Financial Action Task Force (FATF) [e.g. MoneyVal] mutual evaluation process – how it works?

03/08/2023

Jersey is having its FATF mutual evaluation [AKA. MoneyVal]. The purpose is to assess its efforts in combating money laundering and terrorist financing.

How does this work

- Peer reviews by FATF members of different countries conduct and analyse the effectiveness of measures of a selected country [e.g. Jersey].

- The Peer review reports on a comprehensive description and analysis of the country's [e.g. Jersey] system for preventing criminal exploitation of the financial system.

- The Peer report includes specific recommendations to strengthen the system.

The mutual evaluation report assesses a country's

- measures against money laundering, terrorist financing, and proliferation of weapons of mass destruction.

- Actions in addressing designated terrorists or organisations risks

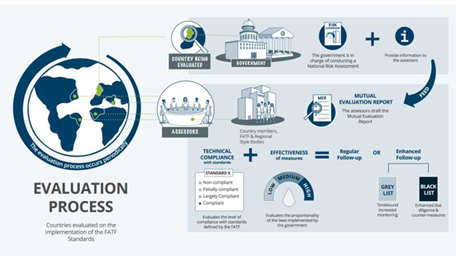

The evaluation consists of two components:

- Technical compliance - Technical compliance assessment examines the legal framework and the implementation of laws.

- Effectiveness - Effectiveness focuses on on-site visits to collect evidence and determine whether the measures function well.

The process is as follows:- [also described below]

The process takes around 18 months and involves several stages:

1) Assessor training educates national experts on FATF Recommendations, enhancing compliance measures and the assessors are selected from member countries, regional bodies, and observer organisations.

2) Country training ensures representatives understand evaluation requirements.

3) Assessors are chosen based on expertise appointed by the President without input from assessed countries.

4) Technical compliance involves the assessed country providing information on existing laws and regulations. Assessors verify compliance and draft a report with ratings.

5) Scoping determines evaluation focus, considering threats, vulnerabilities, and maturity in combatting financial crimes.

6) On-site visits collect data on system effectiveness in the evaluated areas.

7) The mutual evaluation report, including effectiveness and compliance findings, is finalised with input from the assessed country. Independent reviewers review the report.

8) The draft report is presented to the FATF Plenary for discussion and consensus.

9) Following Plenary approval, member countries review the report for technical quality before publication.

10) Countries are expected to address deficiencies identified in the evaluation through post-assessment monitoring, ranging from reporting improvements to issuing public warnings against insufficient progress.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.