2022 Tax Justice Network beneficial ownership registration report

16/12/2022

The Tax Justice Network published today the 2022 update of its beneficial ownership registration report

- https://taxjustice.net/reports/the-state-of-play-of-beneficial-ownership-registration-in-2022/

- https://taxjustice.net/wp-content/uploads/2022/12/State-of-Play-of-Beneficial-Ownership-2022-Tax-Justice-Network.pdf

Based on the findings of the Financial Secrecy Index assessments of 2022 that covered 141 jurisdictions, the report shows that the world is galloping towards beneficial ownership transparency.

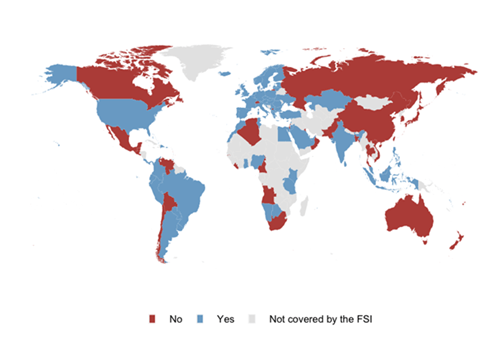

Information on the “beneficial owners” (the natural persons who ultimately own, control or benefit from companies, trusts and other types of legal vehicles) must be “registered” (filed with a government authority) in close to 100 jurisdictions, as shown by the next map.

Although the Financial Secrecy Index usually shows a dire picture of the state of play of global secrecy (truth be told, there is still a lot to improve and many loopholes to close), this report uses the same information but to look at the bright side of things.

The half-full-glass perspective shows that there is plenty to celebrate. Beneficial ownership transparency used to be one of the “boring” indicators of the Financial Secrecy Index back in 2015 because no country had made any progress. By 2022 beneficial ownership transparency has become so mainstream that it’s even featured in a comic by Infolaft’s Mario Hernando Orozco in which Santa Claus refuses to give a present to a kid until the kid declares who will be the beneficial owner of the present.

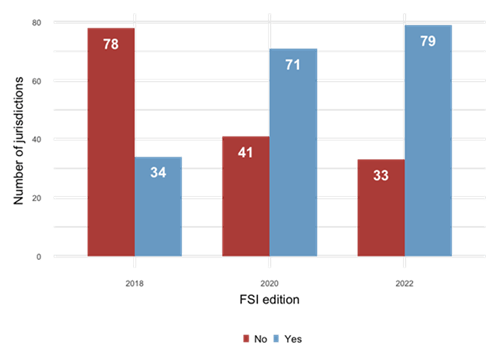

Even when considering just the 112 jurisdictions that the Financial Secrecy Index covered in 2018 (so, not considering the new 40 jurisdictions covered by 2022), the situation has completely reversed.

As the next figure illustrates,

- By 2018 only 34 jurisdictions (in blue) had beneficial ownership registration laws compared to 78 countries (in red) that didn’t.

- By 2022 the situation is flipped: 79 had beneficial ownership registration laws and 33 didn’t.

The report showcases the global diversity in beneficial ownership frameworks, such as which authorities in charge of registration (e.g. the tax administration, the commercial register or a special beneficial ownership register among many other options) and what situations trigger registration (e.g. incorporation, being subject to tax, having a real estate, etc.).

Yet, there is one area that prompts particular celebration: the beneficial ownership definition.

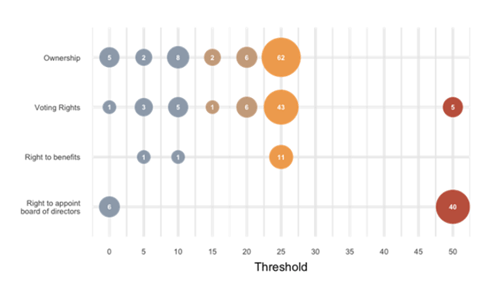

As the next figure shows, many countries, especially developing ones, are

- Moving away from the arbitrary and easily circumvented high threshold of “more than 25% of ownership” towards lower thresholds (including no threshold at all, represented by the “0” in the X axis).

Some countries’ beneficial ownership definitions also add the element of

- “Right to benefits” (e.g. dividends)

- As well as the power to appoint directors

this report only considers cases where

thresholds are used for:

- Ownership

- Voting rights

- Rights to benefits

- Rights to appoint or remove members of the board of directors.

the Figure below presents how many jurisdictions use thresholds for each of these listed categories, and provides a breakdown of the threshold levels (percentage) use for each of these categories.

While most countries apply the highest possible threshold of ownership (“at least 25” or “more than 25” per cent), there is an increasing number of countries applying lower thresholds, including five leading jurisdictions that apply no thresholds at all.

(in the figure below, 0 threshold= any director; 50= the majority of the board).

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.