GUERNSEY 2025 FEEDBACK ON 2024 Discussion Paper (“DP”) on The Future of Sustainability Reporting.

01/08/2025

- Introduction

This paper provides feedback on the responses received to the Commission’s Discussion Paper (“DP”) on The Future of Sustainability Reporting in the Bailiwick of Guernsey, issued in July 2024.

1.1 Who is affected by the proposals in this paper?

The paper sets out a policy position and makes specific proposals to amend governance and anti-greenwashing obligations which are relevant to all persons supervised by the Commission.

1.2 Background

The DP noted the importance and relevance of sustainability-related risk to the financial services industry and sought to explore the next steps which are being taken and which might be taken in the Bailiwick in the future to meet the challenges presented.

The DP provided a summary of international developments in the area of sustainability reporting, including the work of the International Sustainability Standards Board (ISSB).

The paper sought to gather information and views from the finance sector on the potential impact of the ISSB's issued standards.

The DP also sought views on additional steps which might be taken to enhance licensees’ sustainability risk governance and management.

The Commission received 39 responses to the DP from a wide range of persons, including supervised entities across the full spectrum of financial services sectors, industry associations representing supervised entities, professional services firms, and sustainability and technology consultants.

The Commission would like to thank all respondents for providing their feedback to the DP.

1.3 International developments

Following the publication by the International Sustainability Standards Board of its two disclosure standards (the “ISSB Standards”) in 2023 there has been progress in developing disclosure frameworks internationally with the International Financial Reporting Standards Foundation estimating that jurisdictions representing approximately 57% of global GDP had made progress towards the adoption or other use of ISSB Standards [1].

- [1] International Financial Reporting Standards Foundation - Progress on Corporate Climate-related Disclosures—2024 Report =

- https://www.ifrs.org/content/dam/ifrs/supporting-implementation/issb-standards/progress-climate-related-disclosures-2024.pdf

Certain significant jurisdictions have recently modified or slowed the pace of implementation of corporate sustainability disclosure regimes.

- The consultation on the UK’s Sustainability Reporting Standards (SRS), based on the ISSB Standards, has only just recently commenced. However, this represents just the first steps in the potential endorsement of the standards by the UK government, initially on a voluntary basis. The FCA is yet to consult on proposals to require the use of any such endorsed UK SRS by listed companies, and the UK government has yet to complete an assessment of the merits of such requirements for entities outside of the FCA’s remit.

- Reflecting a change in the political landscape, in March, the US Securities and Exchange Commission voted to end its defence of the climate disclosure rules for large corporations, introduced in 2024, which indicates a change of approach to one aligned with the priorities of the new US Government.

- In February 2025, the European Commission adopted proposals for an Omnibus Directive aiming to simplify sustainability reporting requirements, removing an estimated 80% of companies from the scope of the Corporate Sustainability Reporting Directive (CSRD).

- Summary and Key Messages

The majority of respondents were in favour of a proportionate approach to the adoption of ISSB reporting in line with international peers.

Interoperability and flexibility of disclosure requirements was also a theme identified in responses, reflecting the breadth of international interconnection of the jurisdiction’s financial services sector.

A common concern was the need to avoid conflicts with existing international disclosure requirements (e.g. applicable through parent groups, listing venues, markets etc).

Some respondents noted the differing approaches and timescales being taken to the adoption of ISSB Standards internationally and also that the Standards have not been endorsed in certain significant market jurisdictions.

The majority of respondents argued that the definition of Publicly Accountable Entity was not applicable to their operations or broader sector.

Some respondents suggested that any financial services focused sustainability disclosure requirements should be considered alongside general corporate sustainability disclosure requirements.

Respondents did not identify any impediments to the making of ISSB Standards-compliant disclosures within the current Guernsey legal or regulatory framework.

Overall, the majority of respondents, while supportive of the overall aims of the ISSB, did not support or see a need for the implementation of a Bailiwick-specific mandatory sustainability disclosure standard broadly applicable to the regulated financial services sectors at this juncture.

