Is Jersey's VASP NRA impacted by the latest CRYPTO CRIME REPORT on illicit activity in 2025?

11/02/2026

The 2026 Crypto Crime Report from TRM Labs reveals a dramatic surge in illicit cryptocurrency flows, hitting a record USD 158 billion in 2025, a staggering 145% jump from USD 64.5 billion in 2024. This uptick reverses a years-long downward trend and raises critical questions about global risk assessments in the crypto space.

- Read TRM's 𝟐𝟎𝟐𝟔 𝐂𝐫𝐲𝐩𝐭𝐨 𝐂𝐫𝐢𝐦𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 for all the details 👉 https://t.co/DB9ivv9UCK - https://x.com/trmlabs/status/2016519112525017457

As someone tracking these developments, I (mathew Beale @ Comsure) couldn't help but wonder:

- Does this report challenge the validity of Jersey's National Risk Assessment (NRA) for Virtual Asset Service Providers (VASPs)?

- Jersey's NRA, last published in May 2024, rated the sector's residual risk as Medium-High.

In this updated blog post, I'll break down the report's key findings, revisit Jersey's NRA, compare it to other jurisdictions, and explore whether an update is overdue in light of evolving threats like sanctions evasion, stablecoin dominance, and AI-driven fraud.

Key Findings from TRM Labs' 2026 Crypto Crime Report

TRM Labs' analysis employs refined methodologies to identify economically meaningful illicit flows, excluding non-transfer activities such as wash trading. The result? A clearer picture of risks amid crypto's explosive growth. Here's a high-level overview:

- Overall Illicit Flows: USD 158 billion across major blockchains (Bitcoin, Ethereum, TRON, Binance Smart Chain, and Polygon). Sanctions-related activity dominated at USD 93 billion, followed by fraud (USD 35 billion), hacks (USD 2.87 billion from 150 incidents), darknet markets (USD 1.7 billion, up 20%), and drug trafficking (USD 3.4 billion). Money laundering services processed over USD 60 billion in exits from illicit wallets.

- Proportional Decline Amid Growth: Despite the absolute increase, illicit activity accounted for just 1.2% of total attributed on-chain volume (down from 1.3% in 2024) and 2.7% of incoming VASP liquidity (down from 2.9%). This highlights how legitimate crypto adoption is outpacing criminal use, even as raw volumes soar.

- Sanctions Evasion: Flows linked to sanctions grew over 400% year-over-year, largely driven by Russia. Networks such as the A7 wallet cluster processed USD 39 billion, connecting to rebranded exchanges (e.g., Garantex/Grinex) and intermediaries in China and Southeast Asia. Other actors, such as Iran (USD 580 million, 5.9% of its crypto activity) and Venezuela, increasingly rely on crypto for payments and remittances.

- Stablecoins' Dominance: These assets made up 95% of illicit flows to sanctioned entities, with USDT on TRON and BSC handling 84% of fraud inflows. The Ruble-pegged A7A5 stablecoin processed USD 72 billion in total, including USD 37 million for Russian procurement via Chinese channels, though 34% was artificial wash trading.

- Chinese-Language Laundering Networks: These handled USD 103 billion in 2025 (up from USD 123 million in 2020). Platforms like Huione Pay (USD 73 billion), Haowang (USD 7.3 billion), Xinbi (USD 5.9 billion), and Tudou (USD 3 billion) facilitated scams, cybercrime, and drug laundering through escrow and OTC brokers. Enforcement actions (e.g., FinCEN designations) caused rerouting but didn't halt growth.

- AI-Enabled Fraud Explosion: A 500% rise, powered by LLMs for phishing, deepfakes, and scams like romance-investment schemes. Pyramid and Ponzi frauds alone accounted for USD 6.1 billion (up 49%), targeting regions such as Nigeria and India. Criminals now move funds in under 48 hours via chain hopping, accelerating the pace of financial crime.

The report attributes this surge to crypto's integration into global finance, enhanced detection, intensified sanctions, and technology enablers such as AI. While absolute risks are rising, proportional declines signal progress in enforcement and market maturation.

Revisiting Jersey's National Risk Assessment for VASPs

Jersey's NRA, released in May 2024 by the Government of Jersey, evaluates money laundering (ML), terrorist financing (TF), and proliferation financing (PF) risks in the VASP sector. It assigns an overall residual risk of Medium-High, based on:

- Threat Level: Medium-High, driven by ML via pseudonymity, rapid transfers, and global trends like ransomware and fraud. No significant TF/PF threats were noted.

- Inherent Vulnerabilities: Medium-High, including non-face-to-face services, high exposure to politically exposed persons (PEPs), and quick settlements.

- Mitigation Measures: Medium, thanks to a robust regulatory framework (e.g., licensing and AML/CFT laws), but with gaps in supervision and data collection.

