2002 - Suitcases of Secrets: The Jersey Trust Boss Caught Fleeing with Forbidden Files

29/12/2025

During a Q&A at the Comsure December end-of-year 2025 public workshop, a 2002 case was discussed. It is a case that has been forgotten but remains highly relevant to directors and regulators alike.

- More than two decades ago, in Jersey's tightly regulated offshore financial services sector, Piers Coke-Wallis, a prominent trust company director, made headlines for all the wrong reasons.

- Stopping at St Helier port with suitcases packed with client files, computer servers, and sensitive business records, he attempted to board a ferry to France. His arrest exposed the high stakes of defying regulatory orders.

- What followed was a criminal trial, convictions for both Piers and his wife, Natalie, hefty fines, and a legal battle that reached the UK Supreme Court, ultimately setting a landmark precedent on professional disciplinary proceedings and the principle of res judicata.

Comsure workshop feedback

- In today's post-MONEYVAL era, with Jersey's regulators placing even greater emphasis on governance, record-keeping, and compliance with directions, this "forgotten" scandal serves as a stark reminder: ignoring JFSC directives can lead to personal criminal liability, professional ruin, and years of costly litigation.

- As one attendee at the Comsure workshop noted during the discussion, the lessons from 2002 are more pertinent than ever for trust company directors navigating heightened scrutiny in 2025.

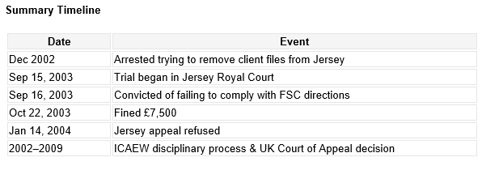

Read on for the full timeline of this dramatic case, from the port arrest to the Supreme Court victory, and why it still matters today.

The Case of Piers Coke-Wallis: A Full Storyline

Background and Lead-Up to the Incident

- Piers Coke-Wallis was a chartered accountant and a member of the Institute of Chartered Accountants in England and Wales (ICAEW). He and his wife, Natalie Coke-Wallis, were directors and shareholders in several trust companies based in Jersey that provided regulated financial services. These companies were subject to oversight under Jersey law, requiring registration and monitoring by the Jersey Financial Services Commission (JFSC). In the early 2000s, the JFSC grew concerned about the corporate governance structures of these companies, leading to extensive correspondence with the Coles-Wallis to demand improvements.

- On August 27, 2002, due to unsatisfactory responses, the JFSC issued a direction under Article 20 of the Financial Services (Jersey) Law 1998, requiring the companies and their directors to appoint independent accountants to review and report on aspects of their corporate governance.

- The situation escalated when, on December 18, 2002, the JFSC issued a further direction prohibiting the companies from taking on new trust business and explicitly barring the removal of any business records from the jurisdiction.

The Incident and Arrest (December 2002)

- Shortly after the December 18 directive, Piers Coke-Wallis attempted to leave Jersey with sensitive business materials. He was stopped by police at St Helier port while trying to board a ferry to St-Malo, France.

- His suitcases contained client files, servers, and other business documents belonging to the trust companies.

- This action directly defied the JFSC's directive against removing records. He was arrested on the spot for non-compliance.

- The JFSC had initiated an investigation into the companies by the end of 2002, which likely contributed to the heightened scrutiny.

Charges and Prosecution

- Piers and Natalie Coke-Wallis were formally charged with failing to comply with the JFSC's directions, which constituted a criminal offence under Article 20(9) of the Financial Services (Jersey) Law 1998.

- This law made such non-compliance punishable by up to two years in prison, a fine, or both.

- The charges stemmed from the attempted removal of records, highlighting regulatory concerns over the integrity of financial services in Jersey, a known offshore financial centre.

The Trial (September 2003)

- The criminal trial commenced at the Jersey Royal Court on September 15, 2003.

- It lasted three days, during which evidence was presented regarding the JFSC directives, the couple's awareness of them, and the events at the port.

Conviction and Sentencing

- On September 16, 2003, the court found both Piers and Natalie Coke-Wallis guilty of the charges. Despite the potential for imprisonment, they escaped a custodial sentence. Each was fined £7,500.

- Gary Godel, the JFSC's director of enforcement, welcomed the verdict but expressed slight disappointment that no prison time was imposed, emphasising the importance of regulatory compliance in the financial sector.

ICAEW's Investigation Committee filed a disciplinary complaint

- The conviction had ripple effects on Piers Coke-Wallis's professional standing. In November 2004, the ICAEW's Investigation Committee filed a disciplinary complaint against him under bye-law 4(1)(a), which holds members liable for acts likely to discredit themselves, the Institute, or the accounting profession.

- This complaint relied on the Jersey conviction as evidence. However, in April 2005, an ICAEW disciplinary tribunal dismissed this complaint, ruling that the Jersey offence did not correspond to an indictable offence under English and Welsh law, as required by ICAEW bye-law 7(1).

