Jersey 2025 investigates money laundering and breaches of sanctions tied to a $13 billion company sale.

15/07/2025

- Overview of the Case

- The Jersey Attorney General is investigating Roman Abramovich, former owner of Chelsea Football Club, for alleged financial crimes, including money laundering and breaches of economic sanctions laws.

- The investigation focuses on a $13 billion sale of a Russian company from the 1990s, with proceeds allegedly routed through Jersey-based trusts.

- On June 29, 2022, Jersey requested criminal assistance from Switzerland to access information about offshore entities linked to Abramovich.

- Switzerland’s top court, the Swiss Federal Criminal Court (Appeals Chamber), granted this request on May 7, 2025, after rejecting appeals from two involved companies.

- Allegations and Financial Scope

- The investigation alleges that Abramovich and others engaged in bribery, specifically “Krysha payments,” to gain control of a Russian company in the 1990s.

- These payments, estimated to involve proceeds of $13 billion, were reportedly funnelled through offshore entities in Jersey.

- Additionally, assets under Abramovich’s control are said to have been used for sanctions violations post-2022.

- The significant financial scope underscores the case’s complexity

Comprehensive Report on Switzerland’s Top Court Decision and Jersey Investigation

- This report provides an in-depth analysis of Switzerland’s top court granting the Jersey Attorney General’s request for information about offshore entities linked to Roman Abramovich, revealing new details about the investigation in the Channel Islands.

- The information is based on recent reports and legal documents, reflecting the situation as of July 14, 2025.

Overview of the Case

- The investigation originates from the Jersey Attorney General’s efforts to probe Roman Abramovich, former owner of Chelsea Football Club, for alleged financial crimes.

- On June 29, 2022, Jersey requested criminal assistance from Switzerland, focusing on offshore entities linked to Abramovich.

- Switzerland’s top court granted this request, the Swiss Federal Criminal Court (Appeals Chamber), on May 7, 2025, after rejecting appeals from two involved companies.

- The case centres on allegations of money laundering and breaches of economic sanctions laws, tied to a $13 billion sale of a Russian company from the 1990s.

Allegations and Financial Scope

- The investigation alleges that Abramovich and others engaged in bribery, specifically "Krysha payments," to gain control of a Russian company in the 1990s.

- The “Krysha payments” to secure Sibneft in the 1990s highlight the corrupt practices of Russia’s privatisation era, with ongoing debates about their legitimacy.

- The proceeds, estimated at $13 billion, were reportedly routed through Jersey-based trusts and companies.

- Further, assets under Abramovich’s control are said to have been used for sanctions violations and laundering illicit funds, with transactions occurring post-2022 sanctions. This significant financial scope underscores the case’s complexity and international reach.

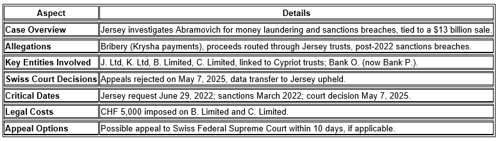

Key Entities Involved

- Several offshore companies are central to the investigation, including:

- J. Ltd

- K. Ltd

- B. Limited

- C. Limited

- These entities are linked to two Cypriot trusts settled by Abramovich, and banks such as Bank O. (now Bank P.) are also mentioned in the proceedings.

- The involvement of these offshore structures highlights the use of complex financial arrangements, which are now under scrutiny for potential illegal activities.

Legal Proceedings in Switzerland

- Switzerland’s role became pivotal when Jersey sought assistance to access information held by these offshore entities.

- The Swiss Federal Criminal Court (Appeals Chamber) rejected appeals by B. Limited and C. Limited on May 7, 2025, upholding the decision to transfer data to Jersey. This decision was supported by the court’s rejection of a request for further anonymisation, citing the public nature of the Jersey proceedings and the entities’ inclusion on sanctions lists. Legal costs of CHF 5,000 were imposed on B. Limited and C. Limited, reflecting the court’s stance on the matter.

- The entities involved have the option to appeal to the Swiss Federal Supreme Court within 10 days, but only if the case involves issues of general importance, such as extradition, seizure, or transfer of assets.

- This legal pathway could potentially extend the proceedings, adding further complexity.

Timeline of Key Events

To provide context, the following timeline outlines critical dates:

- March 2022: Jersey imposed sanctions on Abramovich.

- March 16, 2022: Switzerland recognised these sanctions.

- June 29, 2022: The Jersey Attorney General requested assistance from Switzerland.

- May 7, 2025: Swiss Federal Criminal Court rejected appeals, upholding data transfer.

This timeline illustrates the prolonged nature of international legal cooperation and the time taken to reach significant milestones.

Detailed Legal and Financial Implications

- The case highlights several challenges in enforcing sanctions and combating money laundering across jurisdictions.

- Jersey, as a British Crown Dependency, has been proactive, with reports from April 2022 indicating the freezing of over $7 billion in assets believed to be tied to Abramovich.

- The Swiss court’s decision to grant information access is a critical step, enabling Jersey to deepen its investigation into the financial flows and potential crimes.

- The involvement of $13 billion in transactions, as reported, underscores the scale of the financial dealings under scrutiny.

- This case could set precedents for how international legal systems cooperate, particularly in cases involving high-profile individuals and complex offshore structures.