Commission Response:

The Commission has considered the responses received and recognises the perspectives of industry and the need to take a proportionate approach which recognises the variety of activity within the Bailiwick’s financial services sectors.

The Commission also recognises that the speed, nature and extent of adoption of ISSB Standards internationally has varied between jurisdictions and that, in some cases, there has been reassessment of scope and implementation timetables.

As a member of the International Organisation of Securities Commissions, the Commission notes IOSCO’s support of the ISSB’s work to promote consistent and comparable climate-related and other sustainability-related disclosures for investors.

The Commission, therefore, provides the following policy position:

Policy Position

The Commission confirms that supervised entities are permitted to make disclosures in compliance with ISSB Standards on a voluntary basis [1].

[1] See Page 29, International Financial Reporting Standards Foundation, Jurisdictional Guide for the adoption or other use of ISSB Standards https://www.ifrs.org/content/dam/ifrs/supporting-implementation/adoption-guide/inaugural-jurisdictional-guide.pdf

The Commission has no plans to implement mandatory sustainability disclosure standards applicable to the regulated financial services sectors in the foreseeable future.

The Commission will continue to monitor international developments and will continue to work alongside Guernsey Finance, the industry and the States of Guernsey to ensure the Bailiwick has voluntary and other sustainability disclosure standards in place which best fit with international developments and local needs.

Further to the feedback received on the potential amendment to the Finance Sector Code of Corporate Governance and the making of an Anti-Greenwashing Rule the Commission is proposing a small amendment to the Financial Sector Code of Corporate Governance to make clear the importance of considering environmental risks rather than just climate change risks taking into account the global Convention on Biological Diversity.

The Commission is also offering explanatory guidance to make clear that greenwashing is already forbidden under the Minimum Criteria for Licensing. Further details may be found in the Schedules to this feedback paper.

A more detailed summary of comments received in response to the DP can be found on the next page.

3. Discussion Paper Responses

3.1 ISSB Standards

3.1.1 Bailiwick as a sustainable financial centre

In the DP the Commission sought views on the positioning of the Bailiwick as a sustainable financial centre, advancing for comment the proposition that this should involve the Bailiwick:

- Being recognised internationally as a centre for sustainable finance;

- Applying international standards proportionately and consistently with reputable peer jurisdictions;

- Being involved in raising and providing capital for local, regional and global projects supporting the transition to low carbon economies; and

- Being a jurisdiction that enables investors to make informed choices.

Feedback received

There was broad support for the position set out in the DP from all respondents and certain common themes emerged in the responses received:

- Some respondents supported the statements as a general aspiration or vision but called also for detailed proposals;

- The aspiration to be recognised internationally as a centre for sustainable finance was interpreted differently with some respondents calling for the jurisdiction to take a leading role, but the majority of respondents taking the view that the jurisdiction should maintain a position in step with its peers; and

- A number of respondents commented on the reference to supporting “low carbon economies” as too narrow failing to take in the wider definition of sustainability.

Commission response

The Commission welcomes the broad support for the proposition and notes the call from the majority of respondents for the jurisdiction to maintain a position in step with its peers.

3.1.2 Action Plan

The DP asked if the Bailiwick should develop an action plan to identify and address the potential impact of ISSB Standards.

Feedback received

There was broad support for an action plan to identify and address the potential impact of ISSB Standards.

- Some respondents noted the wider potential impact of corporate sustainability reporting requirements beyond the regulated sector and recommended that the Commission support the government in assessing the potential impact of ISSB implementation to inform the setting of a jurisdictional sustainability action plan or timetable.

- Some respondents cautioned against any swift steps to consult on implementation of local standards until the extent of impact was fully understood and emphasised the need to avoid additional burdensome administrative costs.

- Some respondents expressed the view that few regulated entities would or should be within scope of sustainability disclosure requirements, while others noted that ISSB Standards may be adopted or implemented by some entities in response to external, business-related factors, irrespective of local implementation of disclosure requirements.

Commission response

The Commission notes the general support for continuing to consider the impact and extent of implementation of ISSB Standards on the financial and non-financial services sector.

