COMSURE BRIEFING: Jersey Government's MLCO Consultation Paper (January 2026)

05/02/2026

This Comsure Briefing aims to summarise the Government of Jersey’s consultation on proposed changes to the Money Laundering Compliance Officer (MLCO) regime, highlight the key issues, weigh the pros and cons, and assess the likely impact on JERSEY SUPERVISED BUSINESS (a regulated Jersey entity) if the changes are implemented.

Sources

- Government of Jersey Consultation Page: https://www.gov.je/Government/Consultations/Pages/MoneyLaunderingComplianceOfficerAmendments.aspx

- Consultation Paper: The role of the MLCO (January 2026) – Available for download from the above page. https://www.gov.je/SiteCollectionDocuments/Industry%20and%20finance/Consultation%20Paper_The%20MLCO%20Role.pdf

- If you'd like to submit feedback or need help drafting a response, the contact is growthfjs@gov.je. For the latest, check the official consultation page.

COMSURE BRIEFING INDEX

COMSURE CORE BRIEF

- Briefing Purpose

- Executive Summary

- Current vs Proposed MLCO Framework

- Pros and Cons of the Proposals

- Likely Impact on Our Business if Changes are Implemented

- Recommended Firm Position

APPENDICES

- Appendix 1: Understanding "Management Level" in the Context of Jersey's MLCO Role

- Appendix 2: Proposal to Remove the Natural Person Requirement for the MLCO Role

- Appendix 2A:-- Proposal to Remove the Natural Person Requirement for the MLCO Role - Additional Insights from Official Sources

- Appendix 3: Understanding the Risk-Based Exemption for MLCO Appointment in Jersey

- Appendix 4: Implications for Small Firms Under the Proposed MLCO Changes

- Sources

COMSURE BRIEFING: Jersey MLCO Consultation Paper (January 2026)

1. Executive Summary

- The consultation and proposed changes are driven by:

- Persistent compliance staffing shortages, high turnover (average MLRO tenure 14 months), recruitment difficulties, and

- Feedback that Jersey’s current rules are more prescriptive than FATF requires and most peer jurisdictions.

- The consultation proposes four significant relaxations to the current MLCO regime in the Money Laundering (Jersey) Order 2008 (MLO) to make Jersey more competitive while remaining FATF-compliant:

- Explicitly require the MLCO to be “at management level” (currently only “appropriate seniority”).

- Decouple “responsibility” (strategic oversight) from “function” (day-to-day monitoring/testing).

- Introduce a risk-based approach so that lower-risk/smaller firms may not need a dedicated MLCO. (Albeit the Board/Senior Management Role will retain ultimate responsibility, which rests with the board (Handbook Section 2.2). They must oversee compliance, perhaps via a designated member or committee in small firms.)

- Remove the requirement that the MLCO must be a natural person (allowing corporate appointment in future, with safeguards).

Overall recommendation:

- The changes are broadly positive for JERSEY SUPERVISED business and the sector.

- They offer meaningful flexibility without materially weakening financial crime controls.

- However, the industry should seek safeguards on accountability where corporate MLCOs are permitted.

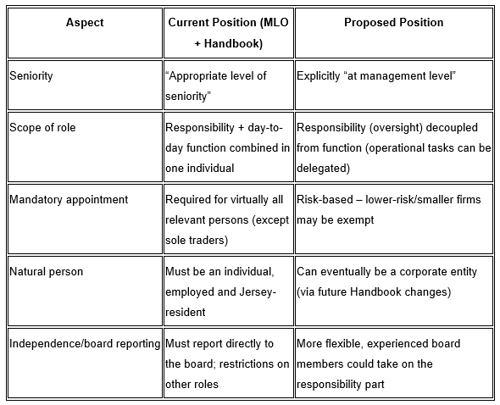

2- Current vs Proposed MLCO Framework

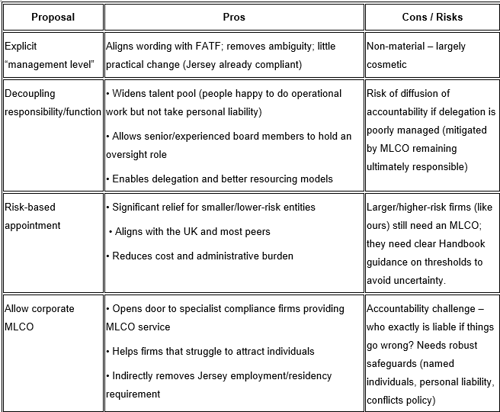

3- Pros and Cons of the Proposals

4. Likely Impact on Our Business if Changes are Implemented

Positive impacts

- Greater structuring flexibility: Firms could appoint a senior board member or Head of Compliance to the “responsibility” part and delegate day-to-day monitoring/testing to a broader team or third-party provider without regulatory friction.

