Customer Risk Assessments – FCA wants robust, tailored, and evidence-based CRAs

19/11/2025

The FCA recently stated that firms’ customer risk assessments must be robust, tailored, and evidence-based, highlighting both good and poor practices in its November 2025 multi-firm review.

FCA’s Message

- The FCA’s review makes it clear: customer risk assessments must be dynamic, evidence‑based, and embedded into firms’ financial crime frameworks. Weak, generic, or outdated CRAs expose firms to regulatory breaches and financial crime risks’ [source: FCA multi‑firm review, Nov 2025]

In short, the FCA’s latest message is clear: customer risk assessments cannot be superficial. They must be dynamic, data-driven, and embedded into firms’ financial crime frameworks.

Key FCA Findings (November 2025 Review)

- Focus of the review: The FCA examined Business-Wide Risk Assessments (BWRAs) and Customer Risk Assessments (CRAs) across a range of firms, including building societies, wealth managers, payments providers, and e-money institutions.

- Expectations: Firms must not only have risk assessments in place but also ensure they are:

- Robust – comprehensive enough to capture all relevant financial crime risks.

- Tailored – adapted to the firm’s specific business model, customer base, and risk exposure.

- Evidence-based – supported by precise data, rationale, and documentation.

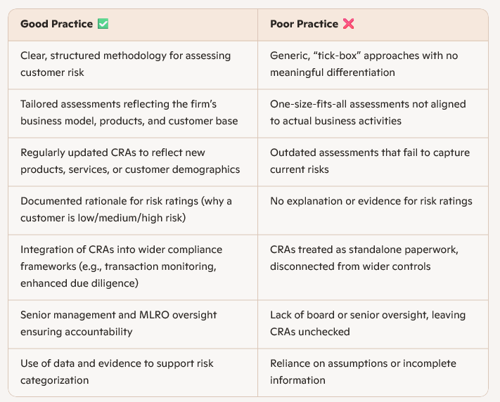

- Good practice examples:

- Clear methodologies for identifying and categorising customer risk.

- Regular updates to reflect changes in products, services, or customer demographics.

- Integration of risk assessments into wider compliance and governance frameworks.

- Poor practice examples:

- Generic, “tick-box” approaches that fail to differentiate between customer types.

- Outdated assessments not aligned with current business activities.

- Lack of documentation or rationale for risk ratings.

Why This Matters

- Financial crime prevention: Customer risk assessments are central to anti-money laundering (AML) and counter‑terrorist financing (CTF) obligations. Weak assessments expose firms to regulatory breaches and reputational harm.

- Senior accountability: The FCA emphasised that Money Laundering Reporting Officers (MLROs), senior managers, and boards must take responsibility for ensuring assessments are meaningful and effective.

- Strategic alignment: This review forms part of the FCA’s 2025–2030 strategy to reduce financial crime harm, showing that risk assessment quality will remain a supervisory priority.

Practical Implications for Firms

- Review and refresh CRAs regularly – especially when launching new products or entering new markets.

- Document rationale clearly – regulators expect firms to show why a customer is rated low, medium, or high risk.

- Embed assessments into wider controls – link CRA outcomes to transaction monitoring, enhanced due diligence, and escalation procedures.

- Train staff – ensure frontline and compliance teams understand how to apply CRA frameworks consistently.

In short, the FCA’s latest message is clear: customer risk assessments cannot be superficial. They must be dynamic, data-driven, and embedded into firms’ financial crime frameworks.

Sources

https://www.complianceangle.co.uk/post/fca-s-2025-risk-assessment-findings-what-firms-need-to-know

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.