The Commission DOES NOT propose to implement mandatory sustainability disclosure standards applicable to the regulated financial services sectors in the foreseeable future.

The Commission confirms, however, that supervised entities are permitted to make disclosures in compliance with ISSB Standards on a voluntary basis.

3.1.3 Current Sustainability Reporting

The DP asked respondents to share details of any existing sustainability reporting they may already be subject to or working towards.

Feedback received

Only 6 respondents indicated that they were neither making nor working towards any form of sustainability reporting.

The majority of respondents did, however, reference use or relevance of a variety of mandatory and voluntary reporting regimes and frameworks with Taskforce on Climate-Related Financial Disclosures (TCFD) and the EU’s Sustainable Finance Disclosure Regulation (SFDR) client reporting being the two most referenced.

There was however a wide variety of reporting frameworks referenced, even within the relatively small sample of respondents, as is illustrated in the word cloud below.

Commission response

The response to this question clearly illustrates the level of engagement already taking place with respect to sustainability reporting but also the very diverse reporting requirements and metrics used across the financial services sector, which reflects the diverse range of activities undertaken and international markets with which the sector interacts.

3.1.4 ISSB Standards Disclosure Expectations

The DP asked if firms expect to make ISSB Standards disclosures in the future or provide data to others making such disclosures. The DP also asked what the key drivers were behind this expectation (other than any anticipated adoption within the jurisdiction).

Feedback received

Just over half of respondents indicated they expect to make ISSB Standards disclosures in the future or provide data to others making such disclosures, while 12 respondents indicated that they had no expectations. The remainder did not provide a definite answer to this question.

Those respondents who expected to make or provide data in support of disclosure gave a range of rationales with imposition of regulatory requirements (both cross-border and local) being the most referenced.

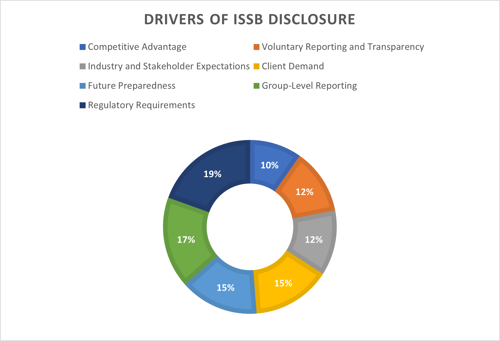

The chart below shows the rationales given by respondents.

Several respondents who indicated no expectation of future ISSB Standards disclosure referenced business connections or relationships with the United States as being influential in their consideration of what approach was optimal.

Commission response

The Commission notes the range of different expectations around disclosure and also the wide range of potential drivers behind ISSB Standards disclosure.

3.1.5 Impediments to Voluntary Disclosure

The DP sought respondents’ views on whether there are any impediments to voluntary disclosure under ISSB Standards (legal, regulatory or otherwise) within the Bailiwick’s current infrastructure.

Feedback received

The majority of respondents did not identify regulatory or legal impediments to voluntary implementation.

A larger number of respondents did however raise potential practical and operational impediments with eight respondents viewing cost and resource constraints, seven respondents focusing specifically on a perceived lack of expertise and training, and seven respondents concerned about the availability and quality of data.

Commission response

The Commission concurs that there are no local regulatory impediments to voluntary disclosure to ISSB Standards by regulated entities.

3.1.6 Application of ISSB Standards in the Bailiwick

The DP sought views on the scope of application of ISSB Standards in the Bailiwick.

Feedback received

A number of respondents suggested that the International Financial Reporting Standards Foundation’s definition of Publicly Accountable Entity (“PAE”) should be adopted to ensure compliance with the ISSB Standards but there were a variety of interpretations as to how this might be applied in the Bailiwick, with the majority opining that few Bailiwick entities were likely to meet or exceed any threshold for qualification as a PAE.

Commission Response

The Commission notes the comments received and observes that there is a parallel between the variety of views on interpretation in this response and the different approaches to scope of application that have been or that are expected to be adopted internationally.

