Hong Kong and the UAE front companies used by Iran to launder billions

10/06/2025

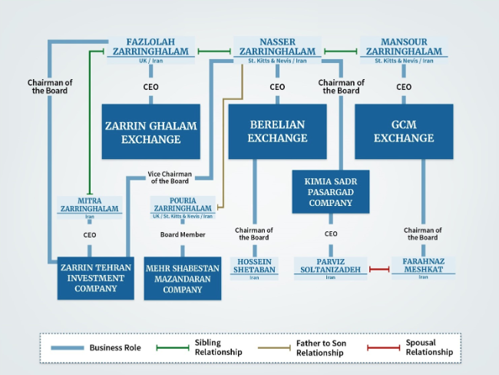

ON JUNE 6, 2025, the U.S. Treasury imposed sanctions on over 30 individuals and entities linked to the Zarringhalam brothers, who have orchestrated a sophisticated shadow banking network to launder billions for the Iranian regime.

This network, primarily in Hong Kong and the UAE, operates through Iranian exchange houses and foreign front companies to evade global financial surveillance.

The Architecture of Deception

- The system operates as a parallel banking system in which settlements are brokered through Iran-based exchange houses that use front companies outside of Iran, primarily in Hong Kong and the United Arab Emirates (UAE), to make or receive payments on behalf of sanctioned persons in Iran.

- The brothers operate three exchange houses: GCM Exchange, Berelian Exchange, and Zarrin Ghalam Exchange, each handling different segments of Iran's illicit economy.

Multi-Currency Obfuscation Tactics

- These front companies operate accounts in multiple currencies at various banks to facilitate payments for blocked Iranian entities engaged in oil sales.

- The network processes transactions in dollars, euros, and other currencies simultaneously, making detection exponentially more difficult for compliance teams.

Geographic Arbitrage Strategy

- Illicit actors such as the Zarringhalam brothers frequently establish their cover companies in Hong Kong or the UAE because they are easy to establish and subject to less scrutiny and oversight in these jurisdictions.

- They identified regulatory gaps between jurisdictions and exploited them systematically.

Documentation Fraud Infrastructure

- Shadow banking brokers may generate fictitious invoices or transaction details to justify payments for sanctioned goods.

- They created entire false commercial narratives to support billion-dollar transactions.

High-Level Institutional Connections

- The network isn't operating in isolation.

- GCM Exchange has assisted the IRGC-QF in receiving funds from the U.S.-sanctioned Astan Quds Foundation via money transfers through China and has also assisted Astan Quds Foundation and the IRGC-QF in collecting approximately $100 million through currency exchanges.

- The Treasury designated 17 Hong Kong companies and 5 UAE entities - all functioning as fronts. Names like "Magical Eagle Limited" and "Prettandy Trading Limited" hide billion-dollar operations behind innocuous-sounding businesses.

Key Points:

- Scope: The network launders proceeds from Iran's oil and petrochemical sales, funding its nuclear and missile programs and supporting terrorist proxies.

- Mechanism: It uses fictitious invoices and transaction details to justify payments for sanctioned goods, creating a parallel financial system.

- Impact: These sanctions aim to disrupt the network's operations and cut off a critical lifeline for the regime.

THE ZARRINGHALAM Brothers control

Guidance to prevent the above

- As a result of the above case, the Treasury’s Financial Crimes Enforcement Network (FinCEN) has issued an updated Advisory to assist financial institutions in identifying, preventing, and reporting suspicious activity connected with Iranian illicit economic activity, including oil smuggling, shadow banking, and weapons procurement.

- https://www.fincen.gov/sites/default/files/advisory/2025-06-06/FinCEN-Advisory-Illicit-Oil-Smuggling-508.pdf

References

- U.S. Targets Iran's 'Shadow Banking' Network With Sanctions https://www.devdiscourse.com/article/law-order/3450373-us-targets-irans-shadow-banking-network-with-sanctions

- US targets Iran's shadow banking with new sanctions https://www.yahoo.com/news/us-issues-iran-related-sanctions-141900114.html.

- Treasury Sanctions Iranian Network Laundering Billions for Regime ...https://home.treasury.gov/news/press-releases/sb0159

- Sanctioning Iran’s “Shadow Banking” Network of Money Launderers and ...https://www.state.gov/releases/office-of-the-spokesperson/2025/06/sanctioning-irans-shadow-banking-network-of-money-launderers-and-illicit-oil-traders/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.