- Easier recruitment/retention: Removes the current “all-or-nothing” personal liability burden that deters good candidates.

- Potential cost savings: Ability to use specialist corporate providers or shared-group resources more efficiently

- Competitive positioning: Brings Jersey closer to Cayman, Guernsey, Luxembourg, and the UK, making it easier to explain the JERSEY SUPERVISED BUSINESS regime to international clients and group headquarters.

Neutral/low impact areas

- Most registered persons (given size/complexity) are unlikely to qualify for the risk-based exemption, so will still need an MLCO.

- The explicit “management level” wording changes almost nothing in practice.

Potential risks (manageable)

- If corporate MLCOs are poorly implemented, supervisory scrutiny could increase on governance and accountability.

- Transitional uncertainty until the JFSC Handbook is updated (expected March 31, 2026, or further amendments made later in 2026.

Overall net impact:

- Moderately positive. The changes address real pain points (staffing, cost, competitiveness) without undermining substance.

Action:

- Respond to consultation by the end of February,

- Deadline for responses: 13 March 2026.

APPENDICES

Appendix 1:

Understanding "Management Level" in the Context of Jersey's MLCO Role

- Based on the provided consultation paper ("Consultation Paper: The role of the MLCO," dated January 2026) and relevant regulatory details from Jersey's financial services framework, the term "management level" is discussed in the paper as part of proposed amendments to the Money Laundering (Jersey) Order 2008 (MLO) to better align with international standards from the Financial Action Task Force (FATF).

What/Who is "Management Level"?

- Definition and Context: "Management level" refers to a senior position within a financial institution or supervised entity, typically equivalent to senior management or a board-level role. This means the individual has the authority, independence, and access to resources needed to effectively oversee compliance programs, influence board decisions, and ensure adherence to anti-money laundering (AML), counter-terrorist financing (CFT), and counter-proliferation financing (CPF) requirements.

- In the consultation paper (Section 3.2), the proposal is to explicitly embed this in the MLO by changing the current requirement from "appropriate level of seniority" to "appointed at management level."

- This aligns directly with FATF Recommendation 18 (R.18) and its Interpretative Note (INR.18), which state: "compliance management arrangements should include the appointment of a compliance officer at the management level."

- The paper notes that Jersey's current framework already implies this through the Handbook (which requires the MLCO to have "sufficient authority to influence board actions"). Still, the change makes it explicit, avoiding ambiguity and aligning with global standards.

- Who Qualifies?: Examples include:

- A member of the board of directors (or equivalent governing body).

- Senior executives, such as a Chief Compliance Officer or Head of Risk, who report directly to the board and have decision-making power.

- The UK equivalent (cited in the paper, Section 3.4) is a "senior manager or director" under the Money Laundering Regulations 2017, where the officer must be part of the board or senior management.

- Why This Level?:

- FATF emphasises a risk-based approach, ensuring the role isn't delegated to junior staff. The person must have "timely access to all records" and the ability to monitor compliance effectively (as per proposed MLO amendments in Appendix I). This prevents dilution of accountability and ensures the role matches the business's size, complexity, and risk profile.

Do They Need to Be Named and Approved as a Key Person?

- Yes, the MLCO is a Key Person and Requires Naming and Approval:

- Under Jersey's Financial Services (Jersey) Law 1998, the MLCO is explicitly defined as a Key Person, alongside roles like the Money Laundering Reporting Officer (MLRO) and Compliance Officer (CO).

- Naming Requirement: The individual (or, if proposals pass, potentially a corporate entity with named accountable persons) must be formally appointed and notified to the Jersey Financial Services Commission (JFSC). This includes providing details during registration or when changes occur.

- Approval Process: The JFSC vets and approves Key Persons, assessing their fitness and propriety (e.g., experience, qualifications, integrity, and lack of conflicts). This is part of the supervisory regime to ensure competence in combating financial crime. Appointments or changes often require JFSC consent or a variation (e.g., for non-residency).

- Current Requirements for MLCO as Key Person (from the paper and JFSC guidance):

- Must be employed by a Jersey firm and resident in Jersey (though variations can be granted for COs, and proposals may relax this for MLCOs).

- Reports directly to the board and maintains independence (e.g., limited additional responsibilities).

- The consultation notes that decoupling "responsibility" (oversight, held by the Key Person MLCO) from "function" (day-to-day tasks) could allow non-Key Persons to handle operations. Still, the MLCO remains the accountable Key Person.

