Guernsey SAR “Consent” Guidance

28/07/2022

The Bailiwick of Guernsey Financial Intelligence Unit ("FIU"),

- Acts as the competent authority with the sole responsibility for the receipt, analysis and timely dissemination of Suspicious Activity Reports ("SARs") filed by Financial Services Businesses and Non-Financial Services Businesses

the report to fulfil obligations set out in

- Part I of The Disclosure (Bailiwick of Guernsey) Law, 2007, or

- Sections 12, 15 or 15A of Terrorism and Crime (Bailiwick of Guernsey) Law, 2002.

The FIU also maintains responsibility for addressing any 'consent' requests as a result of a SARs being submitted.

The FIU has now [Jan 2022] issued CONSENT guidance - https://guernseyfiu.gov.gg/CHttpHandler.ashx?id=149353&p=0 - This document is intended to

- Provide information as to the approach that the FIU will adopt when an appointed Money Laundering Reporting Officer ("MLRO") or Nominated Officer ('NO') of a reporting institution seeks consent from the FIU

- In respect of an act that may constitute a money laundering and/or terrorist financing offence according to relevant legislation.

This document intends to

- Outline the consent regime, and expected responses, and address some common misinterpretations with regards to the application of consent.

in addition to the guide MLROS must know

- Part I of The Disclosure (Bailiwick of Guernsey) Law, 2007 ("Disclosure Law"), 'Disclosure of Information by Financial Services Businesses and by Non-Financial Services Businesses';

- Part II of the Criminal Justice (Proceeds of Crime)(Bailiwick of Guernsey) Law, 1999 ("POCL"), 'Offences in Connection with the Proceeds of Criminal Conduct';

- Part III of the Terrorism and Crime (Bailiwick of Guernsey) Law, 2002 ("TACL"), 'Terrorist Property';

- Part IV of the Drug Trafficking (Bailiwick of Guernsey) Law, 2000 ("DTL"), 'Offences in Connection with the Proceeds of Drug Trafficking';

- Schedule 3 of the Criminal Justice (Proceeds of Crime)(Bailiwick of Guernsey) Law, 1999 ("POCL") 'Specified Businesses'

- Chapter 13 of Guernsey Financial Services Commission ("GFSC") Handbook on Countering Financial Crime and Terrorist Financing, 'Reporting Suspicion';

- FIU Guidance to Improve Suspicious Activity Reports;

- FIU Guidance on Requests for Additional Information

Guidance Contents

- The Consent Regime

- What is the Defence under POCL and TACL?

- When Should I Seek Consent from the FIU?

- What are the consequences if insufficient information is submitted?

- 'No Consent'

- 'Consent granted letter'

- Ongoing Obligations

- Tipping Off Offences

- Can I Discuss this Consent Issue or SAR with the Regulator or Revenue Service?

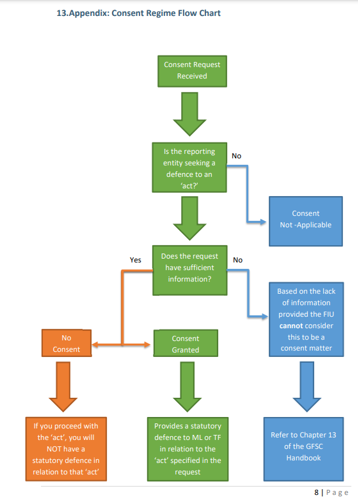

- Appendix: Consent Regime Flow Chart

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.