Certainly many of the interpretations shared have merit: e.g. taking into account that the majority of entities are unlikely to meet any reasonable materiality threshold, the private nature of core activity and the reliance on international group level reporting.

The Commission agrees that it is more likely than not that few local regulated entities would meet the definition of a PAE whilst also noting that international debate on the precise meaning of such definitions continues to take place.

3.1.7 ISSB Standards relevance to the Fund Sector

The DP asked specifically about the relevance of ISSB Standards to the Bailiwick’s fund sector.

Feedback received

Again a wide spectrum of views and observations were provided with the following key themes identified:

- Many respondents pointed to the product level requirements approach taken in other jurisdictions, such as the Sustainable Finance Disclosure Regulation (SFDR) and the Sustainability Disclosure Requirements (SDR), and viewed this as the more relevant consideration for collective investment schemes;

- There was, however, little support for any form of new equivalent product level or labelling regime in the Bailiwick, with fund industry respondents arguing that funds are subject to the relevant regime in the jurisdictions in which they are marketed and that an additional domestic requirement would be burdensome and damage competitiveness;

- Some respondents, generally from the consultancy and professional services sectors, were more in favour of Bailiwick specific disclosure requirements for funds; and

- A smaller number of respondents noted the relevance of sustainability risk to Guernsey collective investment schemes and the need for fund boards to ensure this was adequately considered.

Commission response

The Commission notes the range of comments received and the absence of general support from industry for a Bailiwick fund-specific regime, permitting funds to more easily adapt to requirements in investor jurisdictions.

The Commission DOES NOT at this time propose to consult on any fund-specific mandatory ISSB reporting or new product labelling regime.

The Commission does, however, take on board comments in respect of board risk consideration and the reader’s attention is drawn to the consultation on corporate governance requirements at section 3.3.

3.1.8 Use of Jurisdictional Modifications

The DP sought views on the extent to which the jurisdiction should aim to fully adopt all requirements or remain open to the use of jurisdictional modifications, in the event that the Bailiwick were to implement ISSB Standards.

Feedback received

A majority of respondents, in the event that ISSB Standards were to be adopted in the Bailiwick, favoured the use of jurisdictional modifications, but many considered that this should be done prudently taking into account:

- Consistency with peer jurisdictions;

- Consistency with IFRS guidance on reliefs and modifications (some noted criticism of some jurisdictions that had diverged from the parameters of this guidance); and

- Specific impacts on the Bailiwick financial services sector.

Commission response

The Commission is not proposing mandatory adoption of the ISSB Standards and notes the comments received.

3.1.9 Scope 3 Emissions

The DP sought views on the extent to which firms should be required to report on Scope 3 emissions if ISSB S2 consistent disclosure requirements are introduced in the Bailiwick.

Feedback received

Most respondents noted the potential significance and materiality of Category 15 Financed Scope 3 emissions [Green House Gas Protocol] to the finance services sector, observing the limited utility of disclosure restricted only to Category 1 and 2 emissions.

At the same time it was a widespread observation that the required data from investee companies, suppliers and throughout the value chain was generally not readily available making Scope 3 disclosure practically very challenging and reliant on potentially misleading modelling and estimation techniques. For these reasons the majority of respondents favoured a longer phased approach to the adoption of Scope 3 disclosure, if implemented.

Again, many respondents noted the need for the jurisdiction to take a consistent approach with peers.

Commission response

The Commission is not proposing mandatory adoption of the ISSB Standards and notes the comments received.

3.1.10 Sustainability Data

The DP asked about the sustainability data, if any, that firms are already gathering internally.

Feedback received

88% of firms that responded to the DP indicated that they were collecting carbon emissions data, with 17 firms indicating at least partial collection of Scope 3 emissions data.

A wide variety of types of sustainability data was reported as being collected for a variety of purposes including entity and group level reporting, comparative benchmarking exercises, informing credit and investment decision making, cost efficiency valuation, and compliance with internal Environment, Social and Governance (ESG) policies.

