Circular ownership structures are a problem

13/06/2022

Global Witness analysed UK’s Companies House data and found that 487 UK companies are part of circular ownership structures.

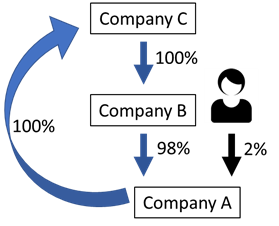

As an example, the following simple loopholes fool any mechanical rule that considers only ownership thresholds

In the example pictured here, beneficial owner “Mary” would avoid being identified as a beneficial owner because she only has 2 per cent of shares and voting rights in company A, way below the 25 per cent threshold.

However, she controls company A because there is no other owner. The rest is just a circular ownership structure (company C owns company B. Company B owns company A, and company A owns company C).

While this simplified version makes the circular ownership structure obvious, if the legal ownership chain involved 10 different layers of companies (instead of only companies B and C), all incorporated in different countries, it would be much less obvious that a circular ownership structure is taking place.

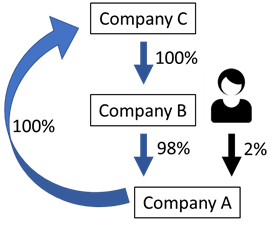

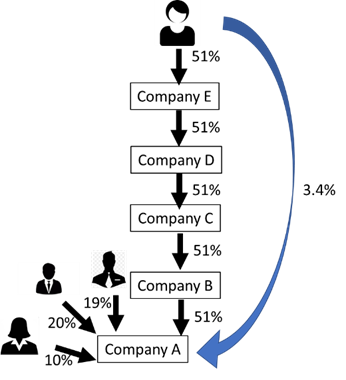

In this second case illustrated here, it would appear again that no individual passes the 25 per cent threshold required to be identified as a beneficial owner of company A, especially Mary who only holds an indirect 3.4 per cent in company A through an ownership chain starting with company E.

However, Mary should be considered a beneficial owner of company A because she is a beneficial owner of company E, that in turn controls company D and so on up to company B which controls 51 per cent of company A.

How to solve this loophole? Beneficial ownership registration must include the full ownership chain, and control at each layer should be considered when determining the beneficial ownership of company A.

Companies as parties to a trust

This loophole prevents a person from being identified as a beneficial owner of a trust despite having a large interest in the trust.

In the case of trusts, every party to the trust must be identified as a beneficial owner:

- The settlor(s), trustee(s), protector(s), beneficiaries and any other person with significant control over the trust. The problem is when a party to the trust is in itself a company.

- For example, if the trustee is a company, or if beneficiaries have interests in the trust through a company.

In the case illustrated here, while regulations don’t always state this explicitly, a holistic interpretation of beneficial ownership laws would require applying the corresponding definition to each type of legal vehicle.

One would start applying the beneficial ownership definitions for trusts and try to identify every party. However, if one of the parties is a company, one would have to apply the definitions for companies, i.e. the 25 per cent ownership threshold.

In this example, the first two individuals which only hold 1 per cent each of interests in the trust

- (i.e. a right to obtain 1 per cent of the trust’s income or capital) are identified as beneficial owners because they are parties to the trust and thresholds are irrelevant for trusts.

In contrast, Mary and the other person hold their interests in the trust through a company. Consequently, only the man passes the threshold of 25 per cent.

This means that Mary, who indirectly holds an interest in the trust of 23.5 per cent (way more than the first two individuals) is not identified as a beneficial owner. In other words, by interposing a company as a party to the trust, it is possible to apply very high thresholds to the beneficial owners of trusts (which are not supposed to depend on thresholds).

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.