From Cairo to Pyongyang via Jersey: The Risky Route of Orascom’s Telecom Empire

21/08/2025

THE FOLLOWING CASE:-

- Illustrates the extreme political and financial risks of doing business in North Korea, even for well-connected, experienced investors like billionaire investor Naguib Sawiris and also jurisdictions such as Jersey.

- Underscores how sanctions, currency controls, and state interference can render even profitable ventures unviable.

- Highlights a standard family wealth vehicle at the centre of debates on corporate ethics, sanctions, and jurisdiction accountability

PLEASE NOTE

- There is no record of legal actions against the key actors, such as the trustees of a Jersey trust, Naguib Sawiris or any other associated persons

- All the information in this post is available on the internet through OSINT

THE CASE –

- Koryolink is a North Korean wireless telecommunications provider, launched in 2008 as a joint venture between:

- Orascom Telecom Media and Technology Holding (OTMT) – 75% ownership

- Korea Post and Telecommunications Corporation (KPTC) – 25% ownership

- It operated under the entity CHEO Technology and was the first 3G mobile operator in North Korea.

- In a 2011 merger between Orascom and Russian telecoms group Vimpelcom, certain Orascom assets, including Koryolink, were excluded and spun off into a new company, Orascom Telecom Media and Technology Holding (OTMT).

- OTMT is a holding company with telecom, internet and cable investments in Egypt, Lebanon and other North African and Middle-Eastern countries, as well as the Koryolink investment in North Korea.

British financial journalist George Turner has issued a report on Orascom Telecom, its owner, Naguib Sawiris, and possible violations of US AND UN SANCTIONS, based on official filings and UK court proceedings.

SOME KEY DETAILS

- Naguib Sawiris is a prominent Egyptian billionaire, telecom magnate, US citizen, and global investor known for his ventures in high-risk markets, including North Korea, where his company Orascom played a pivotal role in establishing the country’s first mobile network.

- Sawiris was introduced to North Korea through Ri Chol, a senior DPRK diplomat and alleged financial handler for Kim Jong Il.

- He founded CHEO Technology, a joint venture with North Korea’s KPTC, to launch Koryolink, the country’s first mobile network.

- Despite initial success, Orascom faced major issues:

- $420 million in trapped profits due to repatriation restrictions.

- Emergence of a state-run competitor undermining Koryolink.

- Loss of operational control despite holding a 75% stake

GEORGE TURNER REPORT HIGHLIGHTED

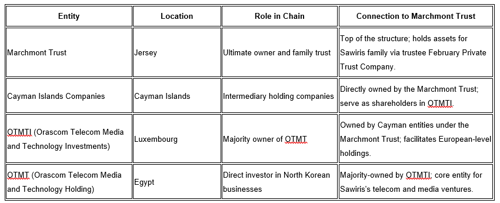

- Naguib Sawiris’s North Korean businesses are owned by OTMT in Egypt.

- The majority of OTMT is owned by OTMTI in Luxembourg.

- According to a Federal Communications Commission application form submitted by another Sawiris company, Accelero Capital Investment Holdings, OTMTI is, in turn, owned by companies based in the Cayman Islands.

- The eventual owner is the Marchmont Trust, a Jersey family trust. The trustee, who looks after the Trust’s assets, is the February Private Trust Company, which is based in the UK Crown Dependency, Jersey.

- As part of the Orascom Telecom deal with the North Korean government to establish the Koryolink subsidiary--a joint venture with the Ministry of Posts and Telecommunications--the company established Orabank, a joint venture with the North Korean National Foreign Trade Bank, which is a sanctioned entity.

- Orascom Telecom is ultimately owned by Marchmont Trust, based in the UK and the Crown of Jersey. The trustee who administers the Trust’s assets, the February Trust Company, is also headquartered in Jersey.

- Among the February Trust Company’s five directors is an American, Kevin Struve, who is also a director of Contrack Watts, which Turner describes as “a major US defence contractor and another Sawiris family-owned business, ORASCOM CONSTRUCTION, which is owned by Naguib Sawaris’ brother, Nassef Sawaris. (Orasom was in essence an EGYPTIAN CHAEBOL*) which the founder split among his three sons into construction, telecom, and hospitality companies.

- *The term "Egyptian chaebol" is not a standard classification. Still, it can be used metaphorically to describe a large, family-controlled conglomerate in Egypt, similar to the chaebols of South Korea. Calling the Sawiris empire an “Egyptian chaebol” is a way to highlight its scale, family control, and diversified global operations, even though Egypt doesn’t formally use the term.

- In a 2013 AP story, Struve is identified as Orascom Construction’s strategic planning director. Contrack Watts, then Contrack International, made the press when it was sued for fraud in connection with USAID-financed construction contracts in Egypt.

