves as a step-by-step tool to assess criteria such as the nature of the services provided (e.g., exchange facilitation) and the jurisdictional nexus. Overall, the note offers a straightforward outline of who is affected, what to report, key dates, and additional resources.

For the full flowchart and context, please see the industry note PDF.

A public consultation on CARF implementation ran until February 13, 2025, and additional guidance on due diligence and reporting is expected post-approval.

All Source Web Links

- https://www.gov.je/TaxesMoney/InternationalTaxAgreements/IGAs/pages/cryptoassetreporting.aspx

- https://www.gov.je/SiteCollectionDocuments/Tax%20and%20your%20money/Implementation%20of%20CARF%20in%20Jersey%20-%20Dec%202025%201.pdf (Industry note with decision tree flow chart)

- https://statesassembly.je/publications/propositions/2025/p-99-2025 (Draft regulations)

FULL JERSEY BRIEFING

Crypto-Asset Reporting Framework and expansion of the Common Reporting Standard

Implementation of the OECD Crypto-Asset Reporting Framework

Jersey is preparing to implement the OECD’s Crypto-Asset Reporting Framework (CARF) from 1 January 2026, subject to approval by the States Assembly.

CARF introduces new international tax transparency requirements for Reporting Crypto-Asset Service Providers (RCASPs), including due diligence, the collection of tax information, and the annual reporting of certain customer transactions to Revenue Jersey.

The industry note outlines:

- Who is affected

- What needs to be reported

- Key dates

- Where to find further guidance on the CARF

Implementation of CARF in Jersey - December 2025

The Crypto-Asset Reporting Framework (CARF) and amendments to the CRS

The CARF is a new global standard requiring the collection, reporting, and exchange of tax information about customers of crypto-asset service providers. It has been developed by the Organisation for Economic Cooperation and Development (OECD) to prevent the use of virtual assets for tax evasion.

It's intended to support the Common Reporting Standard (CRS) for the automatic exchange of financial account information, which has been in effect for financial institutions in Jersey since 2016. The CRS is also being expanded to include some digital assets for the first time.

The CARF will apply to businesses, individuals and entities which provide services effectuating exchange transactions in crypto-assets for or on behalf of customers. This includes crypto-asset exchanges and other intermediaries and service providers which offer exchange services, such as brokers and dealers in relevant crypto-assets.

Similar to the CRS, businesses will have to collect information on the jurisdictions of tax residence and Taxpayer Identification Numbers (TINs) for the users of relevant crypto-assets and their beneficial owners. This information will be reported to Revenue Jersey annually, along with details of relevant transactions undertaken on behalf of the user.

Reportable transactions are those involving:

- Exchanges between crypto-assets and fiat currencies

- Exchanges between one or more forms of crypto-assets

- Transfers of crypto-assets, including Reportable Retail Payment Transactions where an intermediary processes payments on behalf of a merchant accepting crypto-assets in payment for goods or services exceeding €50,000

Transactions will be reported on an aggregate basis by type of crypto-asset and by transfer type, such as:

- Airdrops

- Income derived from staking

- A loan

In addition, details of the number of units and the total value of transfers of crypto-assets effected by a reporting entity on behalf of a crypto-asset user to wallets not associated with a virtual asset service provider or a financial institution will be required.

The relevant crypto-assets that give rise to reporting obligations are any digital representation of value that relies on a cryptographically secured distribution ledger or similar technology to validate and secure transactions. This includes stablecoins, derivatives issued as crypto-assets, and specific non-fungible tokens (NFTs).

Specific categories of crypto-assets that are considered to pose limited tax compliance risks are excluded from reporting obligations, including crypto-assets that cannot be used for payment or investment purposes and those already covered by the CRS.

Central Bank Digital Currency and Specified Electronic Money Products are also excluded from the scope of the CARF. Still, they will fall within the scope of reporting under the expanded CRS when the new rules are introduced.

At the same time as the introduction of the CARF, the OECD is amending the CRS to bring certain electronic money products and Central Bank Digital Currencies within its scope. We will also make changes to ensure that the CRS covers indirect investments in crypto-assets through derivatives and investment vehicles.

In addition to the changes intended to serve as a package alongside the CARF, further changes are being introduced to improve the quality and usability of CRS reporting.

Implementation of the CARF and expansion of the CRS

Jersey signed the Multilateral Competent Authority Agreement to implement the CARF on 26 November 2024. At the same time, Jersey also signed the Addendum to the Multilateral Competent Authority Agreement, agreeing to implement changes to the CRS. The current list of jurisdictions committed to implementing the CARF can be found on the OECD website.

This builds on the commitment made on 10 November 2023, when Jersey joined a group of 48 jurisdictions in expressing its intention to work towards a common implementation timeframe for the CARF and amended CRS, with the intention of first exchanges in 2027.

Joint statement on the implementation of the CARF

Both sets of new rules will come into effect on 1 January 2026, with the first reporting and information exchange requirements in 2027.This is also consistent with the EU's DAC8, finalised in October 2023.

A public consultation on the implementation of both the CARF and the CRS amendments in Jersey was published on 21 November 2024. Feedback is invited by 13 February 2025, following which legislation will be debated by the States Assembly in the second half of 2025.

Consultation on the CARF Regulations

The OECD has published the model rules on the CARF and the expanded CRS, along with commentaries to assist with their interpretation.

Crypto-Asset Reporting Framework and Amendments to the Common Reporting Standard on OECD

This is supported by interpretative guidance on the CARF, which is revised periodically.

FAQs: Crypto-Assert Reporting Framework guidance

The XML schemas required to report information, along with their user guides, are also available on the OECD website.

Crypto-Asset Reporting Framework XML Schema: User Guide for Tax Administrations

Amended Common Reporting Standard XML Schema

Source

https://www.gov.je/TaxesMoney/InternationalTaxAgreements/IGAs/pages/cryptoassetreporting.aspx

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.