Common categories of data collected, in addition to Green House Gas (GHG) emission data, included: energy consumption, water usage and waste management.

Commission response

With the caveat that the cohort of DP respondents may not necessarily be representative of the financial service sector as a whole, the Commission notes that this feedback is indicative of a significant level of engagement by the sector in the process of collecting relevant data to better understand its exposure to sustainability risk.

3.1.11 Reporting Technologies

The DP sought views on the availability of reporting technologies to support ISSB Standards compliant reporting and how the Commission might enable the use of technologies to support this reporting.

Feedback received

A variety of views were shared, with only around one quarter of respondents of the view that available technologies were sufficiently developed.

Respondents of this view observed that ongoing reporting in line with TCFD standards had led to the development of technology, both by third party providers and in-house by larger firms, which can be applied to ISSB Standards reporting.

Others, however, noted that there were gaps in the capability of available systems to meet the level of detailed reporting required by ISSB Standards, for example the limitation in Scope 3 Emission disclosure, reliant on estimation in the absence of granular data.

The observation was also made that the effectiveness on data gathering and reporting technology varies from sector to sector and that technology was often priced to scale for larger firms making this inaccessible for smaller firms.

With respect to the Commission’s potential role in enabling the use of reporting technologies there was again a wide spectrum of views as follows:

- A number of respondents observed that the most significant contribution the Commission could make would be to ensure that there was no misalignment between standards applicable in the Bailiwick, peer jurisdictions and those with which there is a close trading relationship. This will permit reliance on the widest range of reporting technologies and permit interoperability with group and other third-party systems;

- Some respondents took the view that the Commission should not be involved in facilitating reporting technologies, viewing this as a purely commercial decision of reporting entities and possibly a potential route through which a de facto reporting requirement might evolve; and

- Other respondents supported creation of a portal or data depositary and supporting guidance to facilitate simplified reporting particularly for smaller firms.

Commission response

The Commission is not currently proposing to implement a mandatory ISSB Standards disclosure requirement for the regulated financial services sector and, therefore, there will be no misalignment between local standards and the ISSB Standards for firms who make voluntarily disclosures.

The Commission notes the breadth of views as to the Commission’s potential role in facilitating reporting technology and has no plans to develop or facilitate reporting technology at present.

3.2 General anti-greenwashing rules

The DP sought observations from interested parties on the potential introduction of general anti-greenwashing provisions, which would be applicable to all licensees.

Feedback received

The majority of respondents were supportive of the introduction of such anti-greenwashing provisions.

Some respondents, whilst being supportive of the introduction of new rules, made representations that they should not create new obligations but reinforce existing fair, clear and not misleading requirements. Others recommended focussing on guidance and support rather than new rules.

Many respondents also expressed support for adopting an approach which is principles-based and reflects that of the UK’s FCA and aligns with international standards and peer jurisdictions.

Commission Response

Having considered the feedback received, the Commission proposes offering guidance that the current Minimum Criteria for Licensing contain an implicit duty not to engage in greenwashing. Given this, the Commission DOES NOT believe that the creation of new rules separately covering greenwashing is necessary at this juncture.

The Commission reiterates the comment made in the DP, that regardless of specific provisions, all licensees have on an ongoing basis, a duty to meet the minimum criteria for licensing. These include a duty to act with integrity, probity, competence, experience and soundness of judgement. The Commission considers that this encompasses not engaging in, or otherwise knowingly facilitating, greenwashing.

To that extent, the introduction of new anti-greenwashing guidance, whilst clearly demonstrating the Commission’s stance on the practice, should not be onerous for well-managed licensees who are already fulfilling the aforementioned duties which form part of the Minimum Criteria for Licensing.

Next steps

The Commission has prepared proposed anti-greenwashing guidance which is intended to apply to all entities which are licensed under one or more of the Supervisory Laws. A consultation process will take place to allow stakeholders and interested parties the opportunity to provide further feedback.