Jersey's VASP sector is relatively small, limiting its systemic impact.

- The assessment aligns with FATF standards and emphasizes proactive regulation, positioning Jersey as a compliance-friendly jurisdiction.

- But with the TRM report's 2025 data showing illicit flows ballooning due to sanctions, stablecoins, and AI fraud trends that were emerging but not fully quantified in 2024, does this NRA still hold up?

- The short answer:

- It's likely outdated in scope, as global threats have intensified, potentially amplifying Jersey's vulnerabilities through international exposures.

How Jersey Compares to Other Jurisdictions

To contextualise, I analysed NRAs from 15 countries, ordering them from highest to lowest risk based on primary ratings (focusing on residual or inherent risks where available). Ratings follow FATF-inspired scales and may emphasise different aspects, but they provide a benchmark:

- Seychelles: Residual Risk - Very High (high arbitrage).

- Mauritius: Residual Risk - High to Very High (similar offshore risks).

- Ghana: Inherent Vulnerabilities - High.

- Guyana: Residual Risk - High.

- Kenya: Inherent Vulnerabilities - High.

- South Africa: Inherent ML/TF Risk - High; Residual ML Risk - Medium-High.

- United Arab Emirates (UAE): Residual ML/TF Risk - High.

- United Kingdom (Mainland): ML Risk - High.

- Virgin Islands: Vulnerabilities - High.

- Cayman Islands: Residual Risk - Medium-High (offshore peer with similar exposures).

- Jersey: Residual Risk - Medium-High (proactive regulation tempers threats).

- United States: Vulnerabilities - Medium-High (vast market, diverse risks).

- Gibraltar: ML/TF Scores - Medium to High (e.g., exchanges: Medium-High for ML).

- Luxembourg: Inherent Risk - High (2025 NRA); Residual Risk - Medium.

- Pakistan: Inherent Vulnerabilities - Medium.

Jersey ranks 11th, considered moderately risky but favourable due to its regulatory maturity. It shares a Medium-High profile with peers such as the Cayman Islands and the US, where offshore/international flows increase exposure.

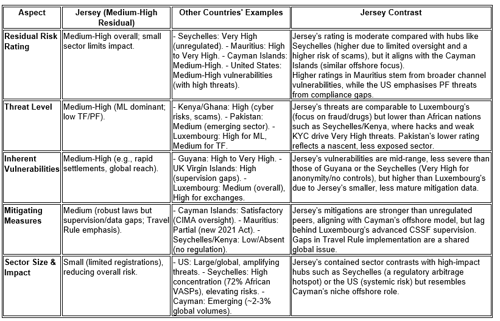

Key Similarities and Differences

- Similarities: Universal threats include pseudonymity, speed, and cross-border flows fuelling ML from fraud, ransomware, and sanctions. Mitigation through licensing and the Travel Rule reduces residual risk in regulated jurisdictions such as Jersey, the Cayman Islands, and Luxembourg. Emerging risks (AI fraud, DeFi, stablecoins) are flagged worldwide, echoing Jersey's calls for better monitoring. FATF influence ensures comparable frameworks.

- Differences: Jersey's small sector size caps impact, unlike the US's massive scale. Regulatory gaps inflate risks in high-threat zones while mature supervision provides offsets. Specific drivers vary, e.g., sanctions dominate in the UAE, while fraud is the leading driver in Africa, underscoring the need for tailored NRAs.

Risk Implications for Jersey and Compliance Recommendations

The TRM report underscores that crypto's integration into global finance amplifies risks, even in well-regulated jurisdictions like Jersey. Potential impacts on the NRA:

- Heightened Threats: Surging sanctions evasion (e.g., Russia-linked A7 networks) and stablecoin use could exploit Jersey's international ties, pushing ML risks higher.

- Vulnerabilities Exposed: AI fraud and chain hopping accelerate crime, challenging existing mitigations.

- Proportional Perspective: Declining illicit shares suggest Jersey's framework is resilient, but absolute growth demands updates.

To mitigate, financial institutions and regulators should:

- Boost Monitoring: Use typology alerts for short holds, cross-chain activity, and high-risk stablecoins.

- Enhance Security: Implement hardware custody and withdrawal governance against hacks.

- Collaborate: Join intelligence networks like TRM's Beacon for real-time insights.

- De-Risk: Scrutinise VASP outflows and adapt to rebrands/migrations.

- Align with Regs: Update for new sanctions and invest in analytics.

Final Thoughts

- Jersey's 2024 NRA remains a solid foundation, but the TRM report's revelations about 2025's illicit surge, fuelled by geopolitics, tech, and scale, signal it's time for a refresh.

