IOM - December 2025 update to the Isle of Man Financial Services Authority (IOMFSA) AML/CFT Handbook

05/12/2025

The Isle of Man Financial Services Authority has issued an updated AML/CFT Handbook in December 2025 to provide enhanced guidance for compliance with the Anti-Money Laundering and Countering the Financing of Terrorism Code 2019 (“the Code”).

While the Handbook provides guidance, adherence to its principles is critical to demonstrating compliance with the Code and mitigating exposure to civil penalties and reputational risk.

SUMMARY

Here’s a clear summary of the December 2025 update to the Isle of Man Financial Services Authority (IOMFSA) AML/CFT Handbook and what readers need to know to meet their obligations under the Anti-Money Laundering and Countering the Financing of Terrorism Code 2019 (“the Code”):

This update reflects evolving regulatory expectations, incorporates recent findings from the National Risk Assessment, and clarifies obligations in key areas, including risk assessments, newly introduced business, and the treatment of Commercially Exposed Persons (CEPs).

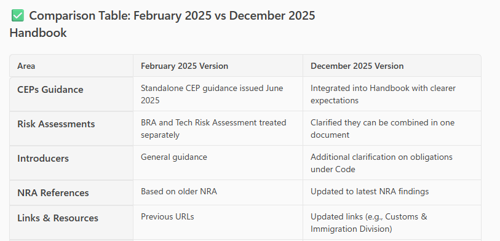

Key Changes in the December 2025 AML/CFT Handbook

The Authority published the updated Handbook on 3 December 2025. The main changes compared to previous versions include:

- Revised Guidance on Commercially Exposed Persons (CEPs)

- CEP guidance has been consolidated into the Handbook (previously issued as a standalone document in June 2025).

- Provides clearer expectations for identifying and managing CEPs, similar to Politically Exposed Persons (PEPs), but focused on commercial influence risk. [iomfsa.im]

- Business Risk Assessment (BRA) and Technology Risk Assessment

- Clarification that both assessments can be recorded in a single document, provided they meet the Code’s requirements.

- Emphasis on documenting methodology and review cycles. [iomfsa.im]

- Introducers

- Additional clarification on obligations when relying on introducers, aligning with the Code’s provisions on “introduced business.” [iomfsa.im]

- National Risk Assessment (NRA) References Updated

- Dates and references throughout the Handbook now reflect the latest NRA findings. [iomfsa.im]

- Updated Links and Resources

- Hyperlinks to the Isle of Man Customs and Immigration Division and other resources have been refreshed. [iomfsa.im]

- Tracked Changes Version Available

- The Authority has published both a clean version and a tracked changes version for transparency. [iomfsa.im]

What Readers Should Know to Meet Obligations Under the Code

The Handbook is guidance, not law, but it explains how to comply with the AML/CFT Code 2019, which is legally binding. Key compliance points reinforced by the December 2025 update:

- Risk-Based Approach

- Maintain a documented Business Risk Assessment (BRA) and Technology Risk Assessment, reviewed regularly and aligned with NRA findings.

- Ensure risk assessments cover ML/TF/PF risks (Money Laundering, Terrorist Financing, and Proliferation Financing). [iomfsa.im]

- Customer Due Diligence (CDD)

- Apply enhanced measures for CEPs and PEPs.

- Verify beneficial ownership and control as per Part 4 of the Code. [gov.im]

- Introduced Business

- Confirm introducers meet eligibility criteria under the Code (e.g., regulated status, written agreements). [gov.im]

- Record-Keeping

- Document all risk assessments, decisions, and reviews to demonstrate compliance. [iomfsa.im]

- Sector-Specific Guidance

- Review updated sector-specific documents (e.g., for accountants, estate agents, virtual asset service providers) published alongside the Handbook. [iomfsa.im]

- Civil Penalties

- Non-compliance with the Code can lead to civil penalties under the Isle of Man regime, in addition to criminal sanctions. [iomfsa.im]

Practical Next Steps for Compliance Teams

- Download the December 2025 Handbook (clean and tracked versions) from IOMFSA’s website.

- Review and update your BRA and Technology Risk Assessment to reflect clarified guidance.

- Update internal policies for CEPs and introduce business.

- Ensure staff training incorporates these changes.

- Cross-check sector-specific guidance relevant to your business.

Sources

- https://www.iomfsa.im/media/3534/aml-cft-handbook-december-2025.pdf

- https://www.iomfsa.im/media/3533/aml-cft-handbook-tracked-december-2025.pdf

- https://www.iomfsa.im/fsa-news/2025/dec/updated-amlcft-handbook-published/

- https://www.gov.im/media/470621/antimoneylaunderingandcounteringthefinancingofterrorismcode2019.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.