Ex-bankers sentenced to 13> years & fined €42> million for €70 million money laundering scheme

17/07/2025

It has been reported that

- Joan Pau Miquel, the former CEO of Banca Privada d’Andorra (BPA), has been sentenced to 7 years and €30 million.

- His former deputy, Santiago de Rosselló, received a six-year prison term and a €12 million fine.

A total of 18 BPA executives were sentenced, with penalties ranging from 3.5 to 7 years in prison.

This landmark case is one of the most complex in Andorran legal history:

- The court's ruling spans 6,180 pages and took 20 months to finalise;

- Legal proceedings began in 2018, involving 195 days of hearings, each lasting six hours; and

- The court also imposed bans on working in the banking sector and, in some cases, expulsion from Andorra.

The case traces back to a 2015 designation by the U.S. Financial Crimes Enforcement Network (FinCEN), FinCEN

- Labelled BPA a “foreign financial institution of primary money laundering concern.”

- Alleged that BPA facilitated illicit transactions for organised crime networks in Russia, China, and other regions.

Although the court did not officially name the primary client, Spanish and Andorran media have linked the scheme to:

- Chinese businessman Gao Ping, who was previously investigated in Spain for orchestrating large-scale tax fraud and money laundering between 2010 and 2012.

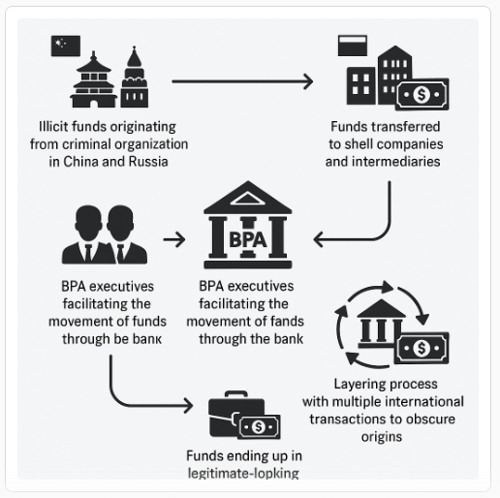

The money laundering scheme involving Banca Privada d’Andorra (BPA) was a highly sophisticated operation that spanned multiple countries and involved senior bank executives knowingly facilitating illicit financial transactions.

It has been reported that the scheme worked as follows:

🧩 Key Elements of the Scheme

- Client at the Centre:

- The laundering was allegedly done on behalf of Chinese businessman Gao Ping, who had previously been investigated in Spain for running a vast tax fraud and money laundering network within the Chinese business community.

- Bank’s Role:

- BPA executives, including CEO Joan Pau Miquel and deputy director Santiago de Rosselló, were found to have knowingly enabled the movement of illicit funds; and

- The bank processed transactions for third-party money launderers acting on behalf of transnational criminal organisations, particularly from Russia and China.

- Techniques Used:

- The scheme involved layering—a classic money laundering tactic where funds are moved through complex layers of transactions to obscure their origin;

- Funds were routed through multiple jurisdictions, making them harder to trace; and

- The bank failed to report suspicious transactions and ignored red flags, violating anti-money laundering (AML) protocols.

See a visual diagram of how the laundering process worked, or a summary of the red flags that regulators missed?

🧾 1. Placement: Inflow of Illicit Funds

- Source: Criminal organisations, including networks from China and Russia, generated illicit funds through activities like tax fraud, smuggling, and corruption.

- Entry Point: These funds were deposited into BPA accounts, often through shell companies or front businesses controlled by intermediaries.

- Red Flag: Large cash deposits or wire transfers from high-risk jurisdictions with no apparent business rationale.

🔄 2. Layering: Obscuring the Money Trail

- Complex Transfers: Funds were moved through multiple accounts, often across different countries and currencies, to make tracing difficult.

- Use of Intermediaries: BPA worked with third-party facilitators who helped disguise the origin of the money.

- False Documentation: Fake invoices, contracts, and business justifications were used to make transactions appear legitimate.

- Red Flag: Transactions lacked economic substance or involved jurisdictions known for banking secrecy.

🏦 3. Integration: Reintroducing Funds as ‘Clean’

- Investment: Laundered money was reinvested into real estate, luxury goods, or legitimate businesses.

- Banking Products: BPA offered private banking services that helped clients integrate funds into the financial system under the guise of wealth management.

- Red Flag: Sudden wealth accumulation by clients with no clear source of income.

🧑💼 4. Internal Complicity: Bank Executive Involvement

- Senior Executives: CEO Joan Pau Miquel and others were found to have knowingly facilitated these transactions.

- Failure to Report: BPA ignored AML regulations, failed to file suspicious activity reports (SARs), and actively concealed the laundering.

- Red Flag: Systemic failure in compliance and internal controls.

References

Banca Privada d’Andorra Sees CEO Jailed Seven Years in €70 Million ... https://fincrimecentral.com/andorra-money-laundering-bpa-case-ceo-sentence/

Top Andorran Bankers Jailed over €70M Laundering Plot | OCCRP https://www.occrp.org/en/news/top-andorran-bankers-jailed-over-eur70m-laundering-plot

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.