The proposal is set out at Schedule 1 to this paper and includes details of how representations in respect of the proposal can be made. The consultation process will run until 26 September 2025, and respondents are asked to submit any comments before that date in order for these to be taken into account.

3.3 Finance Sector Code of Corporate Governance

The DP sought observations on a potential amendment to the Finance Sector Code of Corporate Governance (“the Code”), to widen the scope of risks considered by the board beyond just climate change, to cover broader environmental risks.

This suggestion was to reflect the change of emphasis in new international reporting standards from addressing solely climate-related risks to the inclusion of other sustainability related risks.

This includes, for example, where relevant, consideration of the risks related to the impact of biodiversity loss on ecosystem services relied upon by a firm.

Feedback received

Respondents were largely supportive of this proposal, with many agreeing that expanding the Code to include broader environmental risks is a logical and necessary step, which reflects a growing recognition of the importance of environmental sustainability alongside climate-related risks.

Besides the general support for extending the Code to include a consideration of environmental risk, certain respondents also requested that further guidance be provided.

Commission response

The Code is structured around a set of 8 Principles and additional guidance on how to meet those Principles. In this particular instance, the relevant Principle is number 5 (Risk Management) – which states that:

- “The Board should provide suitable oversight of risk management and maintain a sound system of risk measurement and control”.

We DO NOT propose amending this Principle as it remains valid, relating as it does to any risk that a business faces.

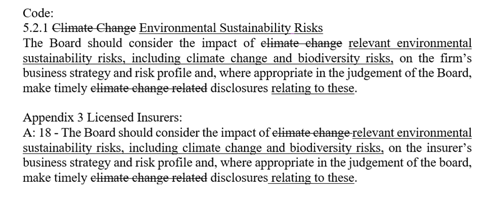

Rather it is the Guidance at paragraph 5.2.1 of the Code which we propose modifying to include:

- A consideration of relevant environmental sustainability risks, appreciating that these may differ from business to business with nature risk –

- For example – varying considerably according to the geography of a firm’s operations.

The Commission considers that boards are best placed to determine which risks are relevant to their specific business, and how these might be mitigated, and is therefore not proposing to add further additional guidance of its own at this time.

Nonetheless, the Commission is cognisant of publicly available sources of assistance for boards, for example the document titled:

- “Asking Better Questions on Nature - For board directors” issued by the Taskforce on Nature-related Financial Disclosures.

- Asking Better Questions on Nature - For board directors – TNFD https://tnfd.global/publication/asking-better-questions-on-nature-for-board-directors/

Whilst the Commission DOES NOT require compliance with the suggestions in such documents, boards may find these helpful when considering the nature related risks which are relevant to their specific businesses and those of their key stakeholders and service providers.

Feedback received

Some respondents suggested that the changes to the Code should not be limited to the addition of environmental risks, but should also encompass broader risks, including “social” risk.

Commission response

The Commission acknowledges that there is considerable literature available discussing ESG (Environmental, Social and Governance) Risk.

However, we are also conscious of the difficulty of effectively and succinctly defining “social risk” and of the dangers of proposing regulation in such a politically contested area.

We therefore DO NOT propose to incorporate “social” risk within the Code.

Feedback received

Some respondents felt that emphasis should be placed on focusing on material risks that are relevant to the specific organisation.

Commission response

As mentioned above, the Commission recognises that not all risks, including those specifically related to sustainability are equally significant for all firms, and the proposed amendment to the Code recognises this by referring to “relevant environmental sustainability risks”.

Feedback received

Other respondents suggested that the Code should capture a broader range of stakeholders.

Commission response

Whilst it recognises the importance of climate change, biodiversity and other environmental risks to all sectors of business and society, the Commission’s remit DOES NOT extend beyond the financial services and associated business sectors regulated by it.

Therefore, the Code cannot be enforced by the Commission in respect of unregulated companies.

Next Steps

In view of the feedback received, the Commission proposes to amend the Code to include consideration by the board of relevant environmental risks – acknowledging the desire of many to consider nature and biodiversity risks properly rather than just focus on climate change considerations.

