COMSURE BRIEFING - JFSC Thematic Examination Feedback on Conflicts of Interest (2025)

08/12/2025

In November 2025, THE JFSC published ITS Examination feedback ON conflicts of interest following its 2024/2025 thematic examination programme.

This COMSURE briefing summarises the key findings, good practices, and implications for our organisation. It includes recommendations for remediation and a self-assessment check sheet to help you evaluate and enhance your compliance framework.

INTRODUCTION AND KEY JFSC MESSAGING

- All registered persons are expected to take a look at this feedback and document actions taken in future JFSC engagements.

- The Jersey Financial Services Commission (JFSC) published feedback in November 2025 on its 2024/2025 thematic examination program focused on conflicts of interest.

- This examination assessed compliance with Principles 2 and 3 of the applicable Codes of Practice across 10 firms (including banks, trust company businesses, investment businesses, and fund services businesses).

- The review highlighted varying levels of compliance, with

- Eight firms having findings and

- 2 with none.

- Key themes include the need for improved policies, procedures, staff training, and controls to identify, disclose, record, and manage conflicts of interest effectively.

- The JFSC emphasises that adequate systems and controls for managing conflicts demonstrate integrity in decision-making and fair treatment of customers.

- Where conflicts cannot be avoided, they must be mitigated through robust measures.

- Inadequate handling increases risks of regulatory breaches, reputational damage, and poor customer outcomes.

JFSC CONFLICTS OF INTEREST REQUIREMENTS

ALL SUPERVISED PERSONS.

- Supervised persons are also required by the AML/CFT/CPF code of practice set out in the handbook to ensure that the MLCO and MLRO have appropriate independence in the business to perform their functions appropriately.

- As such, effective identification, management, and mitigation of conflict risk are essential to a robust risk management framework.

- The JFSC notes that while no explicit obligation exists to test conflict controls, a risk-based approach is expected to ensure effectiveness.

SECTOR-SPECIFIC CODES OF PRACTICE

- Principle 2 of the sector-specific codes of practice requires registered persons to identify and manage conflicts of interest.

- Where possible, registered persons should avoid conflicts, but where they cannot be avoided, they need to be recorded and managed through adequate systems and controls.

- Some of the codes of practice for the examined sectors have additional provisions relating to conflicts of interest.

BANKS

- The code of practice for banks requires:

- › Clear documented policies regarding: › identification, notification and handling of any conflicts of its directors and employees encountered during the normal course of business › › private transactions, self-dealing, preferential treatment and other transactions of a non-arm’s length nature a sound and well documented credit granting and investment process which ensures: › officers make credit decisions free of conflicting interests, on an arm’s length basis, free from inappropriate pressure from outside parties › › when dealing with related parties, senior managers and/or directors with conflicts of interest should be excluded from the process clearly defined employee duties that include sufficient separation of position taking and control functions to avoid conflicts of interest

FUND SERVICES BUSINESS

- The code of practice for fund services businesses requires that, where a conflict arises, a registered person must seek written confirmation that they may continue to provide services to the fund (where appropriate).

INVESTMENT BUSINESS

- The code of practice for investment businesses was enhanced in 2019 to require registered persons to endeavour to avoid any conflict of interest arising.

- This code also imposes express record-keeping obligations regarding employees’ own account dealings.

- The code of practice for investment businesses is supported by published guidance relevant to the sector:

- › Investment Businesses - guidance on conflicts of interests – sets out our expectations on how registered persons should manage conflict of interest risk where conflicts cannot be avoided, and provides some examples of the risks/outcomes of where conflicts are present in this sector.

- 2019 - https://www.jerseyfsc.org/industry/guidance-and-policy/conflicts-of-interests-requirements-under-principle-2-the-code-of-practice-for-investment-business/

TRUST THE COMPANY'S BUSINESS

- The code of practice for trust company businesses requires registered persons to endeavour to avoid any conflict of interest arising.

- THE CODE is also supported by sector-specific guidance: › Trust Company Businesses - guidance on conflicts of interest – sets out some examples of where the JFSC deem a conflict to arise and some controls which can be used to mitigate conflict risk.

QUESTIONNAIRE TO 40 FIRMS

- In September 2024, the JFSC issued a thematic questionnaire to forty registered persons from a cross-section of industry.

- The questionnaire covered:

- › › › › › policies and procedures in place to identify and manage conflicts of interest, disclosing conflicts and keeping records, consideration of conflicts in the compliance risk assessment, compliance monitoring and testing the effectiveness of conflict management controls, staff training.

- SEE HERE

From the initial questionnaire to 40 firms:

- 100% had policies/procedures, but many lacked detail.

- 95% required all employees to disclose conflicts.

- 90% included conflict testing in compliance monitoring, but frequency varied (53% annually).

- Only 75% provided staff training, with 21% tailoring it to roles.

10 FIRMS RESULTS

- Based on the results of this questionnaire, the JFSC selected 10 firms for inclusion in the thematic examination.

KEY FINDINGS FROM JFSC EXAMINATION

- The examination identified

- 19 in-scope findings across the 10 firms,

- Plus two out-of-scope findings and

- Seven observations.

