ASK MAT - Does a Client in Mauritius Have to Disclose Source of Funds (SoF) for AML/CTF/CPF Compliance?

31/10/2025

ASK MAT - Does a Client in Mauritius Have to Disclose Source of Funds (SoF) for AML/CTF/CPF Compliance?

MAT SAYS

- Surprisingly, there is no blanket requirement for SOF. Mauritius uses a strictly risk-based approach (RBA).

- SoF is only legally mandatory on specific "HARD" triggers (e.g., PEPs, three high-risk countries).

- Outside of “HARD” triggers is down to Where Necessary"/"Reasonable" (Regs 3/12/15), the risk-based approach (RABA) of a firm

- The RBA allows a Loophole, for example, in an RBA firm's self-assessment – classify "low-risk" or standard risk and Skip SOF forever.

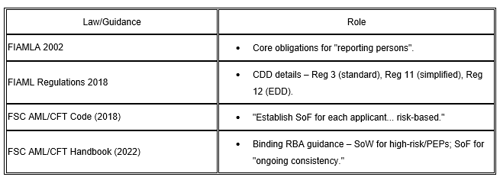

Key Legal Framework

Mauritius' AML/CTF/CPD regime (Financial Intelligence and Anti-Money Laundering Act 2002 – FIAMLA) mandates Customer Due Diligence (CDD) for FSC-regulated entities (banks, trusts, funds):

Mauritius' AML/CTF/CPD regime Key Distinction:

- SoF: Origin of specific funds (e.g., "salary for this wire").

- SoW: Origins of total wealth (e.g., "inheritance + business").

3 "HARD" TRIGGERS (Automatic EDD + SoF)

Only these three forces, SoF – no wiggle room:

- High-Risk Countries (3 only): DPRK, Iran, Myanmar.

- Per Gazette No. 360/2023 (current Oct 2025).

- FATF grey list (~25 jurisdictions)? → Enhanced monitoring only – NO auto EDD.

- PEPs (Politically Exposed Persons): Foreign/domestic + families/associates.

- Suspicious Activity: Red flags (e.g., sudden large wires).

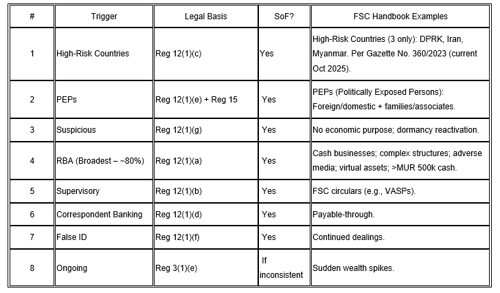

Triggers: When SoF Kicks In

Reg 12(1) FIAML Regs – 8 categories. RBA means institutions self-classify:

TERMINATE

- Can't get SoF? → Terminate + STR (Reg 12(3)).

SOF LOOPHOLES

- "Where Necessary"/"Reasonable" (Regs 3/12/15):

- Loophole: Self-assess – classify "low-risk" (salary payer)? Skip forever.

- Issue: No hard thresholds (e.g., no €15k auto-trigger like EU).

- 90% Low-Risk Hack (Reg 11):

- Simplified CDD – No audit mandate for ratings.

- Clients? Zero Penalty:

- Refuse SoF? → Firm files STR/closes – you walk free.

- Deferred/ Ongoing Gap (Reg 9):

- Funds flow first, verify later.

- Outsourcing Wiggle (Reg 21):

- Rely on foreign banks for ID – but SoF? Institution's call.

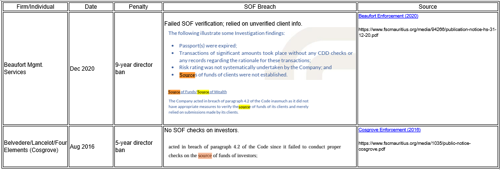

EXAMPLES OF SOF ENFORCEMENT

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.