- Undeterred, the ICAEW filed a second complaint in March 2006, this time focusing directly on the underlying conduct (failing to comply with the JFSC direction) rather than the conviction itself. Coke-Wallis sought to have this dismissed on grounds of res judicata (the matter had already been decided), autrefois acquit (double jeopardy), or abuse of process. A tribunal rejected his application in December 2006, viewing the two complaints as distinct.

- Coke-Wallis pursued judicial review. In November 2008, Mr Justice Owen in the High Court dismissed his claim, ruling that the complaints were not the same and that pursuing the second claim was not an abuse of process, given the public interest in professional standards. The Court of Appeal upheld this in 2009.

Supreme Court Ruling (January 2011)

- Coke-Wallis appealed to the UK Supreme Court. In a unanimous decision on January 19, 2011, in the case R (Coke-Wallis) v Institute of Chartered Accountants in England and Wales [2011] UKSC 1, the Court allowed the appeal and ordered the second complaint dismissed. Led by Lord Clarke, the justices held that both complaints alleged the same breach of bye-law 4(1)(a), with the conviction serving merely as evidence, not the core act.

- The principle of res judicata (specifically, cause of action estoppel) applied, barring the second proceeding as it raised the identical issue already decided.

- The Court emphasised that no public-interest exception exists to override this absolute bar in disciplinary contexts, leaving such matters to Parliament. This ruling reinforced protections against repeated proceedings in professional disciplinary matters.

- The case highlighted tensions between regulatory enforcement in offshore jurisdictions such as Jersey and professional accountability in the UK, underscoring the importance of clear directives and the limits of double-jeopardy-like principles in civil proceedings.

SUMMARY OF FACTS ABOUT PIER'S COKE‑WALLIS’S PROSECUTION IN JERSEY AND THE SUBSEQUENT DEVELOPMENTS:

1. Criminal Charges and Trial

- Initial arrest: In December 2002, Piers Coke‑Wallis, a Jersey-based trust company director, was stopped by police at St Helier port while attempting to board a ferry to St‑Malo with suitcases containing client files, servers, and other business documents. He was arrested for trying to remove records in defiance of a directive from the Jersey Financial Services Commission (FSC). [paminsight.com], [vlex.co.uk]

- Formal prosecution: He and his wife, Natalie Coke‑Wallis, were charged with failing to comply with JFSC directions, a criminal offence under the Financial Services (Jersey) Law 1998. [paminsight.com], [vlex.co.uk]

- Trial commencement: Their criminal trial began at Jersey Royal Court on 15 September 2003. [paminsight.com]

2. Conviction and Sentence

- Guilty verdict: On 16 September 2003, Piers Coke‑Wallis was convicted of non-compliance with the FSC’s directive. [vlex.co.uk]

- Sentencing: On 22 October 2003, he received a £7,500 fine. The offence carried a maximum penalty of up to two years in prison, a fine, or both. [vlex.co.uk]

- Appeal: An appeal to the Jersey Court of Appeal was refused on 14 January 2004. [vlex.co.uk]

3. Regulatory Consequences

- ICAEW disciplinary action: Following the Jersey conviction, the Institute of Chartered Accountants in England and Wales (ICAEW) initiated disciplinary proceedings. Their initial complaint (Conviction Complaint) alleged discreditable conduct based on the Jersey conviction. Still, it was dismissed on the basis that the offence didn’t correspond to an indictable offence in England and Wales. [lexology.com]

- Conduct complaint: Later, ICAEW brought a second complaint focusing on the same underlying attempt to remove documents (the Conduct Complaint). They treated it as a separate issue, claiming misconduct rather than conviction, but maintained it was distinct. [lexology.com]

- Double jeopardy considerations: The case went all the way to the UK Court of Appeal (Civil Division). In the July 2009 judgment (R (Coke Wallis) v ICAEW), the court held that the disciplinary proceedings were distinct and did not violate the principle of double jeopardy. [vlex.co.uk], [lexology.com]

Sources of Information

- https://www.lexology.com/library/detail.aspx?g=ba82a2fa-9544-4d60-8d68-3db64119a5f5

- https://vlex.co.uk/vid/r-coke-wallis-v-793988229

- https://www.thetimes.com/best-law-firms/profile-legal/article/second-disciplinary-complaint-blocked-p5xwwqrljcw?gaa_at=eafs&gaa_n=AWEtsqcZvhvv5674r5MhAwHNLk7tJvhPmgli7P2GDb-5fc-I76HeQ4T1S8uV&gaa_ts=6952aed9&gaa_sig=viptQ53BiTKZUtBON39z7mHcdODQOXRrG6vsNvQqMCTk1QyRM42fqdO5Bsanv3ineI5eLRN3Jwg7oJ_6Nnl9cw%253D%253D

- https://www.paminsight.com/twn/article/court-finds-trustee-guilty

- https://vlex.co.uk/vid/r-coke-wallis-v-793988229 (browsed for detailed extraction)

- https://www.paminsight.com/twn/article/trustee-fined-by-court

- https://www.paminsight.com/twn/article/court-starts-criminal-trial-of-trustee

- https://supremecourt.uk/uploads/uksc_2009_0175_press_summary_4568fda924.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.