Alignment of JFSC Notice on Senior Management Functions with Codes of Practice and AML/CFT/CPF Handbook

05/08/2025

Overview

The Jersey Financial Services Commission (JFSC) Notice designating "senior management functions," issued January 12, 2023, and effective March 13, 2023, implements Article 1(1) of the Financial Services Commission (Jersey) Law 1998.

It defines four categories of senior management functions focused on managing anti-money laundering (AML), countering the financing of terrorism (CFT), and countering proliferation financing (CPF) aspects of a registered person’s affairs that risk serious consequences for the firm or Jersey’s interests. These functions involve decision-making or participation in decisions, with civil penalties under Article 21A for contraventions involving consent, connivance, neglect, or aiding. This document outlines how the Notice aligns with the JFSC Codes of Practice and AML/CFT/CPF Handbook.

Alignment with JFSC Codes of Practice

The JFSC Codes of Practice (e.g., for Trust Company Business, Investment Business, Insurance Business, Money Service Business) set principles for sound governance and compliance, emphasising senior management’s role in monitoring systems, ensuring AML/CFT/CPF compliance, and maintaining appropriate authority. The Notice aligns by designating functions that enforce accountability without duplicating existing duties, extending civil penalties to enhance enforcement.

Key Alignments:

- Direct References: Category 3 of the Notice explicitly covers duties under the Money Laundering (Jersey) Order 2008 (MLO) or AML/CFT/CPF Codes of Practice (e.g., approving high-risk relationships like politically exposed persons or correspondent banking).

- Governance Enhancement: Codes require senior management to apportion responsibilities and monitor operations. The Notice supports this by designating roles with significant influence over AML/CFT/CPF compliance, aligning with Financial Action Task Force (FATF) standards.

- Sector-Specific Ties: For Trust Company Business, senior managers are treated as director-equivalent for accountability. Category 4 aligns with banking-specific duties under the Banking Business (Jersey) Order 2002.

- Avoiding Duplication: The Notice clarifies scopes to avoid overlap with key person roles (e.g., MLRO), ensuring focus on below-board functions with significant risk impact.

The Notice integrates by referencing AML/CFT/CPF Codes in its definitions, ensuring a consistent framework where Codes outline duties and the Notice enforces accountability via penalties.

Alignment with JFSC AML/CFT/CPF Handbook

The AML/CFT/CPF Handbook provides detailed guidance on complying with the MLO and AML/CFT/CPF Codes, with Section 2 (Corporate Governance) emphasising senior management’s role in risk identification, systems/controls, resource allocation, and failure notifications. The Notice aligns by designating functions that support these governance requirements, explicitly referencing the Handbook’s framework.

Key Alignments:

- Cross-References: The Handbook notes the Notice’s designation of senior management functions (effective March 13, 2023) and defines “senior management” broadly for non-companies (e.g., governing bodies or local management).

- Governance Requirements: Senior management must document systems, conduct Business Risk Assessments (BRA), develop strategies, apportion responsibilities (e.g., to MLCO/MLRO), monitor effectiveness, and notify JFSC of material failures. Categories 1-3 of the Notice tie directly to these duties.

- Accountability: The Handbook implies criminal liability under MLO Article 37 for neglect, while the Notice extends civil penalties under Article 21A, enhancing enforcement. MLCO/MLRO roles are scoped separately to avoid overlap.

- MLO Integration: Category 3 covers senior management duties under MLO (e.g., Article 11 policies), aligning with Handbook guidance on compliance oversight.

- Consultation Clarity: JFSC refined the Notice’s scope to complement Handbook requirements, ensuring integration with BRA and strategy obligations.

Integrated Framework

The Notice, Codes, and Handbook form a cohesive regime: Codes and Handbook outline duties and systems. In contrast, the Notice designates accountable individuals for enforcement, aligning with FATF Recommendation 35 for proportionate sanctions.

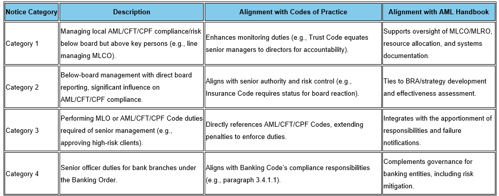

Below is a table illustrating alignments:

Conclusion

The Notice enhances the Codes and Handbook by designating senior management functions with clear accountability, ensuring compliance with AML/CFT/CPF obligations and mitigating risks of serious consequences. Registered persons should integrate these functions into governance documents and notify affected individuals. For firm-specific guidance, consult legal or compliance experts.

Source

https://www.jerseyfsc.org/news-and-events/notice-designating-senior-management-functions-published/

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.