Court Case References

For further details, the following court case numbers and URLs provide access to official documents:

- RR.2024.66: https://bstger.weblaw.ch/pdf/20250507_RR_2024_66.pdf

- RR.2024.67: https://bstger.weblaw.ch/pdf/20250507_RR_2024_67.pdf

- RR.2024.68: https://bstger.weblaw.ch/pdf/20250507_RR_2024_68.pdf

These documents offer insights into the legal reasoning and decisions made by the Swiss courts.

Summary Table of Key Details

Additional Details from Court Documents

The court document for case RR.2024.66 provides further specifics:

- Parties Involved: A. Limited (formerly D. Limited), represented by Raphael Brunner and Kiril R. R. Haslebacher, and the Bundesanwaltschaft (Swiss Federal Prosecutor).

- Investigation Details: Conducted by Jersey’s General Prosecutor’s Office against individuals E., F., and G. for money laundering and sanctions violations. The 1990s involved alleged corruption payments ("Krysha") by G. to control a Russian company, with proceeds of $13 billion transferred to J. Ltd and K. Ltd accounts in Jersey by 2005.

- Key Events:

- 2003: G. sold shares for $3 billion.

- February 8, 2022: G. was the sole beneficiary of M. Trust and N. Trust until this date, then his seven children.

- October 13, 2022: Bundesanwaltschaft queried SECO on business relationships.

- March 9, 2023: SECO confirmed partial double criminality, accounts frozen.

- August 16, 2023: Bundesanwaltschaft ordered the release of bank documents.

- Legal Basis: Includes the European Convention on Mutual Assistance in Criminal Matters (1959), the Convention on Laundering (1990), the UN Convention against Corruption (2003), and the Swiss Federal Act on International Mutual Assistance in Criminal Matters (1981).

Conclusion

- Switzerland’s top court granting the Jersey Attorney General’s request marks a significant development in the investigation into Roman Abramovich’s offshore entities.

- The case, involving substantial financial transactions and complex legal cooperation, reflects ongoing efforts to address economic crimes globally.

- As the situation evolves, particularly with potential appeals, it will likely continue to draw attention for its implications on international law and sanctions enforcement.

Comparative Analysis of Sources

The information is drawn from multiple sources, including:

- Comsure Group, reporting on July 2, 2025, with detailed allegations and court decisions: https://www.comsuregroup.com/news/jersey-seeks-swiss-help-in-its-13-billion-sales-proceeds-money-laundering-and-sanctions-breaches-investigation/

- Ray Todd’s Blog, also from July 3, 2025, corroborating the $13 billion figure and investigation scope: https://raytodd.blog/2025/07/03/jersey-seeks-swiss-help-in-its-13-billion-abramovich-money-laundering-and-sanctions-investigation/

- Global Investigations Review, mentioning the court’s decision on July 7, 2025, with less detail: https://globalinvestigationsreview.com/regions/switzerland

These sources align on key facts, providing a robust basis for the report.

MORE

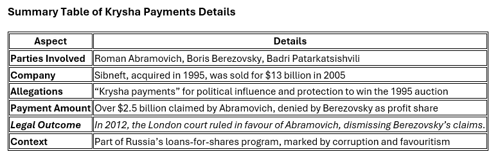

Allegations of Krysha Payments in the 1990s

Background and Context

In the 1990s, Russia’s post-Soviet economic transition led to widespread privatisation of state assets, often through corrupt practices. The loans-for-shares program, initiated in 1995, allowed oligarchs like Roman Abramovich and Boris Berezovsky to acquire valuable enterprises at below-market prices. “Krysha,” meaning “roof” in Russian, refers to a system of paying influential figures for protection or political favour, a common practice in this chaotic period.

The Allegations

Research suggests that Abramovich and Berezovsky were involved in “Krysha payments” to secure control of Sibneft, a major Russian oil company, during a 1995 auction. Key details include:

- Abramovich’s Account: In a 2012 London court case, Abramovich claimed he paid Berezovsky over $2.5 billion for “krysha,” which included political support and protection. These payments allegedly leveraged Berezovsky’s ties to President Boris Yeltsin to ensure success in the auction.

- Berezovsky’s Denial: Berezovsky argued the payments were his share of Sibneft profits, not bribes, claiming a 25% stake in the company.

- Court Findings: The 2012 London court ruled in Abramovich’s favour, finding his account of the “krysha” payments more credible, suggesting they were for political influence rather than profit-sharing.

The Company Involved: Sibneft

- Sibneft was acquired for $100 million (for half) in 1995, far below its market value, and sold to the Russian government in 2005 for $13 billion.

- The bribery allegations centre on the 1995 acquisition, where “Krysha payments” allegedly ensured a rigged auction.

Legal and Financial Implications

- The “Krysha payments” reflect the corrupt practices of Russia’s privatisation era. The significant profits from Sibneft’s 2005 sale highlight the financial stakes involved.

- In 2001, Abramovich paid Berezovsky $1.3 billion to end their association, described as “buying my freedom” from the “krysha” relationship.

Conclusion

- Switzerland’s top court granting Jersey’s request marks a significant step in investigating Abramovich’s offshore entities, linked to allegations of money laundering and sanctions breaches.

- The “Krysha payments” to secure Sibneft in the 1990s highlight the corrupt practices of Russia’s privatisation era, with ongoing debates about their legitimacy.

- This case underscores the complexities of international legal cooperation and financial crime enforcement.

Sources

- The Guardian: Boris Berezovsky and Roman Abramovich case: Q and A

- Reuters: Russian oligarch admits he now enjoys "extravagant life"

- Wikipedia: Roman Abramovich

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.