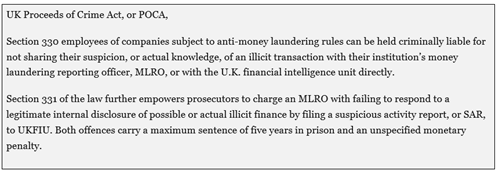

Failing to report money laundering or tipping off is there a risk of prosecution?

12/10/2023

Recent UK data shows a low level of prosecutions for failing to report money laundering or tipping off, as follows:-

Tipping off

The data from the Justice Ministry also shows that from 2012 to 2021, U.K. prosecutors charged.

- Only one individual with “tipping off”— “prejudicing” a police investigation by alerting an account holder that their transactions have drawn attention from law enforcement.

- The case ended without a conviction. Prosecutors accused three other individuals of “prejudicing” a money laundering investigation by falsifying, hiding or destroying evidence or by making an unlawful disclosure but did not secure any convictions.

SARS

It has been reported that the U.K. authorities in the decade up to December 2021,

- Opened 23 criminal cases against employees of banks and other companies for failing to report suspicious activity.

Statistics from the U.K. Justice Ministry indicate that from 2012 to 2021, prosecutors.

- Launched 21 cases and secured 16 convictions against individual employees accused of violating section 330.

- They also secured four convictions against MLROs during those 10 years, but opened only two new cases.

CPS THRESHOLD SOR SUSPICION LOWERED

In June 2021, the Crown Prosecution Service effectively lowered the threshold for charging individuals under section 330 by clarifying that prosecutors can open such cases even without evidence showing that money laundering occurred. Investigators welcomed the change, but the CPS pumped the brakes on their expectations, predicting that the new policy would not lead to a “significant increase” in prosecutions against professional enablers of financial crime.

RECENT SUCCESS

One of the rare cases opened under section 331 targeted Dominic Thorncroft, the owner, director and MLRO of VS1, a money services business in London through which Chinese fraudsters moved £850,000 in criminally derived funds nine years ago. Thorncroft was convicted in June 2021 of failing to report suspicious payments to UKFIU, breaching AML rules and retaining a wrongful credit but acquitted of laundering money.

RECENT FAIL

Six months later, a court in London fined NatWest £265 million for AML breaches that allowed Fowler Oldfield, a jewelry wholesaler in Bradford, to funnel nearly £290 million of suspicious cash into and through the bank from 2012 to 2016.

The FCA found that NatWest staff internally flagged large cash deposits into Fowler Oldfield’s account at least 11 times during those four years but on several other occasions failed to do so. In one branch, employees neither noticed nor warned their managers of at least £42 million cash deposits credited to the wholesaler. NatWest did not file a single SAR pertaining to Fowler Oldfield until July 2014, when the bank learned from the National Crime Agency that the company was under investigation. But those alleged reporting failures have not led to a prosecution of NatWest or any of the bank’s employees.

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.