A 3D Perspective on Modern Risk Prioritisation - Visualising the Speed, Impact, and Likelihood of Risk

23/06/2025

What differentiates a critical risk from a tolerable one is

- Its potential impact or likelihood and

- How fast it can materialise (speed–velocity risk).

Integrating Velocity into Risk Assessment

- Traditionally, risk scores are calculated by multiplying impact and probability.

- Total Risk Score=(Impact × Probability)+Velocity

- By adding velocity, the formula can be adjusted to help identify which risks need immediate attention.

Example

- High Velocity: A chemical spill in a factory can cause immediate harm and operational disruption.

- Low Velocity: An ageing workforce might lead to a gradual loss of expertise over several years.

Understanding the Three Axes

- ✅ Velocity (Speed of Onset)

- Some risks unfold slowly (like regulatory non-compliance), while others, such as cyberattacks, strike rapidly and leave minimal time for reaction.

- Velocity captures the urgency with which a risk needs to be addressed.

- ✅ Impact (Severity of Consequence)

- This reflects the damage a risk can inflict on financials, reputation, operations, or compliance standing if it is not managed proactively.

- ✅ Likelihood (Probability of Occurrence)

- Even a high-impact, fast-moving risk may receive lower prioritisation if it is scarce.

- Conversely, a moderate-impact risk that is highly likely may require closer ongoing controls.

Why Include Risk Velocity?

- Timeliness: Some risks can have immediate effects, while others may take longer to manifest. For example, a data breach can have an almost instant impact, whereas reputational damage might unfold over an extended period.

- Preparedness: Understanding the velocity helps organisations prioritise their response strategies. High-velocity risks require quicker mitigation measures.

How to Measure Risk Velocity

- Qualitative Analysis: Categorise risks as high, medium, or low velocity based on expert judgment.

- Quantitative Analysis: Measure the time frame in hours, days, months, or years.

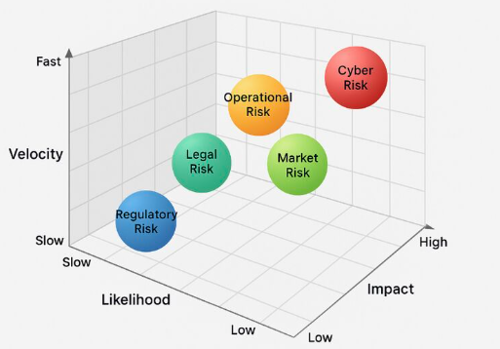

The following 3D Risk Chart provides a dynamic visualisation of how organisations can assess and prioritise risks based on three critical dimensions:

Why This Visualisation Matters

- This model is more than a graphic. It is a decision-support tool that helps boards, chief risk officers and executive committees to:

- Prioritise resources toward fast-moving, high-risk exposures

- Align mitigation strategies with actual threat profiles

- Build escalation plans tailored to velocity and severity

- Enhance overall enterprise resilience and risk-informed decision-making

- By integrating velocity into risk assessments, organisations move beyond static heatmaps and toward dynamic risk intelligence that is responsive, predictive and strategic.

Interpreting the 3D Risk Landscape

The chart positions six major risk categories (Cyber Risk, Operational Risk, Market Risk, Legal Risk, Regulatory Risk, and others) within a 3D space that reveals:

🔴 Cyber Risk sits in the high-velocity, high-impact, high-likelihood zone—making it a top threat that demands real-time monitoring and response.

🟠 Operational Risk is fast-moving and moderately impactful, requiring robust control frameworks and proactive internal audits.

🟢 Market and Legal risks occupy the middle ground—frequent and sometimes fast-moving, but with impact variability depending on exposure.

🔵 Regulatory Risk appears slower and less frequent but carries a significant downstream impact when not addressed, especially from a compliance and reputation standpoint.

Incorporating risk velocity into your risk management framework ensures a more dynamic and responsive approach to potential threats.

References

- Risk management at the speed of business - PwC https://www.pwc.com/sg/en/risk-assurance/assets/ra-sid-risk-velocity.pdf

- What is risk velocity, and should you track it? - Wolters Kluwer

- https://www.wolterskluwer.com/en/expert-insights/what-is-risk-velocity-and-should-you-track-it

- https://www.linkedin.com/posts/mohammad-salman-khan-a160a15_enterpriseriskmanagement-riskmanagement-operationalrisk-activity-7342085942486167552-UN5Q?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAA_6EIB0wPAWyjQcuq_XiD3asUV8xpMeZ0

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.