£10 billion in illicit flows through UK property each year

01/08/2025

The latest National Money Laundering Risk Assessment finds up to £10 billion in illicit flows through UK property each year.

- In late July, the Government published its long-awaited National Money Laundering Risk Assessment (NRA), marking the first update since 2020.

- https://assets.publishing.service.gov.uk/media/6877be59760bf6cedaf5bd4f/National_Risk_Assessment_of_Money_Laundering_and_Terrorist_Financing_2025_FINAL.pdf

- This report provides insights into the evolving money laundering threats the UK faces, which require a joint-up response from Government departments, regulators, the private sector and civil society.

Below, Transparency International UK [TI] take a closer look at the themes of the NRA, how they complement TI's previous work, and looks ahead at what needs to be done to face these challenges.

Opaque property ownership

- Property remains a key area of concern with the National Crime Agency estimating there is a realistic possibility that up to £10 billion could be laundered through the UK property market each year.

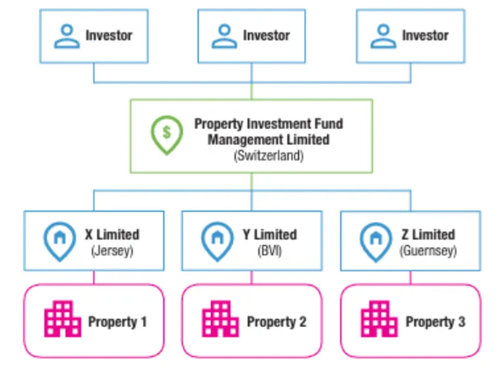

- The use of complex structures to own property is a key enabler, making it easier to hide suspicious owners and their sources of wealth.

- Historically, secretive shell companies have been the key obstacle to revealing property ownership, however, with the introduction of the Register of Overseas Entities (ROE), this has shifted the attention to opaque trusts.

- The NRA highlights TI research released earlier this year, which identified more than 170 properties – worth £2.5 billion – bought with suspicious wealth and owned using opaque trust structures.

- The NRA also notes potential risks related to other opaque financial products – such as COLLECTIVE INVESTMENT TRUSTS, REAL ESTATE INVESTMENT TRUSTS (REITS) AND OPEN-ENDED INVESTMENT COMPANIES (OEICS) – where money is pooled with dividends paid out annually.

Example of an opaque property investment fund:

- The UK Government is yet to quantify the scale of risk related to these vehicles, though their concerns echo TI's analysis of the ROE in 2022.

Alternative payments and tech

- Since the 2020 NRA, TI have seen growing evidence that criminals are using a broader array of methods outside the traditional banking sector to move illicit wealth around the world:

- The 2025 NRA recognises this trend, offering a detailed account of the emerging techniques used by criminals to move their ill-got gains.

- The increasing size, complexity and geographical spread of alternative payment firms – such as electronic money businesses and payment service providers – has moved this sector’s risk profile from medium to high-risk.

- This reinforces TI 2022 research, which found more than one in three UK-registered electronic money institutions (EMIs) had money laundering red flags relating to their owners, directors or activities.

- Government’s assessment of money laundering risk related to cryptocurrency service providers and cryptocurrency has also increased due to the anonymity, speed, and global reach of transactions within the sector. It notes jurisdictions of risk, including Russia, where research by TI colleagues in exile has found a flourishing market for informal crypto-to-cash payment services, including money mule accounts.

- Outside of the regulated sector, the NRA gives a breakdown of different ‘Informal value transfer systems’ (IVTSs) used around the world to launder money, including underground banking, Hawala and Hundi.

- These systems exist outside of the formal banking system and operate in a largely unregulated fashion, relying on a trust-based network of operators around the world.

- Together, these alternative payment mechanisms pose an evolving threat that the UK and its global partners must develop an effective response to.

Professional Enablers

- Across-cutting theme throughout the assessment, which increases the UK’s vulnerability to dirty money, is that of ‘professional enablers’.

- The NRA defines these as:

- “An individual or organisation that is providing professional services that enable criminality.

- Their behaviour is deliberate, reckless, improper, dishonest and/or negligent through a failure to meet their professional and regulatory obligations”.

- The vulnerability of professional enablers, and the risk that they might intentionally or unintentionally enable financial crime, is exacerbated by the fact that they are poorly regulated.

- In particular, the fragmented nature of supervision for lawyers and accountants (with over 22 bodies in charge of overseeing their anti-money laundering compliance) has been a longstanding issue.

- The powers and resources available to these bodies vary considerably, whilst enforcement action does not provide a credible deterrent against poor anti-money laundering procedures or wilful blindness.

- The assessment underscores the need for reform, echoing demands from both civil society and the private sector to consolidate anti-money laundering oversight in the non-financial sector.

SOURCE

https://www.transparency.org.uk/news/authorities-sound-alarm-new-money-laundering-threats

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.