Founders underwater, a £100 million employee pledge, and 130K crowdfunding shares are worthless. LESSONS TO LEARN

21/07/2025

In 2017, BrewDog made headlines with a $1 billion unicorn valuation.

The JULY 2025 article discusses an upcoming reality TV show, House of Unicorns, featuring BrewDog founder James Watt, which aims to guide start-ups toward achieving a $1 billion valuation, blending elements of Dragons’ Den and The Apprentice.

- However, it highlights the cautionary tale of BrewDog’s financial missteps, notably a 2017 deal with private equity firm TSG Consumer Partners that valued BrewDog at £895 million but introduced complex terms that have jeopardised the stakes of its 130,000 crowdfunding investors, known as “Equity Punks,” and likely rendered their shares worthless.

- Watts’ stake and a promised £100 million stock gift to employees in 2022 also appear valueless due to these terms.

- The 2017 deal involved Watt and co-founder Martin Dickie altering the company bylaws to remove investor protections, creating preferred shares with an 18% compounding coupon sold to TSG for £213 million.

- This structure prioritises TSG’s payout, leaving little for other shareholders.

- BrewDog’s aggressive global expansion, funded by further crowdfunding, led to a £2 billion valuation in 2021, but a 2022 auction showed shares trading at a fraction of that value. Losses of £64 million in 2023 and stalled sales in 2024, coupled with £239 million in net debt, further dim prospects for a recovery.

The article suggests that for any value to remain for non-TSG shareholders, a buyer would need to pay over three times BrewDog’s sales by April 2026, an unlikely scenario.

Watt’s show may shed light on his decisions, possibly driven by expectations of a lucrative IPO thwarted by external factors, such as COVID-19, or the allure of immediate cash.

This story makes for sobering reading.

- Essentially, when it comes to employee equity, don't let the preference shareholders outbid everyone else.

But behind the celebratory press releases lay a complex financial structure that would quietly reshape the company’s future, leaving thousands of employees and retail investors holding the short end of the stick.

The Deal Behind the Hype

The real story wasn’t the valuation. It was the structure.

Private equity firm TSG invested £213 million into BrewDog, split as follows:

- £110 million to buy preferred shares from the founders; and

- £102 million of new capital into BrewDog via more preference shares and warrants.

This gave TSG a 22.3% stake in the company, valuing BrewDog at approximately £895 million ($1 billion).

But the shares TSG acquired weren’t ordinary equity; they came with an 18% compounding return, one of the most aggressive quasi-equity terms ever seen.

This wasn’t equity in the traditional sense. It was equity engineered to behave like debt, with a ticking time bomb embedded in the cap table.

The Waterfall Effect

Fast-forward to 2025.

TSG’s original £213 million has now compounded to over £800 million, giving it priority in any sale, IPO, or distribution.

That’s materially more than the likely enterprise value of the company today, which is approximately £500 million.

So what’s left for others?

- 130,000 “Equity for Punks” retail investors: Practically nothing

- Founders’ remaining ordinary shares: Deeply underwater

- Employees with gifted stock from James Watt’s £100m equity pledge: Bye-bye value

The compounding preference didn’t just dilute, it dominated.

The Structural Mistake in Employee Equity

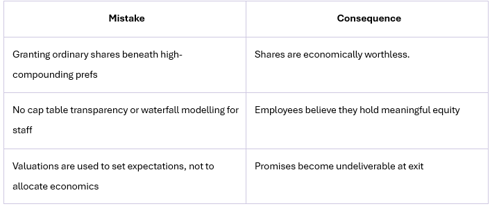

This is a cautionary tale for any founder-led or VC/PE-backed business designing employee equity plans. It shows how preference shares can silently erase ordinary equity value, especially for employees who enter the cap table with no seniority and no visibility.

Designing Better Employee Equity

BrewDog’s structure didn’t fail solely because of the preference shares. It failed because the employee equity was layered beneath them without proper consideration.

Here’s how to do better:

1. Model the Waterfall and Show Staff the Truth = If there’s a preference stack, illustrate it. Use real exit scenarios. Show where employee shares sit in the distribution.

2. Use Instruments That Adjust for Performance = JSOPs, growth shares, and hurdle-based equity can work, if they’re structured to deliver value after prefs.

3. Cap the Preference or Embed Sunset Clauses = An 18% compounding return with no cap or conversion point practically guarantees economic displacement.

4. Align Vesting with Net Equity Value Creation = Not just EBITDA or revenue. Align with the actual net value after the preference equity is accounted for.

Final Thought: Don’t Confuse Ownership With Economics

BrewDog’s preference stack didn’t just deliver returns to TSG; it absorbed the value that was supposed to incentivise thousands of investors, staff, and loyal customers.

If you want equity to mean something for employees, it must be designed with transparency and with aligned economics. Otherwise, it’s not alignment, it’s theatre.

Source

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.