- Impact of Proposed Changes: The proposals don't remove the Key Person status; they enhance flexibility (e.g., allowing board members to hold the role or corporate appointments with safeguards). However, the responsible MLCO would still need JFSC approval to maintain accountability.

Conclusion

- If these changes are adopted (expected in 2026 per the paper's timeline), smaller/low-risk firms may not need an MLCO at all; for those that do, the Key Person approval process remains.

- If you would like more details, please consult the JFSC Handbook or submit feedback to the ongoing consultation (deadline: March 13, 2026).

- If you need clarification on your specific business, I recommend contacting the JFSC directly.

Appendix 2:

Proposal to Remove the Natural Person Requirement for the MLCO Role

Intro

- The Government of Jersey's consultation paper (January 2026) proposes amending the Money Laundering (Jersey) Order 2008 (MLO) to eliminate the mandatory requirement that the Money Laundering Compliance Officer (MLCO) must be a natural person (i.e., an individual).

- This change would enable corporate entities (legal persons, such as specialist compliance firms) to be appointed as MLCOs in certain circumstances, subject to future updates to the JFSC's AML/CFT/CPF Handbook.

- Below, I'll expand on this proposal, drawing on the consultation document, official sources, and comparative insights from similar jurisdictions.

Key Details from the Consultation Paper

- Current Requirement: Under Article 7 of the MLO and the Handbook (Section 2.6), the MLCO must be an individual, employed by the firm, and based in Jersey. This includes restrictions on independence (e.g., limiting other responsibilities) and direct reporting to the board. The paper notes that this "narrows the pool of qualified candidates" and contributes to recruitment challenges, as highlighted in the MONEYVAL Fifth Round Mutual Evaluation Report (MER) for Jersey (2024), which identified shortages of qualified AML/CFT staff and high turnover (average MLRO tenure of 14 months).

- Proposed Change: Amend Article 7(1) of the MLO to state: "a relevant person (other than a sole trader) must appoint a natural or legal person as the compliance officer." This would indirectly remove the "employed" requirement in the Handbook, allowing for outsourced corporate providers.

- Rationale: The Financial Action Task Force (FATF) standards (Recommendation 18 and INR.18) are ambiguous on whether the compliance officer must be a natural person, focusing instead on effective "compliance management arrangements." The proposal aims to address staffing shortages without compromising compliance standards by leveraging Jersey's specialist compliance sector. It would benefit firms facing resource constraints (e.g., smaller Designated Non-Financial Businesses and Professions, or DNFBPs), as evidenced by JFSC data showing persistent vacancies in risk and compliance roles (e.g., 29 vacancies in Trust Company Business in 2024).

- Safeguards Required: The paper emphasises that further work is needed to ensure accountability, including:

- Designation of named accountable individuals within the corporate provider.

- Clear liability frameworks for both corporate and personal responsibility.

- Robust independence and conflict management arrangements.

- Appropriate JFSC supervisory oversight.

- Implementation: If adopted, the change would not immediately allow corporate MLCOs; it would enable future Handbook amendments to specify circumstances. The MLO amendments are targeted for 2026, with Handbook updates potentially subject to separate JFSC consultation.

- Consultation Questions (Section 4.4): Stakeholders are asked to agree/disagree with the proposal, suggest alternatives, foresee benefits (e.g., for businesses using local regulatory providers), and address accountability (e.g., ensuring regulatory liability if a corporation is appointed).

Conclusion

- This proposal is part of a broader effort under the Financial Services Competitiveness Programme to make Jersey's regime less prescriptive while maintaining FATF compliance.

Appendix 2: A - Proposal to Remove the Natural Person Requirement for the MLCO Role - Additional Insights from Official Sources

Intro

- The official Government of Jersey consultation page confirms the scope of the proposal, stating that it would "allow corporate MLCO appointments, with limits."

- It reiterates the goal of flexibility while adhering to FATF standards, and notes that responses are due by March 13, 2026.

- No updates or feedback summaries are available yet, as the consultation is ongoing (launched in February 2026).

- In related JFSC guidance from prior consultations (e.g., on AML/CFT scope exemptions), there's precedent for corporate involvement in compliance roles.

- For instance, Anti-Money Laundering Service Providers (AMLSPs) can already be appointed to handle MLRO/MLCO duties for certain entities, but they must designate natural persons within the provider. This suggests the MLCO change could build on existing outsourcing models, potentially expanding AMLSP-like services.

Pros and Cons

- Pros:

- Wider Talent Pool: Firms could outsource to specialist Jersey-based compliance providers, alleviating recruitment issues (e.g., high costs and turnover). This is particularly useful for multi-jurisdictional groups or smaller entities.