- Global trends don't respect borders, and proactive jurisdictions like Jersey must evolve to stay ahead. If you're in the VASP space, treat this as a wake-up call: Strengthen compliance now to navigate the reshaping crypto crime landscape. Stay tuned for more updates, crypto's wild ride continues.

This post is based on TRM Labs' January 2026 insights and public NRAs. For the latest, you can consult official sources – see below.

Appendix

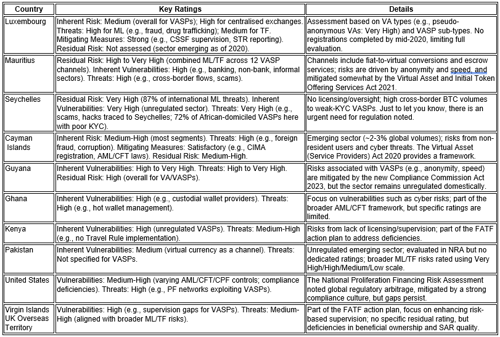

Overview of NRA Ratings for VASPs Globally

National Risk Assessments (NRAs) for Virtual Asset Service Providers (VASPs) vary by country, with a focus on money laundering (ML), terrorist financing (TF), and, in some cases, proliferation financing (PF) risks. These assessments typically evaluate threats (e.g., exposure to crimes like fraud or sanctions evasion), inherent vulnerabilities (e.g., anonymity, cross-border nature), mitigating measures (e.g., regulation, supervision), and residual risk (post-mitigation). Ratings often use scales such as Low, Medium, High, or Very High, though methodologies vary. Many countries follow FATF guidance, but implementation varies; some have dedicated VASP NRAs, while others integrate them into broader assessments. Below is a compilation of available ratings from various jurisdictions (excluding Jersey, which has a Medium-High residual risk). Note that not all countries publicly disclose detailed ratings, and some sectors remain unregulated, implying higher risks.

Key Differences and Contrasts

Sources

- 2026 Crypto Crime Report – Illicit Crypto Trends & Typologies | TRM Labs - https://www.trmlabs.com/reports-and-whitepapers/2026-crypto-crime-report (Published: Jan 28, 2026)

- 2026 Crypto Crime Report Key Insights: TRM Identifies Record USD 158 Billion in Illicit Crypto Flows in 2025, Reversing a Multi-year Decline - TRM Labs - https://www.trmlabs.com/resources/blog/2026-crypto-crime-report-key-insights-trm-identifies-record-usd-158-billion-in-illicit-crypto-flows-in-2025-reversing-a-multi-year-decline (Published: Jan 10, 2026)

- TRM's New Crypto Crime Report Shows Illicit Flows Hit a Record USD 158B in 2025 - https://www.trmlabs.com/resources/blog/trms-new-crypto-crime-report-shows-illicit-flows-hit-a-record-usd-158b-in-2025 (Published: Jan 28, 2026)

- TRM Labs | Blockchain Intelligence Platform - https://www.trmlabs.com/

- TRM Labs 2026 Crypto Crime Report: Illicit Activity Reaches USD 158 Billion | Ari Redbord posted on the topic | LinkedIn - https://www.linkedin.com/posts/ari-redbord_hot-off-the-presses-trm-labs-2026-crypto-activity-7422287635651592193-rQfu

- TRM Labs Reports and White Papers | Blockchain Intelligence and Crypto Risk Insights - https://www.trmlabs.com/resources/reports-and-whitepapers

- Crypto analytics firm TRM Labs reaches unicorn status following $70M Blockchain Capital-led Series C | The Block - https://www.theblock.co/post/388456/crypto-analytics-firm-trm-labs-reaches-unicorn-status-following-70m-blockchain-capital-led-series-c

- TRM Labs Announces $70M Series C to Scale AI Solutions to Disrupt Criminal Networks and Counter National Security Threats - https://www.trmlabs.com/resources/blog/trm-labs-announces-70m-series-c-to-scale-ai-solutions-to-disrupt-criminal-networks-and-counter-national-security-threats

- Sanctions-linked activity pushes crypto crime to record levels - GLI - Global Legal Insights - https://www.globallegalinsights.com/news/sanctions-linked-activity-pushes-crypto-crime-to-record-levels (Published: Jan 30, 2026)

- Illicit crypto volume hit a record USD 158B in 2025. But the share of illicit activity? Just 1.2%. Read TRM's 𝟐𝟎𝟐𝟔 𝐂𝐫𝐲𝐩𝐭𝐨 𝐂𝐫𝐢𝐦𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 for all the details 👉 https://t.co/DB9ivv9UCK - https://x.com/trmlabs/status/2016519112525017457

- 2026 Crypto Crime Report (Browsed Content) - https://www.trmlabs.com/reports-and-whitepapers/2026-crypto-crime-report

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.