COMMON DEFICIENCIES

- Common deficiencies fell into categories such as identification and management of conflicts, internal systems and controls, corporate governance, and independence of key functions (e.g., MLCO/MLRO).

- Identification and Management of Conflicts of Interest:

- Failure to identify all relevant conflicts in the business.

- Inadequate policies and procedures that did not clearly define conflicts, explain reporting processes, or outline management strategies.

- Conflict registers are lacking details like disclosure dates or mitigation measures.

- Inadequate measures to manage unavoidable conflicts, including over-reliance on disclosure alone without additional controls.

- Insufficient staff training on policies, procedures, and regulatory requirements related to conflicts.

- Corporate Governance:

- Inadequate assessment of conflict risks in the business's risk framework.

- Failure to document board discussions on conflicts in minutes, including declarations and mitigations.

- Internal Systems and Controls:

- Staff non-compliance with disclosure procedures.

- Failures in policy adherence, such as not obtaining annual staff declarations, maintaining gifts/hospitality registers, or reviewing policies periodically.

- Inadequate records of staff personal account dealings.

- Compliance Function:

- Failure to conduct testing as per the compliance monitoring plan.

- Poor documentation of testing results on conflict controls.

- Lack of independence for MLCO/MLRO roles, especially where combined with business development or where personal relationships (e.g., spousal, familial) existed without mitigations.

- AML/CFT/CPF Specific Issues:

- Inadequate management of conflict risks where key persons had personal relationships or dual roles, compromising independence.

Good Practices Identified

The JFSC highlighted examples of effective practices that firms can adopt to strengthen compliance:

- Policies and Procedures:

- Clear definitions of conflicts with business-specific scenarios.

- Defined reporting processes, including designated contacts and lines.

- Examples of controls (e.g., disclosure, adjusted reporting lines, additional approvals/reviews/sign-offs).

- Staff Training and Awareness:

- Provided during induction, with periodic refreshers and role-specific sessions.

- Annual declarations where staff confirm understanding of procedures.

- Conflict Registers:

- Comprehensive details including disclosure date, conflict type (e.g., financial, personal/familial, positions held), actual/potential/perceived status, and mitigation controls.

- Corporate Governance:

- Boards are regularly updated on conflicts and mitigations.

- Minutes detailing declarations, decisions, and strategies; separating policy-based disclosures from statutory ones (e.g., under Companies (Jersey) Law 1991, Article 75).

- Internal Systems and Controls:

- Procedures embedded in operational workflows for consistent application.

- Maintenance of gifts/hospitality registers and up-to-date personal account dealing records.

- Compliance Function:

- Testing focused on control effectiveness (not just procedural compliance), providing board assurance.

- Where personal relationships exist among key/principal persons: Disclose in registers, adjust reporting lines, avoid deputy roles, and use committees/third parties for oversight.

- Sector-Specific Good Practices:

- Banks: Sound credit/investment processes excluding conflicted parties; separation of position-taking and control functions.

- Fund Services: Written confirmation to continue services amid conflicts.

- Investment Businesses: Endeavour to avoid conflicts; detailed records of employees' own-account dealings.

- Trust Companies: Use guidance to identify and mitigate specific risks (e.g., familial relationships).

Recommendations and Actions

To align with JFSC expectations, the JFSC recommend the following immediate actions:

- Review Policies and Procedures: Ensure they define conflicts clearly, include reporting/management processes, and are accessible to all staff. Update to incorporate business-specific scenarios and controls.

- Enhance Training: Roll out mandatory training for all staff on conflicts, tailored to roles, including scenarios. Include in induction and require annual confirmations.

- Update Conflict Register: Add fields for disclosure dates, conflict types, and mitigations. Could you implement periodic reviews/reminders for staff disclosures?

- Strengthen Governance: Incorporate conflict risk into our formal risk assessment. Please ensure the board minutes document the discussions and mitigations.

- Compliance Monitoring: Include conflict testing in our plan (risk-based frequency). Document results and focus on control effectiveness.

- Independence Checks: Review MLCO/MLRO roles for conflicts (e.g., dual business development). You can implement mitigations, such as adjusted reporting or external oversight, where needed.

- Self-Assessment: Use the attached check sheet to evaluate current practices and develop a remediation plan. Please review the JFSC guidance on sustainability remediation action plans.

Remediation should be proportionate to risks, sustainable, and holistic. The JFSC may be asked to demonstrate these steps in future JFSC interactions.

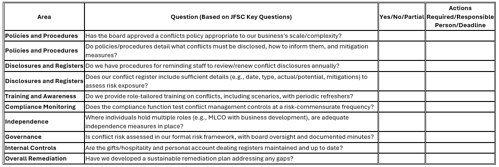

Self-Assessment Check Sheet

Use this check sheet to review our organisation's compliance with JFSC recommendations. Rate each item (Yes/No/Partial) and note actions required. Aim for completion by [insert date, e.g., Q1 2026].

SOURCE

https://www.jerseyfsc.org/media/j5pm3vfj/2025-conflicts-of-interest-examination-feedback.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.