Read more

Marchmont Trust Overview

- As reported and summarised above, The Marchmont Trust is a family trust established in Jersey, a British Crown Dependency, and it serves as the ultimate owner of a complex international corporate chain linked to Egyptian billionaire Naguib Sawiris's business interests.

- Established as part of the Sawiris family's wealth management structure, the trust has drawn scrutiny for its indirect ties to investments in North Korea, particularly in telecommunications and banking sectors, amid concerns over sanctions evasion and financial opacity.

- Below is a detailed overview based on investigative reports and corporate disclosures from around 2016, with no significant public updates or developments reported since then.

Ownership and Structure

- From publicly available documents and sources, The Marchmont Trust sits at the top of a multi-jurisdictional ownership chain designed to hold and manage assets for the Sawiris family.

Key elements include:

- Location and Legal Status: Based in Jersey.

- Trustee: Administered by the February Private Trust Company Limited, also headquartered in Jersey. https://opencorporates.com/companies/je/EXTUID_123549

- This entity manages the trust's assets and has five directors, including American Kevin Struve, who has concurrent roles in other Sawiris-linked businesses.

- Struve's involvement has raised questions about potential conflicts, given his directorship at Contrack Watts (formerly Contrack International), a U.S. defence contractor owned by the Sawiris family that works on projects for the U.S. military.

- Corporate Chain: The trust owns a series of intermediary entities, including companies in the Cayman Islands, which hold the majority stake in OTMTI (Orascom Telecom Media and Technology Investments) in Luxembourg.

- OTMTI, in turn, controls the majority of OTMT (Orascom Telecom Media and Technology Holding) in Egypt. This layered structure is typical of high-net-worth family trusts but has been criticised for enabling opacity in cross-border dealings.

Connections to Naguib Sawiris and North Korean Investments

Naguib Sawiris, a telecom magnate with Egyptian roots and a U.S. passport, founded Orascom Telecom Holdings in the 1990s, which expanded into high-risk markets including North Korea. After selling most of Orascom to VimpelCom (now VEON) in 2011, Sawiris retained the North Korean assets under OTMT, ultimately controlled by the Marchmont Trust.[0] Key North Korean ventures include:

- Koryolink:

- A mobile phone network launched in 2008 as a joint venture between OTMT (75% stake) and the North Korean government (25% via Korea Post and Telecommunications Corporation).

- By 2014, it generated over $340 million in revenue for OTMT, representing a significant portion of its income.

- OTMT also assisted in completing the iconic Ryugyong Hotel in Pyongyang, a long-stalled construction project.

- Orabank:

- Established in 2009 as a banking joint venture with North Korea's Foreign Trade Bank (FTB), to which OTMT committed $127 million initially (though $48 million was later written off).

- Orabank was intended to support financial operations for Koryolink but was closed around 2015-2016 amid sanctions pressures.

- These investments were part of Sawiris's strategy to enter underserved markets. Still, they reportedly became burdensome, with Sawiris describing North Korea dealings as a "curse" due to repatriation issues and sanctions.

- By 2016, Sawiris resigned as OTMT's CEO shortly after Orabank's closure was announced, nominating Tamer El Mahdy as his successor.

Concerns and Flags for Opaque Financial Dealings

Journalists and watchdogs have flagged the structure for potential use in evading scrutiny over North Korea ties, especially given international sanctions against the regime for its nuclear and missile programs:

- Sanctions Risks:

- The FTB was designated by the U.S. Treasury in 2013 as a key facilitator of North Korea's weapons of mass destruction (WMD) programs.

- As a U.S. citizen, Sawiris is subject to U.S. sanctions prohibiting dealings with such entities, raising questions about whether OTMT's Orabank involvement violated rules (though no violations were confirmed in reports, and the JV may have predated or ended post-sanctions).

- OTMT's financial statements included disclaimers about challenges in fund transfers and operations due to escalating UN and U.S. sanctions.

- U.S. Defence Links:

- The overlap via Kevin Struve between the trust's trustee and Contrack Watts (a Pentagon contractor) has sparked concerns about indirect ties between North Korean revenue and U.S. military projects.

- Broader Implications:

- Reports suggest the structures highlighted could have helped North Korea generate foreign currency amid isolation

- No legal actions against the trust or Sawiris related to these issues have been publicly documented.

- The Marchmont Trust, as a standard family wealth vehicle at the centre of debates on corporate ethics, sanctions, and jurisdiction accountability, following the above report of its role in channelling North Korean investments, has positioned itself

Sources

- https://www.financeuncovered.org/stories/the-north-korean-connection

- https://en.wikipedia.org/wiki/Naguib_Sawiris

- https://opencorporates.com/companies/je/EXTUID_123549

- https://www.yahoo.com/news/apnewsbreak-iowa-unaware-companys-fraud-181954581.html

- https://www.financeuncovered.org/stories/the-north-korean-connection

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.