A formal consultation process will take place, which will afford stakeholders and other interested parties the opportunity to consider, and provide feedback, on this particular proposal in more detail.

The formal proposal is set out at Schedule 2 to this paper and includes details of how representations in respect of the proposals can be made. The consultation process will run until 26 September 2025, and respondents are asked to submit any comments before that date in order for these to be taken into account.

3.4 Risk champion

The DP sought views on the concept of the appointment of a sustainability champion for regulated firms and the appropriate level of authority for such an appointment.

Feedback received

Again there was no clear consensus view. Twenty-five respondents were of the view that the concept had merit, but within this cohort a number of respondents were still not in favour of a mandatory regulatory requirement to appoint a sustainability risk champion, with some raising concerns in respect of additional compliance costs for smaller firms.

Some of those not in favour of the risk champion concept, observed that consideration of sustainability risk is a collective board responsibility and that boards should have discretion to design a risk management framework appropriate to the scale and nature of their activity.

With respect to the seniority of a risk champion position there were conflicting viewpoints with some arguing that the role should be based on expertise not seniority, with others arguing that a junior appointment might create the perception that sustainability risk falls outside the remit of the board.

Commission response

The Commission DOES NOT PLAN to impose regulatory requirements for a sustainability risk champion on supervised firms. Boards should, however, ensure that the risk management framework is commensurate with its activity and address the risk consideration provisions within the Code of Corporate Governance, the amendment of which is consulted upon in Schedule 2.

- Next steps

Interested parties are asked to respond to the consultation proposals in Schedules 1 and 2 by 26 September 2025.

SCHEDULE 1 - Consultation on the introduction of new Anti-Greenwashing Guidance

Following publication of the Commission’s Discussion Paper on The Future of Sustainability Reporting in the Bailiwick of Guernsey, and in particular, respondents’ observations in relation to the section titled “Greenwashing”, the Commission proposes to introduce new Anti-Greenwashing Guidance as follows:

- “All persons licensed by the Commission under its supervisory laws have an ongoing duty to meet the Minimum Criteria for Licensing, as set out in such laws. Such criteria include requirements to operate with “Integrity and Skill”, which embrace, amongst others, acting with integrity, professional skill and in a manner which will not tend to bring the Bailiwick into disrepute.

- The Commission considers that this encompasses an implicit duty not to engage in, or otherwise knowingly facilitate, greenwashing.

As such, the Commission would expect that where a licensee issues, or approves the issue of, a communication in relation to a product or service it should ensure that any reference to the environmental sustainability characteristics of the product or service are:

(a) Consistent with the environmental sustainability characteristics of the product or service; and

(b) Fair, clear and not misleading.

Where a communication issued, or approved for issue, by a licensee includes a prospectus or other offering document (regarding a product or service) which is prepared by an unrelated third party, it is accepted that the licensee cannot be directly responsible for ensuring the veracity of any claimed environmental sustainability characteristics described in that third party prospectus or offering document.

Nonetheless, in such the circumstances, the Commission expects a licensee to take reasonable steps to satisfy itself that the third-party document is fair and not misleading, and a licensee should document the steps it has taken to satisfy itself in this respect.

A licensee should not communicate a prospectus or offering document where it knows, or should reasonably be expected to know, that it contains incorrect or misleading information.

The Commission treats material breaches of any aspect of the Minimum Criteria for Licensing seriously.”

Interested parties are asked to respond to this consultation by answering the below question by 26 September 2025.

SCHEDULE 2 - Consultation on update to the Finance Sector Code of Corporate Governance

Following publication of the Commission’s Discussion Paper on The Future of Sustainability Reporting in the Bailiwick of Guernsey, and in particular, respondent's observations in relation to the section titled “Engaging with Sustainability”, the Commission proposes to amend the Finance Sector Code of Corporate Governance (“the Code”) as follows:

- Proposed text of amendment to the Code – underlining represents new text and where text is to be removed, this is shown with a :

- Interested parties are asked to respond to this consultation by answering the below questions by 26 September 2025.

SOURCE

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.