Mauritius Financial Services Commission Amends the AML/CFT Handbook

01/04/2021

The Financial Services Commission (FSC) has, on 31st March 2021, amended the AML/CFT Handbook (Handbook).

The Handbook serves as guidance to the licensees who are under the purview of the FSC, and they are required to comply with the primary AML/CFT legislation, which is as follows:

- Financial Intelligence and Anti-Money Laundering Act 2002;

- Financial Intelligence and Anti-Money Laundering Regulations 2018; and

- United Nations (Financial Prohibitions, Arms Embargo, and Travel Ban) Sanctions Act 2019.

The amendments* which were brought in the FSC Handbook are as follows:

- The wording ‘Countering’ was replaced by ‘Combatting’;

- References to the former FSC ‘Code’ withdrawn;

- Responsibilities of Management, Compliance, and Risk Management has been set out when conducting the Business Risk Assessment (Page 26);

- Approach to be adopted for Risk Management (Page 27);

- No limitation concerning the known risk factors (Page 33);

- New definition of Ultimate Beneficial Owner has been included (Page 44); and

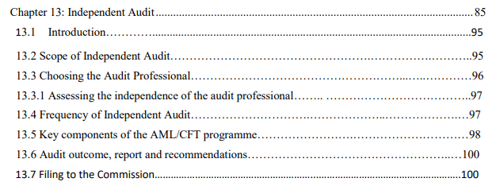

- The Independent Audit function has been included (Page 85-101).

https://www.fscmauritius.org/media/99188/aml-cft-handbook.pdf

The Team

Meet the team of industry experts behind Comsure

Find out moreLatest News

Keep up to date with the very latest news from Comsure

Find out moreGallery

View our latest imagery from our news and work

Find out moreContact

Think we can help you and your business? Chat to us today

Get In TouchNews Disclaimer

As well as owning and publishing Comsure's copyrighted works, Comsure wishes to use the copyright-protected works of others. To do so, Comsure is applying for exemptions in the UK copyright law. There are certain very specific situations where Comsure is permitted to do so without seeking permission from the owner. These exemptions are in the copyright sections of the Copyright, Designs and Patents Act 1988 (as amended)[www.gov.UK/government/publications/copyright-acts-and-related-laws]. Many situations allow for Comsure to apply for exemptions. These include 1] Non-commercial research and private study, 2] Criticism, review and reporting of current events, 3] the copying of works in any medium as long as the use is to illustrate a point. 4] no posting is for commercial purposes [payment]. (for a full list of exemptions, please read here www.gov.uk/guidance/exceptions-to-copyright]. Concerning the exceptions, Comsure will acknowledge the work of the source author by providing a link to the source material. Comsure claims no ownership of non-Comsure content. The non-Comsure articles posted on the Comsure website are deemed important, relevant, and newsworthy to a Comsure audience (e.g. regulated financial services and professional firms [DNFSBs]). Comsure does not wish to take any credit for the publication, and the publication can be read in full in its original form if you click the articles link that always accompanies the news item. Also, Comsure does not seek any payment for highlighting these important articles. If you want any article removed, Comsure will automatically do so on a reasonable request if you email info@comsuregroup.com.