- Cost Efficiency: Reduces the need for in-house hires, potentially lowering employment costs while maintaining expertise.

- Competitiveness: Aligns Jersey with peers; for example, Guernsey permits outsourcing of the Compliance Officer (CO) role to natural persons via licensed providers (though the MLCO remains a natural person resident in the British Islands).

- No Dilution of Standards: The paper asserts benefits "without diluting the quality of the output," as corporate providers would still need to meet JFSC vetting.

- Cons/Risks:

- Accountability Challenges: Diffusion of responsibility if not properly safeguarded. For example, who faces censure if compliance fails? The paper calls for "robust" mechanisms, but details are pending.

- Potential for Conflicts: Corporate providers might serve multiple clients, raising independence issues.

- Regulatory Scrutiny: JFSC may impose stricter oversight, increasing administrative burdens initially.

- Limited Immediate Impact: Corporate appointments won't be automatic; dependent on Handbook changes.

Comparative Context from Other Jurisdictions

- Guernsey: Similar to Jersey, the MLCO must be a natural person, employed by the firm or group, and resident in the British Islands (per the Handbook on Countering Financial Crime). However, outsourcing is permitted for some compliance functions via licensed providers.

- Mauritius: Requires MLCO, MLRO, and deputies to be natural persons with no outsourcing allowed, emphasising individual accountability.

- UK: The Money Laundering Regulations 2017 require a natural person (board member or senior manager) for the compliance officer role in larger firms, but allow flexibility for DNFBPs based on risk and scale, and do not explicitly require a corporate option; third-party providers can support functions.

- General FATF Alignment: Other jurisdictions like San Marino have faced MER criticism for lax management-level requirements, but Jersey's proposal avoids this by maintaining oversight while adding flexibility.

Potential Impacts on Jersey Businesses

- If implemented, this could benefit sectors like trust companies (which show high vacancies) by enabling shared corporate MLCOs. However, larger firms might stick with individuals to avoid perceived risks. Overall, it supports Jersey's competitiveness without major reforms, as recent JFSC reviews (e.g., 2024 Key Persons green paper) found no urgent need for broader changes.

Appendix 3:

Understanding the Risk-Based Exemption for MLCO Appointment in Jersey

Intro

- The proposed amendments in the Government of Jersey's January 2026 consultation paper on the Money Laundering Compliance Officer (MLCO) role under the Money Laundering (Jersey) Order 2008 (MLO) introduce a "risk-based exemption," meaning certain businesses may not need to appoint a dedicated MLCO if they meet specific criteria related to their size, complexity, and risk profile.

- Below, I'll explain what this means, who might qualify, and related details based on the consultation document and current status (as of February 4, 2026).

What Does It Mean to Qualify for the Risk-Based Exemption?

- Core Concept: Currently, almost all "relevant persons" (supervised businesses under Jersey's AML/CFT/CPF regime) must appoint an MLCO, except sole traders. The proposal shifts to a risk-based approach, where appointment is required only "where appropriate about the size, nature/complexity and risk factors" of the business. This aligns with Financial Action Task Force (FATF) standards (Recommendation 18 and Interpretative Note 18), which allow flexibility based on business risk and scale.

- Qualification Criteria: Businesses would self-assess eligibility using factors like:

- Size: E.g., number of employees, assets under management (AUM), or revenue thresholds (specific parameters are being consulted on).

- Nature/Complexity: Simpler operations (e.g., low-volume transactions or straightforward client structures) vs. complex ones (e.g., international trusts or high-net-worth services).

- Risk Factors: Low money laundering/terrorist financing/proliferation financing (ML/TF/PF) risk, determined via the firm's Business Risk Assessment (BRA), a required document under the AML Handbook that evaluates inherent risks.

- Practical Implications: If a business qualifies, it wouldn't need a dedicated MLCO, but it must still maintain robust AML/CFT/CPF measures (e.g., policies, controls, and monitoring). Ultimate responsibility would likely shift to the board or equivalent collectively, as per consultation feedback.

- Justification Process: Eligibility could be justified through the BRA, with supporting JFSC Handbook guidance. Firms might need to document and notify the JFSC of their exemption rationale, subject to supervisory review.

- Why This Change? Jersey's current "one-size-fits-all" rule is more prescriptive than peers (e.g., UK, where appointment is only "where appropriate" based on size/nature). It aims to reduce burdens on low-risk entities amid staffing shortages (e.g., high compliance turnover noted in the 2024 MONEYVAL report).

