Crypto exchange collapses have led to $30–50 billion in investor losses

24/09/2025

Crypto exchange collapses have led to $30–50 billion in investor losses.

Globally, the crypto and virtual asset industry has seen significant defaults and bankruptcies, both among exchanges and token projects.

Here's a comprehensive overview:

Crypto Exchange Bankruptcies

Number of Major Exchange Bankruptcies:

- At least 17 major crypto exchange bankruptcies have occurred since 2009.

- More than 5 exchanges collapsed in 2022 alone, triggered by the fall of TerraUSD and FTX.

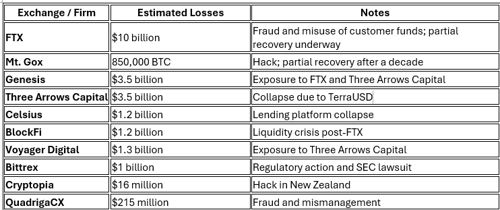

The total investor losses from these bankruptcies are well over $30 billion, with some of the most significant cases including:

Failed Token Projects

Number of Failed Cryptocurrencies

- Out of nearly 7 million cryptocurrencies listed since 2021, 3.7 million have failed (i.e., stopped trading or were abandoned).

- 52.7% of all crypto projects have failed, with 1.8 million failures in Q1 2025 alone.

Reasons for Token Failures:

- Lack of utility or use case

- Poor security (e.g., hacks)

- Rug pulls and scams

- Market volatility and regulatory pressure

Total Estimated Cost to Investors:

- Exchange-related losses: Over $30 billion

- Token project losses: Difficult to quantify precisely, but likely tens of billions more, especially from retail investors in failed ICOs, meme coins, and DeFi scams.

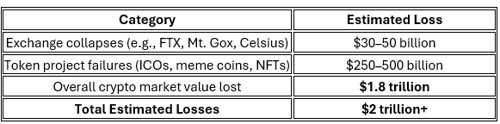

Based on the most comprehensive data available, the total estimated global investor losses from failed crypto exchanges and token projects are well over $2 trillion.

Here's how that breaks down:

TOTAL CRYPTO MARKET VALUE LOST

According to the Bank for International Settlements (BIS):

- $1.8 trillion in crypto market value was wiped out between late 2021 and the end of 2022.

- This includes:

- $450 billion lost during the Terra/Luna collapse (May 2022).

- $200 billion lost during the FTX bankruptcy (Nov 2022).

TOKEN PROJECT FAILURES

From 2021 to early 2025, over 3.7 million crypto tokens have failed, mostly due to:

- Lack of utility

- Meme coin speculation

- Fraud and rug pulls

- Market dilution

While exact investor losses from these failed tokens are harder to quantify, the CoinGecko and CryptoNews reports suggest:

- Billions more in retail losses, especially in 2024–2025.

- 1.8 million tokens failed in Q1 2025 alone, accounting for nearly $250 billion in estimated losses.

Consolidated Estimate:

SOURCES

- Crypto shocks and retail losses https://www.bis.org/publ/bisbull69.pdf

- Dead coins: How many cryptocurrencies have failed? - CoinGecko https://www.coingecko.com/research/publications/how-many-cryptocurrencies-failed

- Over 3.7 Million Crypto Tokens Suffered Collapse https://cryptonews.com/news/over-3-7-million-crypto-tokens-suffered-collapse-between-2021-and-2025-report/

- Crypto Bankruptcies 2025: List of Bankrupt Crypto Exchanges To Date https://www.hedgewithcrypto.com/crypto-bankruptcies/

- Crypto Bankruptcies List: 9 Largest Companies that Failed https://buybitcoinworldwide.com/bankruptcies/

- Dead coins: How many cryptocurrencies have failed? - CoinGecko https://www.coingecko.com/research/publications/how-many-cryptocurrencies-failed

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.