- REMBER - This is still a proposal. The consultation (open January 30 to March 13, 2026) seeks input on thresholds and implementation. If adopted, details will be finalised in MLO amendments and Handbook updates by late 2026.

Who Can Have an Exemption?

- Primary Beneficiaries (Explicitly Mentioned):

- Designated Non-Financial Businesses and Professions (DNFBPs): These include accountants, casinos, high-value dealers (e.g., jewellers/art dealers), lawyers, real estate agents, and Virtual Asset Service Providers (VASPs). They often have lower inherent risks and smaller scales, making them prime candidates. JFSC data show DNFBPs already outsource compliance more (e.g., 30% of estate agents' compliance staff are non-Jersey-based).

- Sole Traders: Already exempt under the current MLO (no change proposed).

- Potential Other Classes (Under Consultation):

- The paper asks stakeholders: "Other than the DNFBP population, are there any other classes of business you think should be eligible?"

- This could extend to small financial services firms, such as:

- Local/low-risk lenders (e.g., similar to recent exemptions for "local lending" under other Jersey laws).

- Small trust company businesses (TCBs) or fund services businesses (FSBs) with minimal clients or AUM.

- Non-complex entities in banking, investment business (IB), or insurance if risks are low.

- Exclusions: Larger/higher-risk firms (e.g., major banks or international TCBs) would likely still require an MLCO, as per FATF's emphasis on proportionate measures.

- Who Decides? The JFSC would specify exemptions in the updated Handbook, potentially including objective tests (e.g., <10 employees or a low-risk BRA rating). Firms wouldn't automatically qualify; they'd need to demonstrate low risk, and the JFSC could challenge claims during supervision.

Pros, Cons, and Next Steps

- Pros: Reduces costs/recruitment pressures for small firms (e.g., avoiding MLCO salary/liability); enhances competitiveness; maintains FATF compliance.

- Cons/Risks: Potential accountability gaps if boards aren't equipped; uncertainty until Handbook guidance is issued; no exemption from overall AML obligations.

- Current Status: No final exemptions yet. The consultation is gathering views on parameters (e.g., employee counts). Law drafting ends in March 2026, with changes possibly live mid-2026. Related AML Handbook updates (e.g., on complex structures) are delayed to May 2026, but this MLCO proposal is separate.

Appendix 4:

Implications for Small Firms Under the Proposed MLCO Changes

Intro

- Under the proposals in the Government of Jersey's January 2026 consultation paper on the Money Laundering Compliance Officer (MLCO) role, a qualifying small or lower-risk firm would not need to appoint an MLCO, who is currently designated as a Key Person under Jersey's financial services regime.

- This is part of the risk-based approach outlined in Section 3.4 and Appendix I of the paper, which aims to make the requirement optional for businesses where it's "appropriate for the size, nature/complexity and risk factors."

- However, as of February 4, 2026, these are still proposals; the consultation is ongoing (open from January 30 to March 13, 2026), and no final decisions or updates have been announced.

Key Details

- MLCO as a Key Person: Currently, the MLCO is a Key Person under the Financial Services (Jersey) Law 1998 and the Proceeds of Crime (Supervisory Bodies) (Jersey) Law 2008. This means they must be vetted and approved by the Jersey Financial Services Commission (JFSC), with requirements for fitness, propriety, Jersey residency/employment, and independence. If a firm is exempt from appointing an MLCO, it inherently won't need this Key Person role.

- Who Qualifies for Exemption?: Primarily smaller/lower-risk entities, such as certain Designated Non-Financial Businesses and Professions (DNFBPs) like accountants, real estate agents, or lawyers. Other small financial firms may qualify based on factors such as employee headcount, assets under management, or a low-risk Business Risk Assessment (BRA). The JFSC would provide detailed Handbook guidance if adopted.

- Ongoing Obligations: Even without an MLCO, firms must maintain full AML/CFT/CPF compliance (e.g., policies, training, monitoring, and an MLRO, which remains mandatory). Responsibility would shift to the board as a whole.

- Timeline and Status: Law drafting is scheduled for end-March 2026, with changes possibly going live later in 2026. Related AML Handbook updates (separate from this consultation) are delayed to May 31, 2026.

- This change could reduce costs and administrative burdens for small firms, but it's subject to consultation feedback.

END

Sources

- Government of Jersey Consultation Page: https://www.gov.je/Government/Consultations/Pages/MoneyLaunderingComplianceOfficerAmendments.aspx

- Consultation Paper: The role of the MLCO (January 2026) – Available for download from the above page. https://www.gov.je/SiteCollectionDocuments/Industry%20and%20finance/Consultation%20Paper_The%20MLCO%20Role.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.